What is the guidance on looking up the 2025 PIT debts in Vietnam? Which agency has the authority to cancel tax debts in Vietnam?

What is the guidance on looking up the 2025 personal income tax debts in Vietnam?

To look up the latest personal income tax (PIT) debts in 2025, you may follow one of the two methods below:

Method 1: Lookup PIT debts via the General Department of Taxation's Electronic Portal:

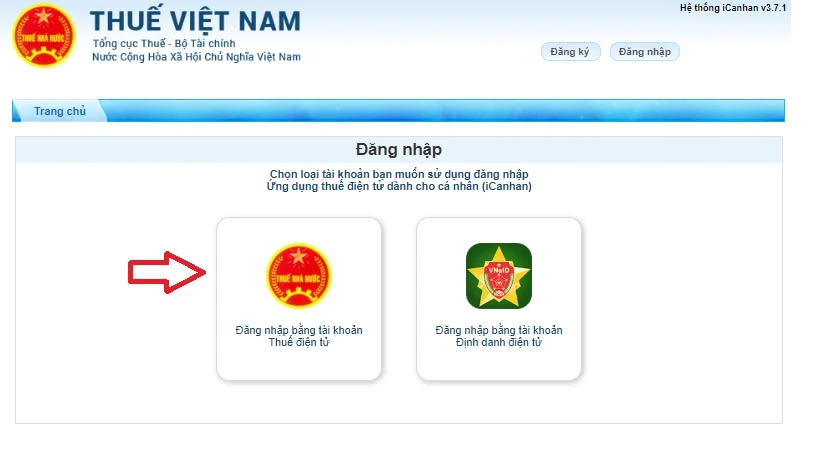

- Step 1: Access the General Department of Taxation's Electronic Portal at: https://thuedientu.gdt.gov.vn

- Step 2: Select the "Individual" section and log in using your electronic tax account or VNeID electronic identification account. If you do not have an account, you can register using your tax code and citizen identification number.

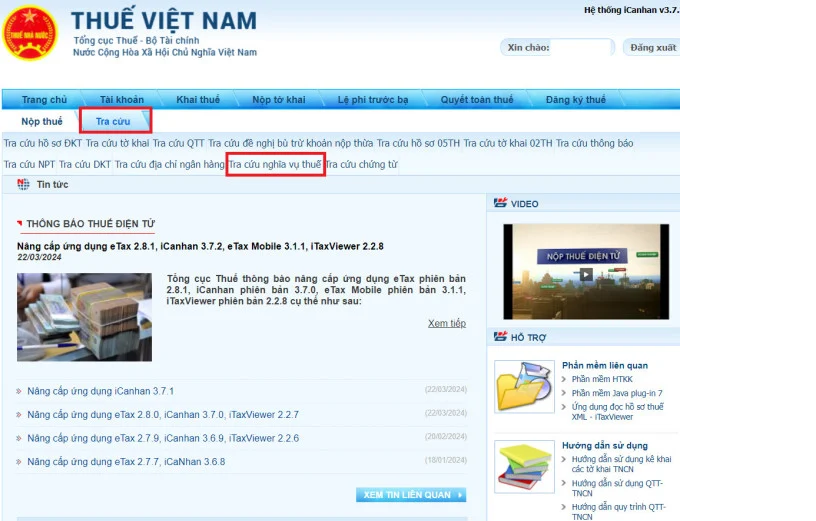

- Step 3: After logging in, select "Look Up" > "Tax Obligation Lookup."

