What is the appendix form showing the statement on dependents regulated for personal deduction Form 05-3/BK-QTT-TNCN in Vietnam?

What is the appendix form showing the statement on dependents regulated for personal deduction Form 05-3/BK-QTT-TNCN in Vietnam?

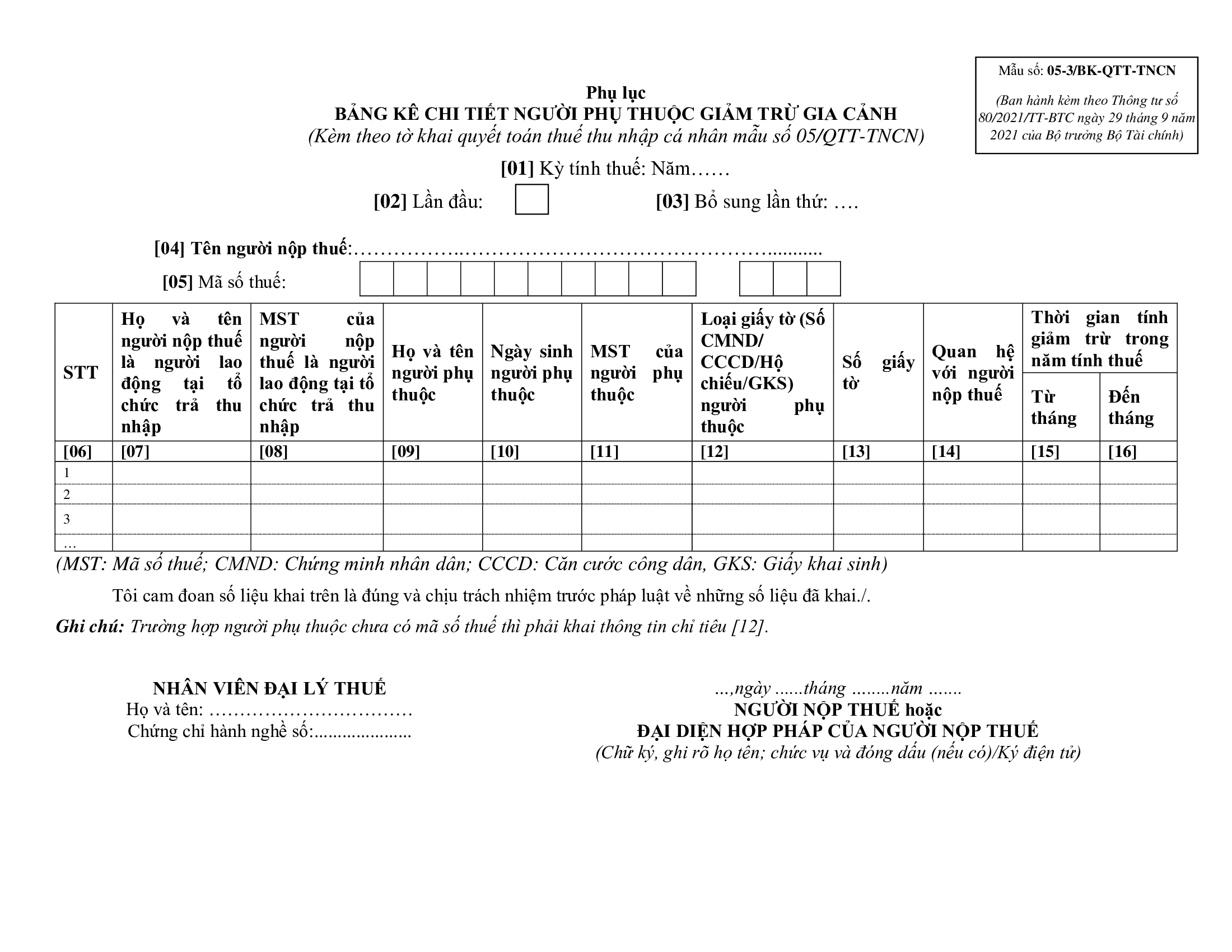

The appendix form showing the statement on dependents regulated for personal deduction Form 05-3/BK-QTT-TNCN is issued together with Circular 80/2021/TT-BTC as follows:

Download Form 05-3/BK-QTT-TNCN: here

What is the appendix form showing the statement on dependents regulated for personal deduction Form 05-3/BK-QTT-TNCN in Vietnam? (Image from the Internet)

How many dependents can an individual in Vietnam register for personal deduction?

