How much is the environmental protection tax on kerosene business in Vietnam?

Is Kerosene subject to environmental protection tax in Vietnam?

According to Article 3 of the Law on Environmental Protection Tax 2010, the taxable objects for environmental protection tax include:

Taxable Objects

1. Gasoline, oil, lubricants, including:

a) Gasoline, except ethanol;

b) Jet fuel;

c) Diesel oil;

d) Kerosene;

dd) Mazut oil;

e) Lubricating oil;

g) Grease.

2. Coal, including:

a) Lignite;

b) Anthracite coal;

c) Fat coal;

d) Other types of coal.

3. Hydro-chloro-fluoro-carbon (HCFC) solution.

4. Plastic bags subject to tax.

5. Herbicides restricted for use.

6. Termite pesticides restricted for use.

7. Forestry product preservatives restricted for use.

8. Warehouse disinfectants restricted for use.

9. Should it be necessary to supplement other taxable objects to comply with each period, the Standing Committee of the National Assembly shall consider and regulate.

The Government of Vietnam regulates the details of this Article.

Kerosene is one type of oil subject to the environmental protection tax.

How much is the environmental protection tax on kerosene business in Vietnam? (Image from the Internet)

How much is the environmental protection tax on kerosene business in Vietnam?

According to Article 8 of the Law on Environmental Protection Tax 2010, the tax brackets for environmental protection tax are specified as follows:

The absolute tax rates are regulated according to the following tax brackets table:

| No. | Goods | Unit | Tax Rate (VND/unit of goods) |

|---|---|---|---|

| I | Gasoline, oil, lubricants | ||

| 1 | Gasoline, except ethanol | Liter | 1,000-4,000 |

| 2 | Jet fuel | Liter | 1,000-3,000 |

| 3 | Diesel oil | Liter | 500-2,000 |

| 4 | Kerosene | Liter | 300-2,000 |

| 5 | Mazut oil | Liter | 300-2,000 |

| 6 | Lubricating oil | Liter | 300-2,000 |

| 7 | Grease | Kg | 300-2,000 |

| II | Coal | ||

| 1 | Lignite | Ton | 10,000-30,000 |

| 2 | Anthracite coal | Ton | 20,000-50,000 |

| 3 | Fat coal | Ton | 10,000-30,000 |

| 4 | Other types of coal | Ton | 10,000-30,000 |

| III | Hydro-chloro-fluoro-carbon (HCFC) solution | kg | 1,000-5,000 |

| IV | Plastic bags subject to tax | kg | 30,000-50,000 |

| V | Herbicides restricted for use | kg | 500-2,000 |

| VI | Termite pesticides restricted for use | kg | 1,000-3,000 |

| VII | Forestry product preservatives restricted for use | kg | 1,000-3,000 |

| VIII | Warehouse disinfectants restricted for use | kg | 1,000-3,000 |

The absolute tax rate for Kerosene is from 300 VND/liter to 2,000 VND/liter.

Note: Based on the prescribed tax brackets, the Standing Committee of the National Assembly specifies the particular tax rates for each type of taxable goods ensuring the following principles:

+ The tax rate on taxable goods must be in line with the socio-economic development policy of the State in each period;

+ The tax rate on taxable goods is determined based on the degree of negative impact the goods have on the environment.

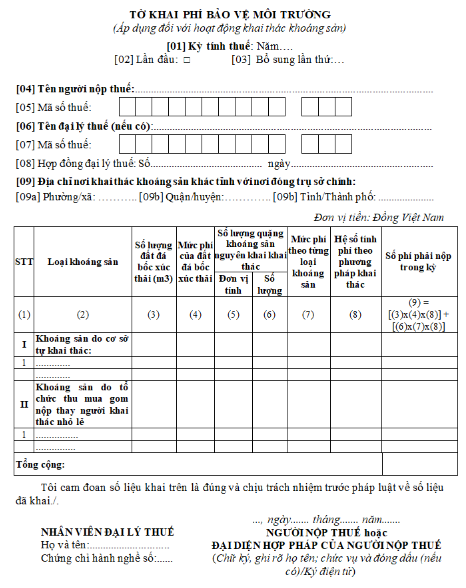

What contents are included in the Form for environmental protection fee declaration for Kerosene in Vietnam?

