Are agricultural tractors exempt from VAT in Vietnam?

Are agricultural tractors exempt from VAT in Vietnam?

Based on the provisions of Clause 3a, Article 4 of Circular 219/2013/TT-BTC (amended by Clause 2, Article 1 of Circular 26/2015/TT-BTC) as follows:

Objects Exempt from VAT

...

3a. Fertilizers include organic and inorganic fertilizers such as: phosphate fertilizers, urea, NPK fertilizers, mixed nitrogen fertilizers, phosphate, potash; bio-fertilizers and other fertilizers;

Feed for livestock, poultry, aquatic animals, and other animals, including both processed and unprocessed products such as bran, oil cakes, fishmeal, bone meal, shrimp meal, other types of feed used for livestock, poultry, aquatic animals, and other animals; feed additives (such as premix, active ingredients, and carriers) as stipulated in Clause 1 Article 3 of Decree No. 08/2010/ND-CP dated February 5, 2010, of the Government of Vietnam on feed management and Clauses 2 and 3 Article 1 of Circular No. 50/2014/TT-BNNPTNT dated December 24, 2014, of the Ministry of Agriculture and Rural Development;

Offshore fishing vessels are ships with a main engine capacity of 90CV or more used for seafood exploitation or logistical services for seafood exploitation; machines and specialized equipment serving the exploitation, preservation of products for fishing vessels with a total main engine capacity of 90CV or more used for seafood exploitation or logistical services for seafood exploitation;

Specialized machinery and equipment for agricultural production include: ploughs; harrows; rotary tillers; row markers; root cutters; equipment for field leveling; seeders; transplanters; sugarcane planters; sod mat production systems; tillage machines, ridge tillers, spreaders, fertilizer dispensers; machines, pesticide sprayers; harvesters for rice, corn, sugarcane, coffee, cotton; harvesters for tubers, fruit, roots; tea pruning machines, tea pluckers; threshing machines for rice; corn hulling machines; corn shellers; soybean threshers; peanut shellers; coffee hullers; machines for preliminary processing of coffee beans, wet paddy; dryers for agricultural products (rice, corn, coffee, pepper, cashew, etc.), aquatic products; machines for collecting, loading sugarcane, rice, straw in fields; incubators, poultry hatchers; grass harvesters, hay balers; milkers and other specialized machines.

...

Based on the above regulations, in cases where the imported tractor used as a mover for plows, harrows, etc. (not attached to other machinery, equipment performing functions such as plowing, harrowing, rotary tilling, row marking, sowing, spraying pesticides, field leveling) does not qualify as specialized machinery and equipment for agricultural production, and is used solely in agriculture without applications for other purposes, it is not exempt from VAT.

Are agricultural tractors exempt from VAT in Vietnam? (Image from Internet)

When is the time for calculating VAT for imported agricultural tractors in Vietnam?

The time for calculating VAT is specified in Article 8 of Circular 219/2013/TT-BTC as follows:

time for calculating VAT

1. For the sale of goods, it is the time of transfer of ownership or right to use the goods to the buyer, regardless of whether payment has been collected.

2. For service provision, it is the time of completion of the service provision or the time of issuing the service provision invoice, regardless of whether payment has been collected.

For telecommunications services, it is the time when reconciliation of data on telecommunications service fees is completed as per economic contracts between telecommunications service businesses but no later than two months from the month the connection service fees arise.

3. For the supply of electricity, clean water, it is the date of recording the consumption index on meters for billing.

4. For real estate business, infrastructure construction, housing construction for sale, transfer or lease, it is the payment schedule according to the project's implementation progress or the payment schedule recorded in the contract. Based on the collected amount, the business shall declare the arising output VAT in the period.

5. For construction, installation, including shipbuilding, it is the time of acceptance, handover of works, work items, completed construction volumes, installation, whether payment has been collected or not.

6. For imported goods, it is the time of customs declaration registration.

Therefore, the time for calculating VAT for imported agricultural tractors is at the time of customs declaration registration.

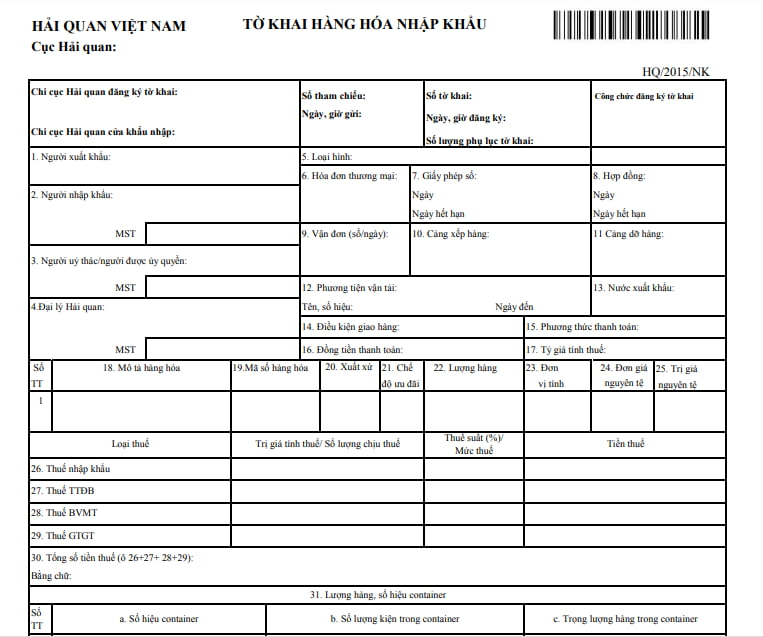

What is the latest import customs declaration form for 2024?

The latest Import Customs Declaration Form for 2024 is Form HQ/2015/NK as prescribed in Appendix 4 issued with Circular 38/2015/TT-BTC.

Form HQ/2015/NK: DOWNLOAD