Personal deduction consists of two parts: deduction for the taxpayer and deduction for dependents. The taxpayer will automatically receive a personal deduction when calculating personal income tax and there is no limit on the maximum number of dependents registered for the deduction.

Under Point c, Clause 1, Article 9 of Circular 111/2013/TT-BTC, the principles for calculating personal deduction can be summarized as follows:

- The taxpayer with income from wages and remunerations shall calculate personal deduction for him/herself;

- The taxpayer may make deductions for his or her dependants if the taxpayer has applied for tax registration and been issued with the tax code.;

- The deduction for a dependant shall apply to only one taxpayer in the tax year. Where multiple taxpayers have the same dependant to provide for, they shall reach an agreement on the person that makes the deduction for such dependant.

Therefore, the law does not limit the number of dependents for one taxpayer, as long as they belong to the eligible group and meet the corresponding conditions as regulated for personal deduction.

What does income ineligible for personal deduction upon PIT calculation in Vietnam include?

Under Clause 1, Article 19 of the Personal Income Tax Law 2007 (amended and supplemented by Clause 4, Article 1 of the Law on Amendments to Personal Income Tax Law 2012) and Clause 4, Article 6 of the Law Amending Tax Laws 2014, the personal deduction is the amount of money deducted from the taxable income before calculating tax on incomes from business, or wages earned by the resident taxpayer.

Thus, it means that the types of income under Article 2 of Circular 111/2013/TT-BTC will not be eligible for personal deduction:

(1) Income from capital investments, including:

- Loan interest.

- Dividends.

- The added value of capital contribution received when the enterprise is dissolved, converted, divided, split, merged, amalgamated, or upon capital withdrawal.

- Income from capital investments in other forms, except for bond interest from the Government of Vietnam.

(2) Income from capital transfer, including:

- Income from transferring capital shares in economic organizations.

- Income from transferring securities.

- Income from transferring capital under other forms.

(3) Income from real estate transfer, including:

- Income from transferring land use rights and assets attached to land.

- Income from transferring ownership or use rights of houses (including future-formed houses).

- Income from transferring leases of land, water surface.

- Other income received from real estate transfer in any form.

(4) Income form winning prizes, including:

- Lottery winnings.

- Prize winnings in various promotional activities.

- Betting winnings.

- Prize winnings in games, contests, and other forms of winnings.

(5) Income from copyright, including:

- Income from transferring and licensing intellectual property rights.

- Income from technology transfer.

(6) Income from franchising.

(7) Income from inheritance comprising securities, capital shares in economic organizations, businesses, real estate, and other properties requiring ownership or use right registration.

(8) Income from receipt of gifts comprising securities, capital shares in economic organizations, businesses, real estate, and other properties requiring ownership or use right registration.

- What are Answers to Round 3 of the Contest on Learn about the 95th Anniversary of the Founding of the Communist Party of Vietnam and the History of the CPV Committee of Quang Ninh Province?

- How to calculate benefits for those retiring early upon downsizing in Vietnam? Is the retirement allowance subject to PIT?

- What is the initial licensing fee declaration form in Vietnam in 2025? How to complete the 2025 licensing fee declaration?

- What is the schedule of fees for chemical affairs in Vietnam? What are regulations on the management and use of fees in chemical affairs in Vietnam?

- What are the slaughtering control fees in veterinary in Vietnam? Are livestock farms subject to environmental protection fees in Vietnam?

- What are instructions for completing the tax declaration for fixed tax payers changing tax calculation methods in Vietnam (Form 01/CNKD)?

- How to determine the 2025 Tet bonus fund for Vietnamese officials and public employees according to Decree 73? Are 2025 Tet bonuses for Vietnamese officials and public employees taxable?

- What is the 2025 Tet holiday schedule for Shopee couriers in Vietnam? Shall goods under 1 million VND sent via express delivery to Vietnam not be exempted from import duty?

- What is the fixed asset liquidation minutes form in Vietnam according to Circular 200/2014?

- How to calculate benefits for Vietnamese tax officials retiring early in 2025?