What are details of the Form 01/GHAN - Request for tax payment extension in Vietnam under Circular 80?

What are details of the Form 01/GHAN - Request for tax payment extension in Vietnam under Circular 80?

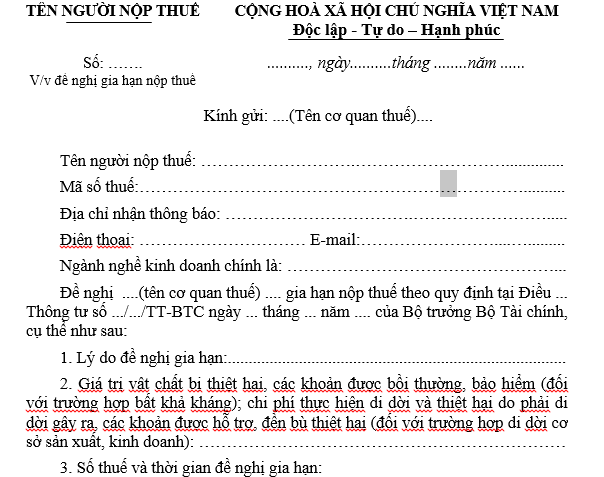

Based on Form 01/GHAN Appendix 1 issued with Circular 80/2021/TT-BTC stipulating the form of the request for tax payment extension:

Download Form 01/GHAN - Request for Tax Payment Extension according to Circular 80

What are details of the Form 01/GHAN - Request for tax payment extension in Vietnam under Circular 80? (Image from the Internet)

What is the duration of the tax payment extension in Vietnam?

Based on Article 62 of the Tax Administration Law 2019 stipulating the extension of tax payment:

Article 62. Extension of Tax Payment

- The extension of tax payment is considered based on the request of the taxpayer who falls into one of the following cases:

a) Suffer material damage, directly affecting production and business due to encountering force majeure situations stipulated in Clause 27, Article 3 of this Law;

b) Must suspend operations due to relocation of production and business facilities according to the request of competent authorities affecting production and business results.

- Taxpayers eligible for tax payment extension as stipulated in Clause 1 of this Article are granted an extension for part or all of the tax payable.

- The tax payment extension time is stipulated as follows:

a) Not more than 02 years from the deadline for tax payment for cases stipulated at Point a, Clause 1 of this Article;

b) Not more than 01 year from the deadline for tax payment for cases stipulated at Point b, Clause 1 of this Article.

- Taxpayers shall not be penalized and are not required to pay late payment interest on tax debt during the tax payment extension period.

- The head of the tax administration agency directly manages based on the tax payment extension dossier to decide the amount of tax extended and the tax payment extension period.

According to the above stipulations, the tax payment extension period is specified as follows:

- Not more than 02 years from the deadline for tax payment in case of material damage, directly affecting production and business due to encountering the following force majeure circumstances:

+ Taxpayers suffer material damage due to natural disasters, catastrophes, epidemics, fires, unexpected accidents

+ Other force majeure circumstances according to regulations of the Government of Vietnam.

- Not more than 01 year from the deadline for tax payment in case of suspension of operations due to the relocation of production, business facilities according to the request of competent authorities affecting production, business results.

What documents are included in the Application for tax payment extension for imports and exports in Vietnam?

Based on Article 11 of Circular 06/2021/TT-BTC, the documents in the Application for tax payment extension for imports and exports include:

[1] Official Dispatch requesting an extension of tax payment: 01 original copy

[2] Documents accompanying the official dispatch requesting an extension of tax payment for cases of material damage, directly affecting production and business due to encountering force majeure circumstances

- Documents, records confirming the cause of damage from functional agencies in the area where the damage occurred:

+ Confirmation from one of the following agencies or organizations: Communal, ward, commune-level town police; People's Committee of the commune, ward, commune-level town; Management Board of Industrial Parks, Export Processing Zones, Economic Zones; Management Board of border gates, Airport Authorities, Port Authorities where force majeure events occurred due to natural disasters, catastrophes, epidemics, unexpected accidents causing material damage, directly affecting production and business: 01 original copy

+ Fire incident confirmation record from the local fire prevention and control police where the fire occurred: 01 original copy.

- In case of force majeure difficulties due to war, riots, strikes leading to suspension or stoppage of production, business operations, or risks beyond the subjective responsibility of the taxpayer, the taxpayer must submit proof documents and materials showing the cause of force majeure difficulties leading to the inability to pay taxes, late payment interest, fines on time: 01 certified copy from the authority requesting tax payment extension

- Insurance contract, compensation payment notice from the insurance organization (if any), in case the insurance contract does not include tax compensation, there must be a confirmation from the insurance organization; contract or compensation agreement record from the carrier in case of loss caused by the carrier (if any); 01 certified copy from the authority requesting tax payment extension.

[3] Documents accompanying the official dispatch requesting an extension of tax payment in case of suspension of operations due to the relocation of production, business facilities at the request of competent authorities affecting production, business results.

- Decision to withdraw the production, business location by the competent state agency for the old production location of the enterprise (except in cases of relocation of business production locations for the enterprise's request and purpose): 01 certified copy from the authority requesting tax payment extension

- Confirmation document from local authorities on the enterprise's suspension of production business due to relocation: 01 original copy

- Documents proving the level of direct damage due to the relocation of the business place. The value of damage is determined based on the remaining value of damaged goods.

The remaining value of damaged goods is determined based on dossiers, documents, and relevant legal regulations directly to determine: Factories, warehouses, machinery, equipment dismantled without capital recovery (original value minus depreciated costs), dismantling costs of equipment, factories at the old facility, transportation installation costs at the new facility (after deducting recovery costs), wages paid to employees for idle time (if any).

In complex cases related to specialized technical economics, a confirmation document from a specialized agency is required: 01 original copy.