Are air conditioners subject to excise tax in Vietnam?

Are air conditioners subject to excise tax in Vietnam?

First, to understand the excise tax, it should be noted that currently, the law does not define the concept of "What is a excise tax?" However, it can be referred to according to the taxable and non-taxable objects as specified in Article 2 of the Law on excise tax 2008 (amended by Clause 1, Article 1 of the Law on amendments to the Law on excise tax 2014) and Article 3 of the Law on excise tax 2008.

Additionally, according to Article 5 of the Law on excise tax 2008 as follows:

Tax Basis

The basis for calculating the excise tax is the taxable price of goods and services subject to the tax and the tax rate. The amount of excise tax payable is equal to the taxable price of excise multiplied by the excise tax rate.

Summarizing the above regulations, it can be understood that the excise tax is an indirect tax levied on a number of luxury goods and services to regulate production, import, and social consumption.

It also strongly adjusts the income of consumers, contributing to increasing the State Budget and strengthening the management of the production and business of taxable goods and services.

The excise tax is paid by the establishments directly producing such goods, but the consumer is the one who bears the tax since it is included in the sale price.

Further, according to Article 2 of the Law on excise tax 2008 (amended by Clause 1, Article 1 of the Law on amendments to the Law on excise tax 2014), the taxable objects are specified as follows:

Taxable Objects

1. Goods:

a) Cigarettes, cigars, and other tobacco preparations used for smoking, sniffing, chewing, inhaling, and holding;

b) Alcohol;

c) Beer;

d) Automobiles with less than 24 seats, including vehicles that are both for transporting passengers and goods with two or more rows of seats and a fixed partition between the passenger compartment and the cargo compartment;

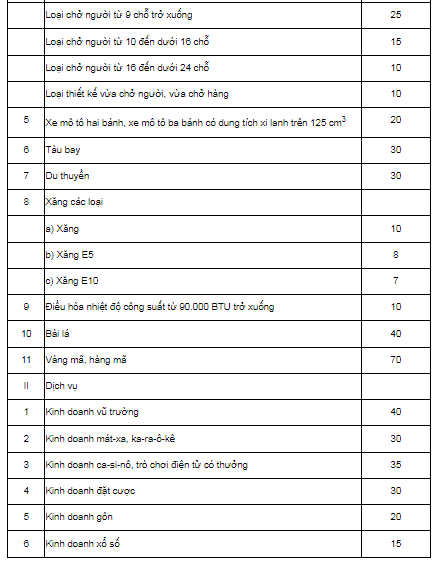

đ) Motorcycles with two wheels and motorcycles with three wheels with cylinder capacity over 125 cm3;

e) Airplanes, yachts;

g) All types of gasoline;

h) Air conditioners with a capacity of 90,000 BTU or less;

i) Playing cards;

k) Votive paper and votive objects.

2. Services:

a) Night club business;

b) Massage, karaoke;

c) Casino business; prize-winning electronic games including jackpot machines, slot machines, and similar types of machines;

d) Betting businesses;

dd) Golf business including selling membership cards, and golf-play tickets;

e) Lottery business.

Thus, according to the above provisions, air conditioners with a capacity of 90,000 BTU or less are subject to excise tax.

(Additional explanation: BTU (short for British thermal unit) is a unit of energy used in the United States. BTU or BTU/h can be simply understood as the amount of energy needed to increase 1 pound (454 grams) of water by 1 degree F. 143 BTU can melt 1 pound of ice.

This unit is used to describe the thermal (energy) value of fuel or power capacity.) (This information is for reference only./.)

Are air conditioners subject to excise tax in Vietnam? (Image from the Internet)

When is a reduction in excise tax applicable in Vietnam?

According to Article 9 of the Law on excise tax 2008, the tax reduction is regulated as follows:

- Taxpayers producing goods subject to excise tax facing difficulties due to natural disasters or unexpected accidents are eligible for tax reduction.