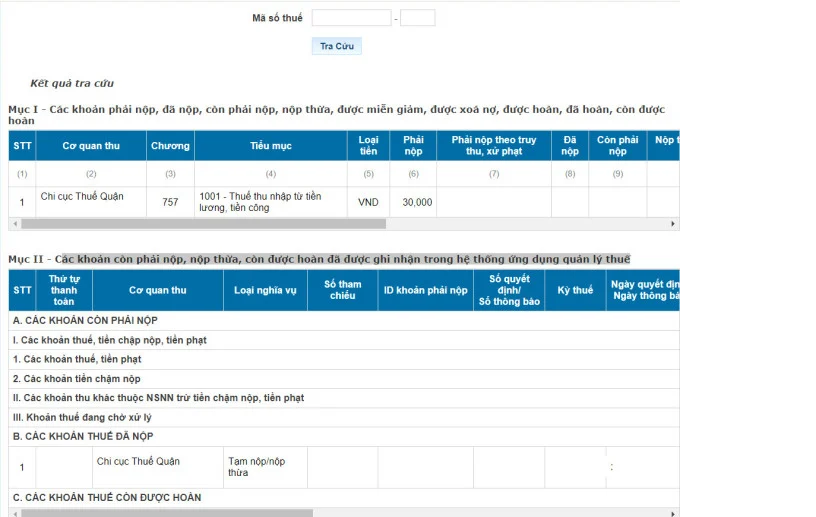

- Step 4: The system will display information about taxes that are due, paid, outstanding, overpaid, exempted, written off, refundable, and yet to be refunded.

Method 2: Lookup PIT debts via the eTax Mobile application:

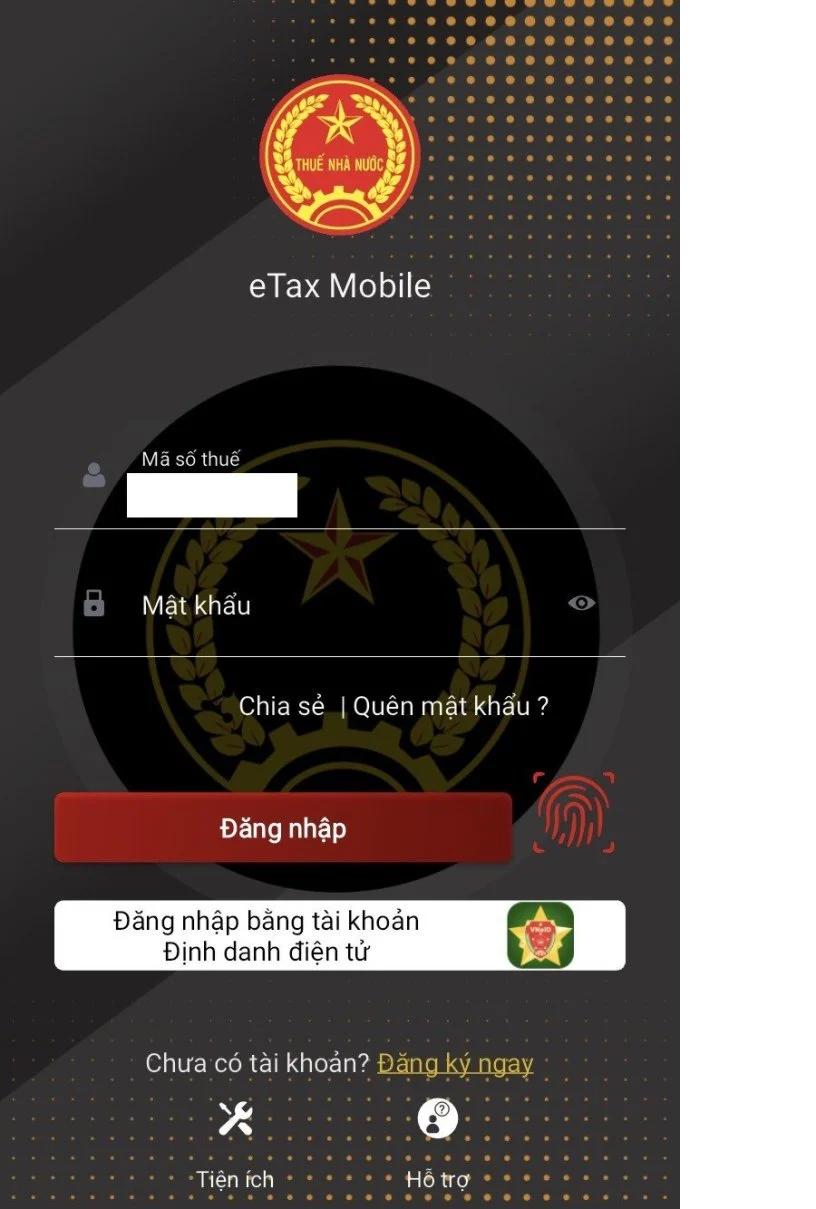

- Step 1: Download and install the eTax Mobile app from the App Store (iOS) or Google Play (Android).

