What are regulations on method for calculation of the grant element of a loan using ODA or concessional loan in Vietnam?

What are regulations on method for calculation of the grant element of a loan using ODA or concessional loan in Vietnam? What is sample proposal for program/project funded by ODA or concessional loan in Vietnam?

What are regulations on method for calculation of the grant element of a loan using ODA or concessional loan in Vietnam?

Pursuant to Appendix I of Decree 114/2021/ND-CP regulating the method for calculation of the grant element of a loan using ODA or concessional loan as follows:

APPENDIX I

METHOD FOR CALCULATION OF GRANT ELEMENT OF LOAN

(Attached to Decree No. 114/2021/ND-CP dated December 16, 2021 of the Government)

1. The incentive component is determined on the basis of factors such as loan currency, loan period, grace period, loan interest rate, fees, other loan costs, and structural aid to increase incentives (if any) and discount rate at the time of calculation. Aid amounts for technical support, hiring design consultants, developing a Feasibility Study Report... will not be counted.

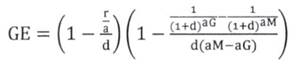

2. The preferential component of the loan is calculated according to the following formula:

In there:

GE: Incentive component of the loan (%)

G: Grace period (years)

M: Loan term (years).

r: Loan interest rate (%) is the compound interest rate of nominal interest rate and all other loan fees and costs under foreign loan agreements, including non-refundable ODA structured to increase incentives (if any), is calculated based on the internal rate of return method of disbursed cash flows and debt repayment cash flows each year during the loan term of the project.

a: Number of debt repayments per year (according to sponsor's conditions)

d: Discount rate of each period: d = [(1 + d') (1/a) ] - 1(%)

d': Discount rate (%) corresponding to the loan interest rate of the Vietnamese Government on the market at the time of calculation

3. The discount rate calculated corresponding to the loan interest rate of the Government of Vietnam on the market at the time of calculation (d') stated in Clause 2 above is specifically determined as follows:

a) In case at the time of calculation the Government of Vietnam issues international bonds, the discount rate is the lower interest rate between the Government's international bond issuance interest rate and the prescribed discount interest rate in Clause b of this Article.

b) In case at the time of calculation the Vietnamese Government does not issue international bonds, for foreign loans with a loan term of less than 15 years, the discount rate is the discount rate (DDR) set by the OECD Announced annually corresponding to each major loan currency; For loans with a loan term of 15 years or more, the discount rate is calculated as the average of the most recent 10-year commercial reference interest rate (CIRR) announced by the OECD corresponding to each major loan currency (USD, EUR and JPY and WON) plus forward risk levels also announced by the OECD. For other currencies, apply the discount rate announced by the OECD applicable to the USD.

What is sample proposal for program/project funded by ODA or concessional loan in Vietnam?

Pursuant to Appendix II of Decree 114/2021/ND-CP regulating the method of calculating the preferential element of a loan as follows:

APPENDIX II

FORM OF PROGRAM AND PROJECT PROPOSAL USING ODA AND CONCESSIONAL LOANS

(Attached to Decree No. 114/2021/ND-CP dated December 16, 2021 of the Government)

I. KEY INFORMATION

1. Name of program and project (Vietnamese and English).

2. Managing agency, proposing unit and program/project owner (expected): Name, address, other relevant information.

3. Foreign sponsors and co-sponsors (if any) are expected to support the implementation of the program/project.

II. BASE PROPOSITION

- The importance, necessity and feasibility of programs and projects in terms of economics, society, environment, science, technology and related planning according to the provisions of law on planning.

- Efforts have been/are being made to resolve the issues raised.

- Programs and projects being implemented in the same field (if any).

- Intended foreign sponsor (clearly state the reason for using ODA capital or concessional loan capital of this sponsor).

III. RECOMMENDED CONTENT

1. Objectives and scope of the program or project: Describe the general objectives, specific objectives and scope of the program or project.

2. Expected main results of the program or project: Summary of expected main results.

3. Estimated implementation time of the program or project (which determines the construction time and operation time).

4. Estimated total level, structure of capital sources for project implementation and proposed financial mechanism:

- Total investment capital: non-refundable ODA capital, ODA loan capital, foreign preferential loans, counterpart capital detailed in original currency and equivalent value in Vietnam Dong and USD (using exchange rates accounting announced by the Ministry of Finance at the time of proposal).

- Loan terms and conditions: Clearly state the expected interest rate (floating/fixed), expected interest rate and fees (if any); For project programs expected to use floating interest rate loans, the floating interest rate in the proposal includes the base floating interest rate (Libor, Sibor, Eurobor...) and marginal interest rate in the market at the time of loan proposal; Estimated loan term and loan grace period.

- Propose domestic financial mechanism, expected annual disbursement progress (associated with program and project implementation time).

- Plan to balance debt repayment sources.

5. Plan to use loan capital, plan to use counterpart capital (including plan to arrange equity), plan to secure loan, plan to repay debt and proposal to authorized lending agency (bear credit risk or not bear credit risk) in case the project proposal is to lend to state-owned enterprises and public service units.

6. Impact assessment:

- Preliminary assessment of economic, social and environmental effectiveness (if any).

- Preliminary assessment of the impact on the proposing agency's medium-term public investment plan.

Best regards!