- The tax reduction is determined according to the actual losses caused by natural disasters or unexpected accidents, but not exceeding 30% of the tax payable in the year the damage occurs, and not exceeding the value of assets damaged after compensation (if any).

What is the excise tax rate for air conditioners in Vietnam?

According to Article 5 of the Law on excise tax 2008, the calculation of the excise tax is as follows:

Tax Basis

The basis for calculating the excise tax is the taxable price of goods and services subject to the tax and the tax rate. The amount of excise tax payable is equal to the taxable price of excise multiplied by the excise tax rate.

In addition, the excise tax payable on goods is determined by the following formula:

Excise tax = Taxable price of excise x tax rate

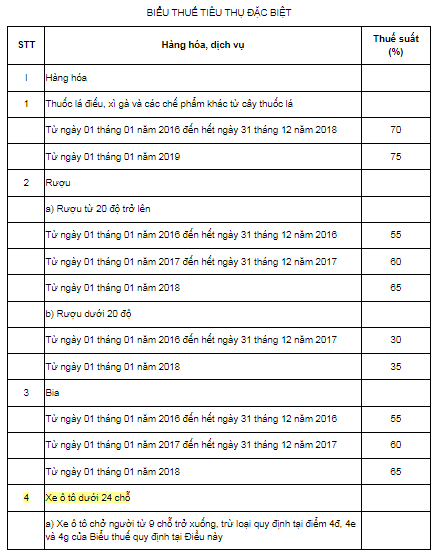

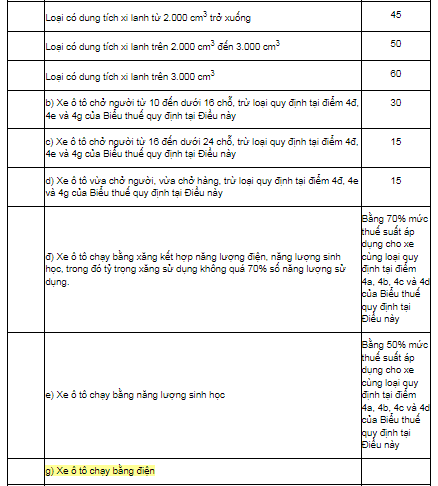

Moreover, according to Article 7 of the Law on excise tax 2008 (amended by Clause 4, Article 1 of the Law on amendments to the Law on excise tax 2014, Clause 2, Article 2 of the Law on Amendments to the Law on Value Added Tax, Law on excise tax, and Law on Tax Management 2016, and Article 8 of the Law on amendments to the Law on Public Investment, Law on Public-Private Partnership Investment, Law on Investment, Law on Housing, Law on Bidding, Law on Electricity, Law on Enterprises, Law on excise tax, and Law on Civil Judgment Enforcement 2022), the excise tax rate for assorted goods is as follows:

Tax Rate

The excise tax rate for goods and services is specified in the following excise tax Schedule:

...

Thus, according to the regulations, air conditioners (air conditioning units) are subject to a 10% excise tax.

- What is the currency unit used in tax accounting in Vietnam?

- Which enterprise groups will the General Department of Taxation of Vietnam focus on inspecting and auditing in 2025?

- What are guidelines on online submission of unemployment benefits application in Vietnam in 2025? Are unemployment benefits subject to personal income tax?

- How long can the tax audit period on taxpayers’ premises in Vietnam be extended for complex matters?

- From January 1, 2025, which entities are exempted from ferry service fees from the state budget in Vietnam?

- How to determine VAT applicable to ships sold to foreign organizations in Vietnam?

- What is the maximum penalty for late submission of tax declaration dossiers in Vietnam?

- What is the duty-free allowance on gifts given for humanitarian in Vietnam?

- Are votive papers subject to excise tax up to 70% in Vietnam?

- Shall enterprises use invoices during suspension of operations in Vietnam?