- Step 2: Open the application and log in using your registered tax code and password. If you do not have an account, you can register directly on the application using your tax code and citizen identification number.

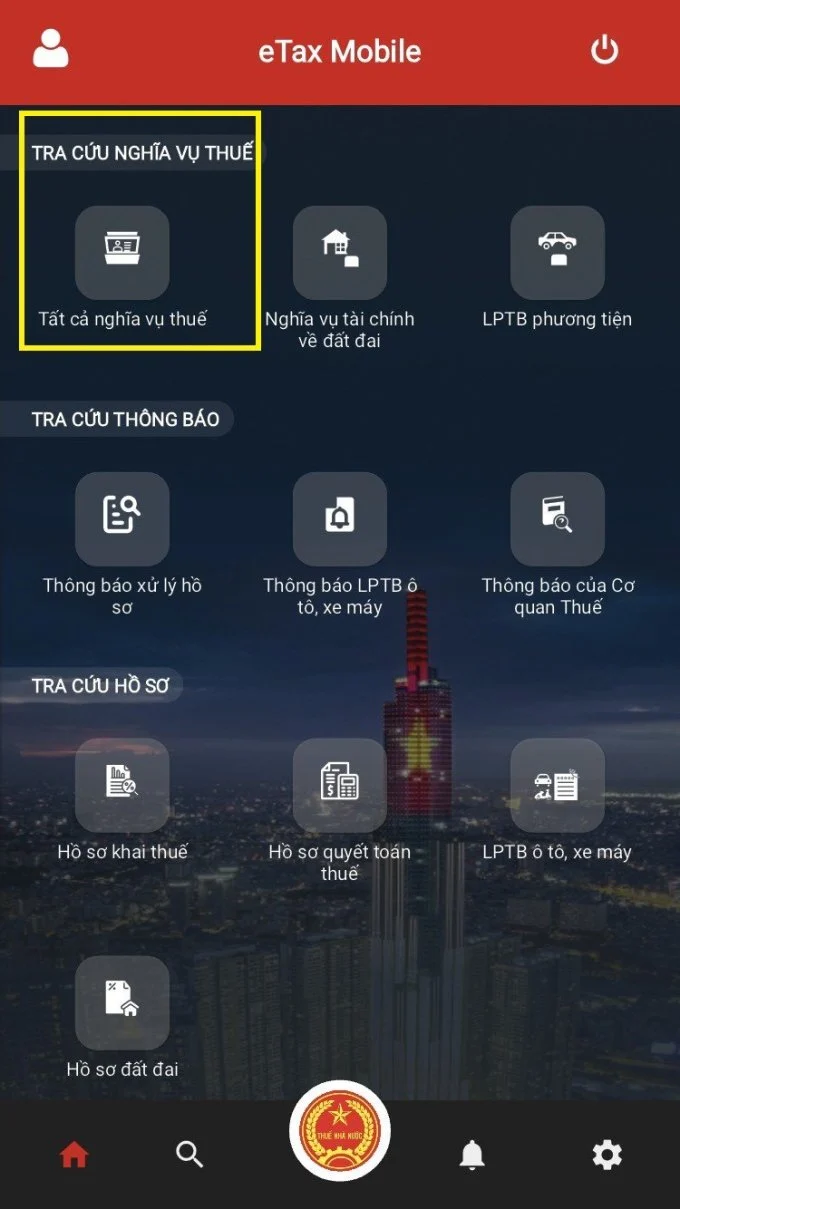

- Step 3: In the main interface, select "Tax Obligation Lookup" > "All Tax Obligations."

