What are personal income tax brackets in Vietnam in 2025? How to calculate personal income tax in Vietnam in 2025?

What salary is subject to personal income tax in Vietnam in 2025?

According to Article 1 of Resolution 954/2020/UBTVQH14, the new family deduction levels are specified as follows:

Family Deduction Levels

Adjusting the family deduction levels as stipulated in Clause 1, Article 19 of the Personal Income Tax Law No. 04/2007/QH12, amended and supplemented by Law No. 26/2012/QH13, as follows:

- The deduction level for the taxpayer is 11 million VND/month (132 million VND/year);

- The deduction level for each dependent is 4.4 million VND/month.

Thus, currently, individuals with a salary exceeding 11 million VND/month (132 million VND/year) (in the case of no dependents) must pay personal income tax.

However, the actual taxable income will vary depending on the number of dependents. Individuals with many dependents will receive more deductions, meaning the salary level subject to tax will be higher compared to those with no or fewer dependents.

What are personal income tax brackets in Vietnam in 2025?

According to Clause 2, Article 7 of Circular 111/2013/TT-BTC (The provisions related to personal income tax for individual businesses in this article were annulled by Clause 6, Article 25 of Circular 92/2015/TT-BTC), personal income tax (PIT) in Vietnam is applied according to a progressive tax schedule with 7 tax brackets as follows:

| Tax Bracket | Taxable income/year (million VND) | Taxable income/month (million VND) | Tax Rate (%) |

| 1 | Up to 60 | Up to 5 | 5 |

| 2 | Over 60 to 120 | Over 5 to 10 | 10 |

| 3 | Over 120 to 216 | Over 10 to 18 | 15 |

| 4 | Over 216 to 384 | Over 18 to 32 | 20 |

| 5 | Over 384 to 624 | Over 32 to 52 | 25 |

| 6 | Over 624 to 960 | Over 52 to 80 | 30 |

| 7 | Over 960 | Over 80 | 35 |

Personal Income Tax Brackets 2025? (Image from the Internet)

What is the guidance on calculating personal income tax in Vietnam in 2025?

Before calculating personal income tax (PIT), it is necessary to determine who is the taxpayer because the tax calculation method applicable to these subjects is different.

According to Article 2 of the Personal Income Tax Law 2007, the taxpayers are categorized into the following two groups:

- Resident individuals with taxable income.

- Non-resident individuals with taxable income arising in Vietnam.

Following is the detailed guidance on calculating personal income tax in 2025:

(1) How to calculate personal income tax for resident individuals

Currently, the calculation of PIT for resident individuals includes two cases as follows:

Case 1: Resident individuals with a labor contract of 03 months or more and having income from wages, salaries.

Case 2: Resident individuals without labor contracts or with labor contracts of less than 03 months.

*Calculating PIT for resident individuals with labor contracts of 03 months or more

The formula for calculating PIT is as follows:

PIT Payable = Taxable Income x Tax Rate

In which:

- Taxable Income (TNTT) = Taxable income - Deductions.

- The tax rate from wages and salaries is calculated progressively as stipulated in Article 22 of the Personal Income Tax Law 2008. To be specific:

| Tax Bracket | Taxable income/year (million VND) | Taxable income/month (million VND) | Tax Rate (%) |

| 1 | Up to 60 | Up to 5 | 5 |

| 2 | Over 60 to 120 | Over 5 to 10 | 10 |

| 3 | Over 120 to 216 | Over 10 to 18 | 15 |

| 4 | Over 216 to 384 | Over 18 to 32 | 20 |

| 5 | Over 384 to 624 | Over 32 to 52 | 25 |

| 6 | Over 624 to 960 | Over 52 to 80 | 30 |

| 7 | Over 960 | Over 80 | 35 |

However, based on Appendix No. 01/PL-TNCN issued together with Circular 111/2013/TT-BTC, a streamlined method for calculating PIT on wages and salaries is outlined as follows:

| Bracket | Taxable Income/month (VND) | Tax Rate | Method 1 Tax Payable | Method 2 Tax Payable |

| 1 | Up to 5 million | 5% | 0 million + 5% TNTT | 5% TNTT |

| 2 | Over 5 million to 10 million | 10% | 0.25 million + 10% TNTT over 5 million | 10% TNTT - 0.25 million |

| 3 | Over 10 million to 18 million | 15% | 0.75 million + 15% TNTT over 10 million | 15% TNTT - 0.75 million |

| 4 | Over 18 million to 32 million | 20% | 1.95 million + 20% TNTT over 18 million | 20% TNTT - 1.65 million |

| 5 | Over 32 million to 52 million | 25% | 4.75 million + 25% TNTT over 32 million | 25% TNTT - 3.25 million |

| 6 | Over 52 million to 80 million | 30% | 9.75 million + 30% TNTT over 52 million | 30 % TNTT - 5.85 million |

| 7 | Over 80 million | 35% | 18.15 million + 35% TNTT over 80 million | 35% TNTT - 9.85 million |

Example: Ms. C has an income from wages, salaries in the month of 40 million VND and pays insurance contributions at the rate of: 8% social insurance, 1.5% health insurance, 1% unemployment insurance on the salary. Ms. C supports 2 children under 18 years old, and in the month, she does not make charitable, humanitarian, or educational promotion contributions.

Tax Payable Calculation Using the Streamlined Method

- Ms. C's taxable income is 40 million VND.

