What is the form of report on operation of tax agent in Vietnam in 2024? Shall a tax agent be suspended from business if it does not submit the operation report?

What is the form of report on operation of tax agent in Vietnam in 2024?

Pursuant to Clause 8, Article 24 of Circular 10/2021/TT-BTC providing regulations on sending notifications and reports to the Tax Department via the electronic information portal of the General Department of Taxation as follows:

Responsibilities of the tax agent

...

- Sending notifications and reports to the Tax Department via the electronic information portal of the General Department of Taxation:

a) Within 5 working days from the date of any changes to the information of tax agent employees, a notification of changes to the tax agent employee information must be sent using Form 2.8 in the Appendix promulgated with this Circular;

b) No later than January 15 each year, a report on the operation of the tax agent must be sent using Form 2.9 in the Appendix promulgated with this Circular. The report information is calculated from January 1 to December 31 of the reporting year.

Therefore, tax agents must report their operation using Form 2.9 in the Appendix promulgated with Circular 10/2021/TT-BTC.

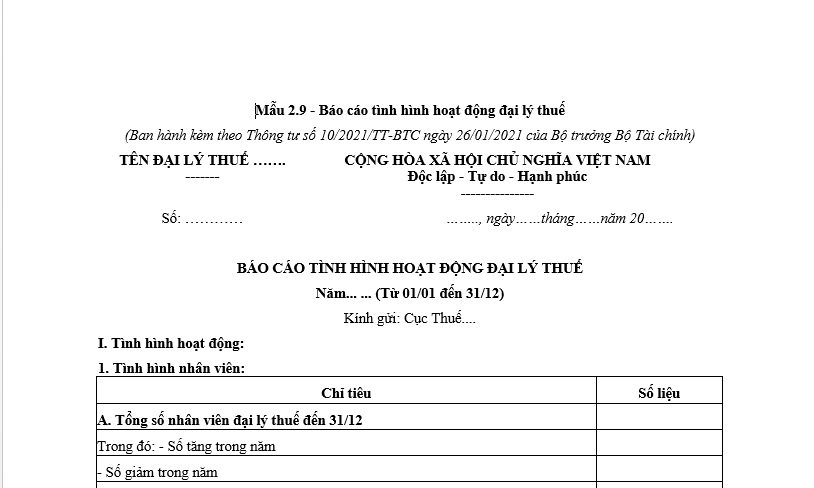

The Appendix attached to Circular 10/2021/TT-BTC stipulates Form 2.9 report on the operation of tax agents for the year 2024 as follows:

Form 2.9 report on the operation of tax agents for the year 2024... Download

What is the form of report on operation of tax agent in Vietnam in 2024? (Image from the Internet)

Vietnam: Shall a tax agent be suspended from business if it does not submit the operation report in 2024?

Pursuant to Clause 1, Article 26 of Circular 10/2021/TT-BTC, the cases in which a tax agent is suspended are as follows:

Suspension of Tax Procedure Service Business

- A tax agent will be suspended from providing tax procedure services if it falls into one of the following cases:

a) Does not meet the conditions specified in Clause 2, Article 102 of the Tax Administration Law for 3 consecutive months.

b) Fails to provide or provides incomplete or inaccurate information and documents to the tax authority as required.

c) Discloses information causing material, spiritual damage, or defames the reputation of the taxpayer using tax agent services (except in cases where the taxpayer agrees or the law provides otherwise).

d) Misuses and mismanages tax agent employees contrary to what is specified in this Circular.

đ) Fails to submit notifications or reports as specified in Clause 8, Article 24 of this Circular for 15 days or more past the reporting or notification deadline as stipulated by the tax authority.

...

Accordingly, a tax agent will be suspended from providing tax procedure services if it fails to submit the operation report as required by Clause 8, Article 24 of Circular 10/2021/TT-BTC for 15 days or more beyond the report or notification deadline stipulated by the tax authority.

Vietnam: When shall a tax agent have its certificate of eligibility for tax procedure services revoked?

Pursuant to Clause 1, Article 27 of Circular 10/2021/TT-BTC specifying the cases in which a tax agent will have its certificate of eligibility for tax procedure services revoked:

Revocation of certificate of eligibility for tax procedure services

- A tax agent will have its certificate of eligibility for tax procedure services revoked if it falls into one of the following cases:

a) Commits acts to help taxpayers evade taxes or be penalized for violating regulations related to tax procedure service business to the extent of being subject to criminal liability.

b) Falsely declares or fabricates documents to obtain a certificate of eligibility for tax procedure services.

c) Is dissolved, bankrupt, or has its business registration certificate, investment registration certificate, or equivalent documents revoked; is informed by the tax authority that the taxpayer does not operate at the registered address.

d) Exceeds 90 days from the effective date of the decision to suspend tax procedure service business under the provisions of Article 26 of this Circular without remedying the violation.

- The tax agent must cease tax procedure service business from the effective date of the decision to revoke its certificate of eligibility for tax procedure services by the Tax Department.

....

Accordingly, a tax agent will have its certificate of eligibility for tax procedure services revoked if it falls into one of the following cases:

(1) Commits acts to help taxpayers evade taxes or be penalized for violating regulations related to tax procedure service business to the extent of being subject to criminal liability.

(2) Falsely declares or fabricates documents to obtain a certificate of eligibility for tax procedure services.

(3) Is dissolved, bankrupt, or has its business registration certificate, investment registration certificate, or equivalent documents revoked; is informed by the tax authority that the taxpayer does not operate at the registered address.

(4) Exceeds 90 days from the effective date of the decision to suspend tax procedure service business under the provisions of Article 26 of Circular 10/2021/TT-BTC without remedying the violation.