- Step 4: The system will display detailed information about taxes due, paid, outstanding, and other related information.

Note: Taxpayers can click on the "view details" button to check whether they are eligible for a tax refund or if additional taxes are due, and the specific amount.

What is the guidance on looking up the 2025 PIT debts in Vietnam? Which agency has the authority to cancel tax debts in Vietnam? (Image from the Internet)

Is a deceased individual eligible for cancellation of outstanding tax in Vietnam?

Pursuant to Article 85 of the Tax Administration Law 2019 prescribing cases eligible for cancellation of outstanding tax as follows:

Cases eligible for tax debt, late payment interest, and fine cancellation

- Enterprises, cooperatives declared bankrupt that have settled payments in accordance with insolvency laws and have no assets for tax, late payment interests, and fine payment.

2. Individuals who have died or have been declared deceased, incapacitated for civil acts by a court and have no assets, including inherited assets, to pay outstanding taxes, late payment interests, and fines.

- Tax debts, late payment interests, and fines of taxpayers not falling under the circumstances specified in items 1 and 2 of this Article, which the tax administration authority has applied enforcement measures as provided in point g item 1 Article 125 of this Law, and such debts have been overdue for more than 10 years since the tax payment deadline but cannot be collected.

Taxpayers who are individuals, business individuals, household owners, business household owners, sole proprietorship owners, and single-member limited liability companies who have had their tax debts, late payment interests, and fines canceled as specified in this item must repay these amounts to the State before resuming production or business, or establishing new production or business facilities.

- Taxpayers are no longer operational at the registered business address with the business registration authority; the tax administration authority has cooperated with the commune people's committee where the taxpayer has the headquarters or contact address to verify that the taxpayer or their legal representative is not present in the registered location and announced nationwide that the taxpayer is not present at the registered address.

...

Under the above regulations, if an individual has died and does not have any assets, including inherited assets, to pay due taxes, late payment interests, and fines, they are eligible for cancellation of outstanding tax.

Which agency has the authority to cancel tax debts in Vietnam?

Pursuant to Article 87 of the Tax Administration Law 2019 prescribing the authority for cancellation of outstanding tax as follows:

(1) The President of the Provincial People's Committee shall decide on the cancellation of tax debts, late payment interests, and fines for the following cases:

- Cases specified in items 1 and 2, Article 85 of the Tax Administration Law 2019;

- Households, business households, individual businesses, and individuals specified in item 3, Article 85 of the Tax Administration Law 2019;

- Enterprises, cooperatives under cases specified in item 3, Article 85 of the Tax Administration Law 2019 with tax debts, late payment interests, and fines below 5,000,000,000 VND.

(2) The General Director of the General Department of Taxation and the General Director of the General Department of Customs shall decide on the cancellation of debts for enterprises, cooperatives under cases specified in item 3, Article 85 of the Tax Administration Law 2019 with tax debts, late payment interests, and fines from 5,000,000,000 VND to below 10,000,000,000 VND.

(3) The Minister of Finance shall decide on the cancellation of debts for enterprises, cooperatives under cases specified in item 3, Article 85 of the Tax Administration Law 2019 with tax debts, late payment interests, and fines from 10,000,000,000 VND to below 15,000,000,000 VND.

(4) The Prime Minister of the Government of Vietnam shall decide on the cancellation of debts for enterprises, cooperatives under cases specified in item 3, Article 85 of the Tax Administration Law 2019 with tax debts, late payment interests, and fines from 15,000,000,000 VND or more.

(5) The President of the Provincial People's Committee shall report the results of cancellation of outstanding taxs, late payment interests, and fines to the People's Council of the same level at the beginning of the year. The Minister of Finance shall compile a report on cancellation of outstanding taxs, late payment interests, and fines to be submitted by the Government of Vietnam to the National Assembly when settling the state budget.