Is the credit-invoice method applied by the taxpayer that earns at least 1 billion VND in annual revenue in Vietnam?

Is the credit-invoice method applied by the taxpayer that earns at least 1 billion VND in annual revenue in Vietnam?

Based on the provisions in Article 12 of Circular 219/2013/TT-BTC regarding the credit-invoice method as follows:

Credit-invoice method

1. The credit-invoice method applies to business establishments that fully implement accounting policies, invoices, and documents as prescribed by law on accounting, invoices, and documents, including:

a) Business establishments currently in operation with an annual revenue from selling goods, providing services from 1 billion VND or more and fully implementing accounting policies, invoices, and documents as prescribed by law on accounting, invoices, and documents, excluding households, individuals doing business paying tax according to the credit-invoice method as guided in Article 13 of this Circular;

b) Business establishments voluntarily registered to apply the credit-invoice method, excluding households, individuals doing business paying tax according to the credit-invoice method as guided in Article 13 of this Circular;

c) Foreign organizations, individuals providing goods, services for the purpose of conducting search, exploration, development, and exploitation of oil and gas to pay tax according to the deduction method declared and deducted on their behalf by the Vietnamese side.

2. Annual revenue from 1 billion VND or more serves as the basis to determine the business establishment paying VAT according to the deduction method based on the guidance in point a, clause 1 of this Article as the revenue from selling goods, providing services subject to VAT and is determined as follows:

a) Business establishments determine annual revenue based on the total indicator "Total revenue of VAT-liable goods, services sold" on the monthly VAT declaration of the tax calculation period from November of the previous year until the end of October of the current year before the year of determining the VAT calculation method or on the quarterly VAT declaration for the tax calculation period from the fourth quarter of the previous year until the end of the third quarter of the current year before the year of determining the VAT calculation method. The stable application period for the tax calculation method is 2 consecutive years.

...

Accordingly, a company with revenue over 1 billion VND in the year must switch to declaring VAT using the credit-invoice method.

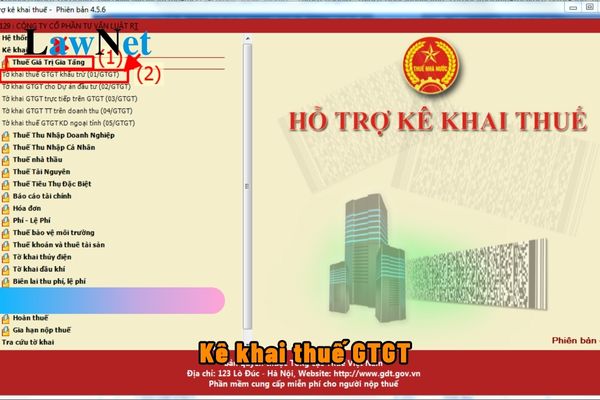

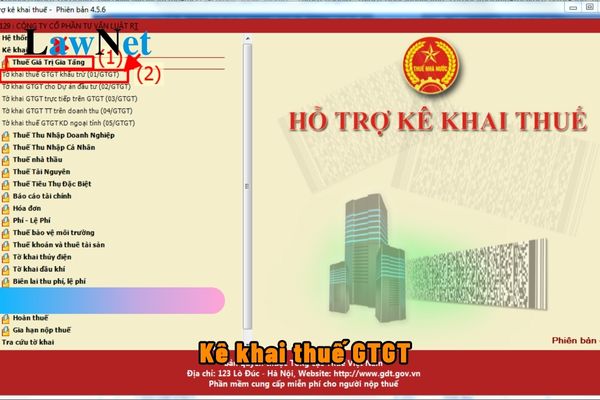

Is the credit-invoice method applied by the taxpayer that earns at least 1 billion VND in annual revenue in Vietnam? (Image from the Internet)

When is the deadline for submitting VAT declarations in Vietnam?