- Ms. C receives the following deductions:

+ Personal family deduction: 11 million VND

+ Deduction for 02 dependents (2 children): 4.4 million VND x 2 = 8.8 million VND

+ Social insurance, health insurance, unemployment insurance: (The maximum salary for SI, HI contributions is not more than 20 times the statutory pay rate, i.e., not more than 2,340,000 x 20 = 46,800,000 VND) 40 million VND x (8% + 1.5% + 1%) = 4.2 million VND

Total deductions: 11 million VND + 8.8 million VND + 4.2 million VND = 24 million VND

- Ms. C's taxable income: 40 million VND - 24 million VND = 16 million VND

=> The taxable income of 16 million VND in the month falls under tax bracket 3. Hence, the personal income tax payable is:

16 million VND x 15% - 0.75 million VND = 1,650,000 VND

*Calculating PIT for resident individuals without labor contracts or with labor contracts of less than 03 months

Based on point i, Clause 1, Article 25 of Circular No. 111/2013/TT-BTC, for cases where the taxpayer is a resident individual without a labor contract (LCD) or with an LCD of less than 03 months with a total income payment from 2 million VND/occasion or more, tax is withheld at 10% of the income (withheld before payment).

The formula for calculating PIT for this case is:

PIT = 10% x Total Income Before Payment

If an individual only has a single income subject to withholding tax at the rate mentioned above but estimates their total taxable income, after family deductions, does not reach the taxable threshold, they may submit a declaration (according to the form issued with the tax management guidance document) to the income-paying organization for exemption from temporary tax withholding.

Based on the individual's declaration, the income-paying organization will not withhold tax. At the end of the tax year, the income-paying organization must compile a list and income of individuals not reaching the withholding tax threshold (using the form issued with the tax management guidance document) and submit to the tax authority. The individual making a declaration must take responsibility for their declaration, and if fraud is detected, they will be dealt with according to the provisions of the Tax Management Law.

Individuals making declarations using Form 08/CK-TNCN must have taxpayer registration and a tax code at the time of declaration.

Download Form 08/CK-TNCN...Here

Example: An individual works freelance, without signing a labour contract. During the month, this individual receives income from a company amounting to 5,000,000 VND/occasion. Since the income is 2 million VND/occasion or more, the company must withhold 10% PIT before payment.

Tax Calculation:

PIT = 10% × Total Income Before Payment

= 10% × 5,000,000 = 500,000 VND

The actual amount received by the individual:

= 5,000,000 - 500,000 = 4,500,000 VND

Cases of Tax Withholding Exemption for Individuals:

If an individual estimates their total taxable income after family deductions does not reach the taxable threshold (i.e., below 132 million VND/year for those without dependents, or below 176 million VND/year if having 1 dependent),

The individual may submit a Declaration using Form 08/CK-TNCN to the company for temporary tax withholding exemption.

(2) How to calculate personal income tax for non-resident individuals

According to Clause 1, Article 18 of Circular 111/2013/TT-BTC, non-resident individuals are not allowed family deductions, so they only need to have positive taxable income to be subject to income tax at a 20% tax rate on taxable income.

Thus, the formula for calculating PIT for non-resident individuals is as follows:

PIT = 20% x Taxable Income

Determining individual taxable income on wages and salaries in Vietnam for non-resident individuals working simultaneously in Vietnam and abroad but unable to segregate the income generated in Vietnam is conducted according to the following formula:

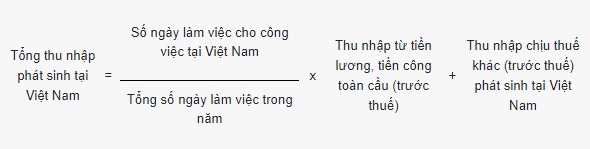

- For cases where foreign individuals are not present in Vietnam:

Where: The total number of working days in the year is calculated according to the policies stipulated in the Labor Code 2019.

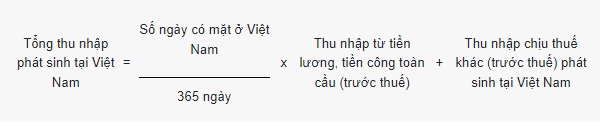

- For cases where foreign individuals are present in Vietnam:

Other (pre-tax) taxable income arising in Vietnam in the aforementioned cases refers to cash or non-cash benefits that employees enjoy beyond wages, salaries paid or covered by employers.

- How many parts does the format of e-invoices have? If individual businesses no longer use tax authority-ordered printed invoices in Vietnam, how long do they have to destroy them?

- Ministry of Finance of Vietnam guides early retirement policy under the Decree 178: What authority and responsibility does the Ministry of Finance of Vietnam have in fee and charge management in Vietnam?

- Can Tho City Tax Department provides guidance on the implementation of Decree 20 on related-party transactions

- Is it necessary to notify the supervisory tax authority when selecting a currency unit in accounting in Vietnam?

- When buying inventory in Vietnam, if the input VAT is deductible, which accounts should be recorded?

- What is the Form 01/XSBHDC on personal income tax declaration 2025 for multi-level marketing enterprises in Vietnam?

- How to download the advance payment slip form according to Circular 200? How to fill out the advance payment slip form in Vietnam?

- Is it mandatory to use a digital signature for e-tax transactions in Vietnam?

- Vietnam: Shall the TIN of the household business's representative be deactivated when the household business ceases operations?

- What is the guidance on looking up the 2025 PIT debts in Vietnam? Which agency has the authority to cancel tax debts in Vietnam?