What is the application form for PIT refund - Form 01/DNXLNT in Vietnam?

What is the application form for PIT refund - Form 01/DNXLNT in Vietnam?

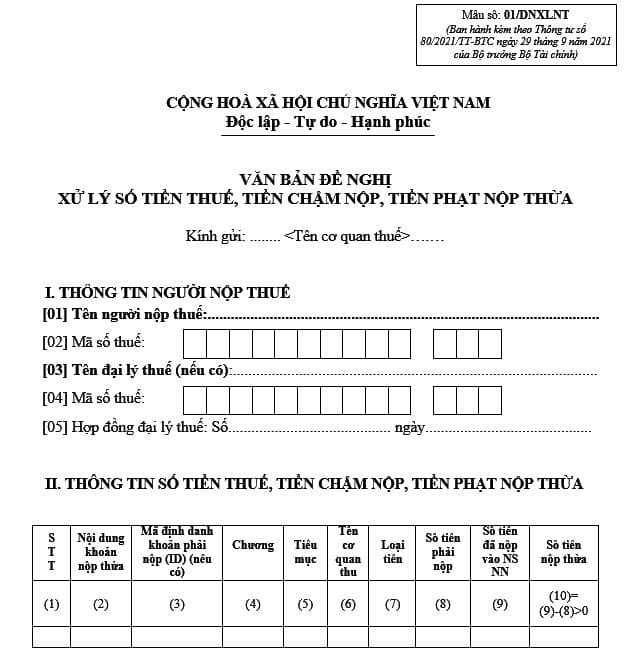

In case salary payers conduct tax finalization for authorizing employees, they must prepare the application form for PIT refund made in Form No. 01/DNXLNT Appendix I issued together with Circular 80/2021/TT-BTC as follows:

The most comprehensive application form for a PIT refund for employees in 2024: Here.

What is the application form for PIT refund - Form 01/DNXLNT in Vietnam?(Image from the Internet)

What are the methods of submitting PIT refund applications by employees in Vietnam?

Under Clause 2 Article 72 of the Law on Tax Administration 2019:

Receipt and processing of tax refund claims

1. Tax authorities shall process tax refund claims as follows:

a) Supervisory tax authorities of taxpayers shall receive tax refund claims in accordance with tax laws. Collecting tax authorities shall receive claims for refund of overpaid amounts. In case of refund of overpaid amounts under an annual/terminal statement of corporate income tax or personal income tax, the tax authority that received the statement shall provide the refund.

b) Collecting customs authorities shall receive tax refund claims in accordance with tax laws. Customs authorities where exit procedures are followed shall receive tax refund claims submitted by foreigners and Vietnamese people residing overseas.

2. Tax refund claims may be submitted:

a) in person at tax authorities;

b) by post;

c) electronically through online portals or tax authorities.

3. Within 03 working days from the day on which the claim is received, the tax authority shall inform the taxpayer in writing of whether the claim is granted or rejected.

4. The Minister of Finance shall elaborate this Article.

Thus, employees can submit their PIT refund applications through the following methods:

- Submit applications directly at the tax authority;

- Send applications via postal service;

- Send electronic applications through the e-portal of the tax authority.

What are the procedures for PIT refund for taxpayers being individuals?

Under Article 2 of the Procedures issued together with Decision 679/QD-TCT 2023, the regulations on the procedures for the refund of tax on income from salaries and remunerations are as follows:

Procedures

The refund procedures includes the following contents:

1. Receive the tax refund application according to the regulations at Article 32, Article 43 of Circular No. 80/2021/TT-BTC dated September 29, 2021, by the Ministry of Finance guiding the implementation of some articles of the Law on Tax Administration and Decree No. 126/2020/ND-CP dated October 19, 2022, of the Government detailing some articles of the Law on Tax Administration (hereinafter referred to as Circular No. 80/2021/TT-BTC) for the following cases:

...

d) PIT refund for individuals directly finalizing tax with the tax authority: The tax refund application for individuals with income from salaries and remunerations who directly finalize tax with the tax authority as per point b, clause 1, Article 42 of Circular No. 80/2021/TT-BTC.

dd) Other overpayment refunds:

- The tax refund application for overpaid taxes and other charges specified in clause 2, Article 42 of Circular No. 80/2021/TT-BTC.

- The refund application for personal income tax related to income from salaries and remunerations of organizations and individuals paying income from salaries and remunerations who finalize tax for authorized individuals as specified in point a, clause 1, Article 42 of Circular No. 80/2021/TT-BTC.

2. Classify the tax refund applications according to the regulations at Article 33, Article 44 of Circular No. 80/2021/TT-BTC.

3. Process the tax refund applications according to the regulations at Article 34, Article 45 of Circular No. 80/2021/TT-BTC:

a) Process the tax refund applications subject to refund before inspection.

b) Process the tax refund applications subject to inspection before refund.

4. Appraise the tax refund applications: Appraisal is required for applications subject to appraisal according to the regulations under the Regulation on providing legal opinions for draft legislative documents, drafts of legislative documents, and appraisal of draft administrative documents issued by tax authorities of various levels enclosed with Decision No. 1033/QD-TCT dated June 1, 2018, by the General Director of the General Department of Taxation and subsequent amendments, replacements, and supplements (if any).

5. Make a refund decision:

a) Issuing a Refund Decision or a Refund Decision incorporating offset of state budget revenue, Notification of non-eligibility for refund (according to the regulations at Article 36, Article 46 of Circular No. 80/2021/TT-BTC).

b) Issuing a Payment Decision to the bank being tax agent according to the regulations at Article 36 of Circular No. 80/2021/TT-BTC, Article 21 of Circular No. 72/2014/TT-BTC dated May 30, 2014, by the Ministry of Finance, as amended and supplemented by clause 15, Article 1, Circular No. 92/2019/TT-BTC dated December 31, 2019, by the Ministry of Finance for VAT refunds to agent banks.

6. Issue a command for refunding state budget receipts or a command for refunding with offset of state budget receipts as per the regulations on implementing policies in state budget accounting and treasury operations.

7. Recover refunds according to the regulations at Article 40, Article 50 of Circular No. 80/2021/TT-BTC.

Therefore, the procedures for PIT refund consist of the following steps:

-

Receive the tax refund application according to regulations.

-

Classify the tax refund applications according to Article 33, Article 44 of Circular 80/2021/TT-BTC.

-

Process the tax refund applications according to Article 34, Article 45 of Circular 80/2021/TT-BTC.

-

Appraise the tax refund applications.

-

Make a refund decision.

-

Issue a command for refunding state budget receipts or a command for refunding with offset of state budget receipts.

-

Recover refunds.

- What are guidelines for salary arrangement of ranks of tax officials in Vietnam?

- What are 02 submission methods of Form 01/PLI on employment report for the last 6 months of 2024 in Vietnam? What is the union fee for members in people's armed forces in Vietnam?

- Who is a intermediate tax inspector in Vietnam? What are the duties?

- What is the VAT rate on endodontic treatment services in Vietnam?

- Is an information technology center subject to VAT in Vietnam?

- Are rice and corn harvesters subject to VAT in Vietnam?

- Are agricultural tractors exempt from VAT in Vietnam?

- What is the form of report on operation of tax agent in Vietnam in 2024? Shall a tax agent be suspended from business if it does not submit the operation report?

- VAT rate increased from 5% to 10% for film production services in Vietnam: What are significant amendments in the draft Value-Added Tax Law?

- From January 1, 2025, which entities are exempt from road user charges at toll plazas in Vietnam?