According to Article 44 of the Law on Tax Administration 2019, the deadline for submitting VAT declarations is stipulated as follows:

- The deadline for submitting tax dossier for tax declared monthly, quarterly is as follows:

+ No later than the 20th day of the month following the month in which the tax obligation arises for cases of monthly declaration and payment;

+ No later than the last day of the first month of the quarter following the quarter in which the tax obligation arises for cases of quarterly declaration and payment.

- The deadline for submitting tax dossier for tax calculated annually is as follows:

+ No later than the last day of the third month from the end of the calendar year or fiscal year for annual tax finalization dossiers; no later than the last day of the first month of the calendar year or fiscal year for annual tax declaration dossiers;

+ No later than the last day of the fourth month from the end of the calendar year for personal income tax finalization dossiers of individuals directly conducting tax finalization;

+ No later than December 15 of the preceding year for fixed-tax declaration dossiers of business households, individuals paying tax by the fixed method; in case business households, individuals newly start their business, the deadline for submitting fixed-tax declaration dossiers is no later than 10 days from the start of business.

- The deadline for submitting tax dossier for each time the tax obligation arises is no later than the 10th day from the day the tax obligation arises.

- The deadline for submitting tax dossier in case of termination of operation, termination of contract, or reorganization of enterprise is no later than the 45th day from the occurrence of the event.

- the Government of Vietnam stipulates the deadline for submitting tax dossiers for agricultural land use tax; non-agricultural land use tax; land levy; land rent, water surface rent; fees for granting mineral exploration rights; fees for granting water resource exploitation rights; registration fees; business license fees; collections into the state budget as prescribed by law on management and use of public assets; reporting cross-border profits.

- The deadline for submitting tax dossier for export and import goods is in accordance with the provisions of the Customs Law.

- In case taxpayers declare taxes via electronic transactions on the last day of the tax declaration submission period when the tax authority’s electronic portal has a malfunction, taxpayers shall submit electronic tax declarations and payment documents on the next day after the electronic portal of the tax authority resumes operation.

What are the regulations on the extension of the deadline for paying value-added tax of month, quarter in Vietnam?

According to Article 4 of Decree 64/2024/ND-CP on the extension of tax payment deadlines and land rent as follows:

- For value-added tax (excluding value-added tax at the import stage)

+ Extension of tax payment deadline for value-added tax payable (including the tax amount allocated to other provincial-level localities where taxpayers have their head office, tax amount paid for each arising occasion) in the tax calculation period from May to September 2024 (for cases of monthly value-added tax declaration) and for the second quarter of 2024, the third quarter of 2024 (for cases of quarterly value-added tax declaration) of enterprises, organizations specified in Article 3 of Decree 64/2024/ND-CP.

The extension period is 05 months for the value-added tax of May 2024, June 2024, and the second quarter of 2024, the extension period is 04 months for the value-added tax of July 2024, the extension period is 03 months for the value-added tax of August 2024, the extension period is 02 months for the value-added tax of September 2024 and the third quarter of 2024.

The extension period specified in this point is calculated from the end of the tax payment deadline for value-added tax according to the provisions of the law on tax administration.

The enterprises, organizations eligible for extension will still have to declare and submit their monthly, quarterly value-added tax returns in accordance with current legal provisions but are not required to pay the payable value-added tax arising on the declared value-added tax returns.

- What are guidelines for salary arrangement of ranks of tax officials in Vietnam?

- What are 02 submission methods of Form 01/PLI on employment report for the last 6 months of 2024 in Vietnam? What is the union fee for members in people's armed forces in Vietnam?

- Who is a intermediate tax inspector in Vietnam? What are the duties?

- What is the VAT rate on endodontic treatment services in Vietnam?

- Is an information technology center subject to VAT in Vietnam?

- Are rice and corn harvesters subject to VAT in Vietnam?

- Are agricultural tractors exempt from VAT in Vietnam?

- What is the form of report on operation of tax agent in Vietnam in 2024? Shall a tax agent be suspended from business if it does not submit the operation report?

- VAT rate increased from 5% to 10% for film production services in Vietnam: What are significant amendments in the draft Value-Added Tax Law?

- From January 1, 2025, which entities are exempt from road user charges at toll plazas in Vietnam?