According to Clause 3, Article 16 of Circular 80/2021/TT-BTC:

Tax declaration, tax calculation, allocation, and payment of environmental protection tax

...

3. Tax declaration, tax payment:

a) For petroleum:

The dependent units of the key trader or dependent units of the subsidiary of the key trader conducting business in a province different from where the key trader or the subsidiary of the key trader is headquartered, which does not maintain accounting records to separately declare environmental protection tax, the key trader or the subsidiary of the key trader shall declare the environmental protection tax and submit the tax declaration document using form No. 01/TBVMT, along with the appendix detailing the allocation of the environmental protection tax amounts payable to the localities benefiting from the tax revenue for petroleum, using form No. 01-2/TBVMT annexed to Appendix II of this Circular, to the directly managing tax authority; and pay the allocated tax amounts to the province where the dependent unit is headquartered as per the provisions in Clause 4, Article 12 of this Circular.

...

The form for Environmental Protection Fee Declaration for Kerosene is Form 01/PBVMT as defined in Appendix 2 attached to Circular 80/2021/TT-BTC:

Download Form 01/PBVMT for Environmental Protection Fee Declaration: Here

Notes about the environmental protection fee declaration for mineral exploitation activities are as follows:

Criteria [09a], [09b], [09c]:

- Declare the information of the locality where the taxpayer conducts mineral exploitation activities in a different province than the main office as per Point i, Clause 1, Article 11 of Decree 126/2020/ND-CP dated October 19, 2020, of the Government of Vietnam. In cases where the taxpayer conducts mineral exploitation activities in multiple districts, declare this criterion as follows:

+ If the Tax Department manages tax collection, the taxpayer declares one representative district where there is mineral exploitation activity.

+ If the Regional Tax Branch manages tax collection, the taxpayer declares one representative district under the Regional Tax Branch where there is mineral exploitation activity.

What documents are included in the environmental protection tax declaration application?

Based on Subsection 21, Section 2, Administrative Procedures issued with Decision 1462/QD-BTC in 2022, the environmental protection tax declaration application includes:

- The environmental protection tax declaration form is form No. 01/TBVMT according to Appendix 1, List of tax declaration documents issued with Decree 126/2020/ND-CP and Circular 80/2021/TT-BTC.

- Appendix of the table determining the environmental protection tax amounts payable to localities benefiting from the tax revenue for coal, according to form No. 01-1/TBVMT in Appendix 1, List of tax declaration documents issued with Decree 126/2020/ND-CP and Circular 80/2021/TT-BTC (in cases where the taxpayer allocates the environmental protection tax payable for petroleum to each locality where the dependent unit is headquartered according to the regulations).

- Appendix of the table allocating the environmental protection tax amounts payable to localities benefiting from the tax revenue for petroleum, according to form No. 01-2/TBVMT in Appendix 1, List of tax declaration documents issued with Decree 126/2020/ND-CP and Circular 80/2021/TT-BTC (in cases where the taxpayer determines the tax amount payable to each locality where the coal mining company is headquartered according to the regulations).

Number of documents: 01 set

- What are 02 methods for writing a self-assessment for members of Communist Party of Vietnam who hold leading positions in 2024? How much is the membership fee for CPV members in political-social organizations?

- Is there an official adjustment to increase pension in Vietnam from July 1, 2025? Does increasing the pension affect the personal income tax in Vietnam?

- What are 02 methods for writing Form 02B on limitations, shortcomings, and causes in the self-assessment for members of Communist Party of Vietnam for the end of 2024? How much is the membership fee for CPV members in armed forces?

- What are 02 ways to write limitations, shortcomings, and causes in the Form 02A on year-end self-assessment for members of Communist Party of Vietnam 2024? Which incomes are bases for determining membership fees?

- How to determine the effective tax rate and top-up tax percentage in Vietnam?

- Will there be penalties imposed for supplementing a tax return before a tax audit in Vietnam?

- When shall a fine which is 2 times as much as the amount of evaded tax be imposed for the act of tax evasion in Vietnam?

- What are cases of distribution of corporate income tax in Vietnam?

- Is a person who assists in tax evasion subject to publishing of information about taxpayers in Vietnam?

- What are conditions for not imposing anti-dumping duties on products whose dumping margin are not more than 2 % of export price in Vietnam?