What are details of Form 02-1/BK-QTT-TNCN - Appendix for the List of personal deduction for dependents in Vietnam under Circular 80?

What are details of Form 02-1/BK-QTT-TNCN - Appendix for the List of personal deduction for dependents in Vietnam under Circular 80?

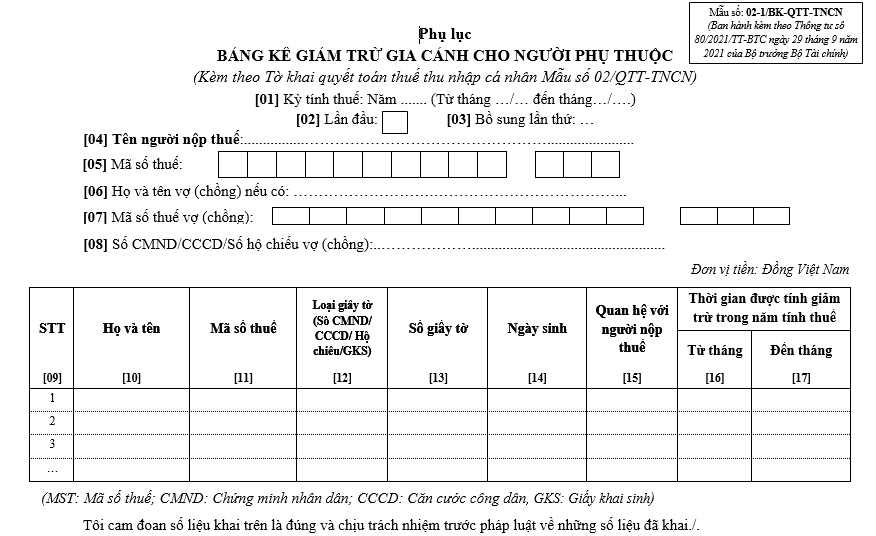

Based on Form 02-1/BK-QTT-TNCN Appendix 2 List of Tax Declaration Forms issued together with Circular 80/2021/TT-BTC, the appendix for the list of personal deduction for dependents is stipulated as follows:

Download Form 02-1/BK-QTT-TNCN Appendix for the List of personal deduction for dependents under Circular 80

What are details of Form 02-1/BK-QTT-TNCN - Appendix for the List of personal deduction for dependents in Vietnam under Circular 80? (Internet image)

What are the personal deductions in Vietnam for 2024?

Based on Article 19 of the Personal Income Tax Law 2007 amended by Clause 4 Article 1 of the Amendment Personal Income Tax Law 2012 and amended by Article 1 of Resolution 954/2020/UBTVQH14 governing personal deductions in Vietnam:

Article 19. Personal deductions

- personal deductions are amounts deducted from taxable income before calculating tax on income from business, salary, wages of taxpaying individuals who are residents. personal deductions include the following two parts:

a) The deduction for taxpayers is VND 11 million/month (VND 132 million/year);

b) The deduction for each dependent is VND 4.4 million/month.

- Determination of personal deduction for dependents shall follow the principle that each dependent can only be counted once for deduction for one taxpayer.

- A dependent is someone whom the taxpayer has a responsibility to support, including:

a) Minor children; children with disabilities, unable to work;

b) Individuals with no income or income not exceeding the prescribed level, including adult children studying at universities, colleges, vocational schools; spouses unable to work; parents beyond working age or unable to work; other people with no one to rely on whom the taxpayer must directly support.

The Government of Vietnam determines the income level and declaration to identify dependents eligible for personal deductions.

According to the above regulation, taxpayers who are residents are entitled to personal deductions for 2024 as follows:

- The deduction for taxpayers is VND 11 million/month (VND 132 million/year).

- The deduction for each dependent is VND 4.4 million/month.

Note: The personal deduction is deducted from taxable income before calculating tax on income from business, salary, wages.

Who is considered a dependent of a personal income taxpayer in Vietnam?

Based on point d, Clause 1, Article 9 of Circular 111/2013/TT-BTC, dependents of a personal income taxpayer include:

[1] Children: biological children, legal adopted children, extramarital children, stepchildren of the wife, stepchildren of the husband, specifically including:

- Children under 18 years old (fully calculated by the month).

- Children from 18 years old and above with disabilities, unable to work.

- Children studying in Vietnam or abroad at university, college, vocational education levels, children from 18 years old and above in general education without income or with an average monthly income in the year from all sources not exceeding VND 1,000,000.

[2] Spouse of the taxpayer who meets the conditions prescribed.

[3] Biological father and mother; father-in-law, mother-in-law (or father-in-law, mother-in-law); stepfather, stepmother; legal adoptive father, adoptive mother.

[4] Other individuals with no place to rely on whom the taxpayer is directly supporting and meeting the conditions prescribed, including:

- Siblings of the taxpayer.

- Paternal grandparents; maternal grandparents; uncles, aunts, uncles of the taxpayer.

- Nephews of the taxpayer including: children of siblings.

- Others who must be directly supported according to legal regulations.

Additionally, individuals counted as dependents must meet the following conditions:

- For those in working age, they must simultaneously meet the following conditions:

+ Have a disability, unable to work.

+ Have no income or an average monthly income in the year from all sources not exceeding VND 1,000,000.

- For those beyond working age, they must have no income or an average monthly income in the year from all sources not exceeding VND 1,000,000.