Is massage service business subject to special consumption tax in Vietnam?

Is massage service business subject to special consumption tax in Vietnam?

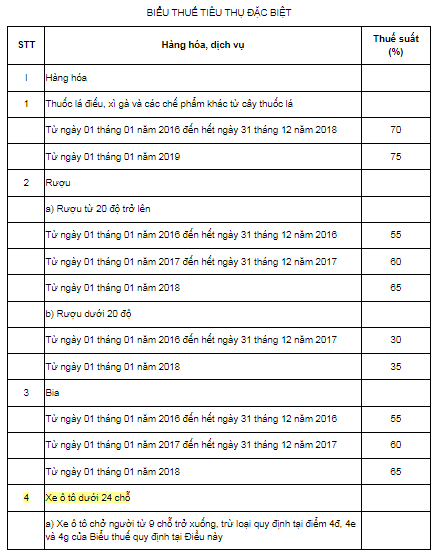

Based on Article 2 of the Special Consumption Tax Law 2008 (amended by Clause 1, Article 1 of the Amended Special Consumption Tax Law 2014), the taxable objects are stipulated as follows:

Taxable Objects

1. Goods:

a) Cigarettes, cigars, and other products derived from tobacco used for smoking, sniffing, chewing, inhaling, sucking;

b) Alcohol;

c) Beer;

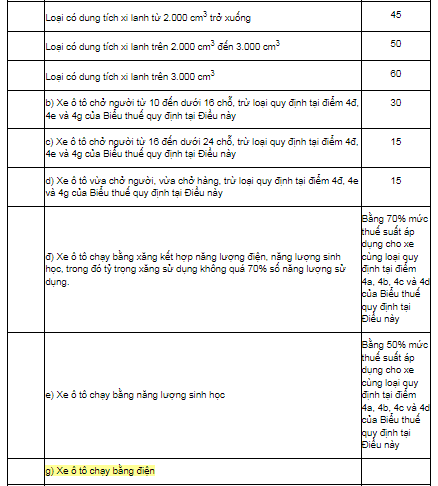

d) Automobiles with less than 24 seats, including dual-purpose vehicles that transport both passengers and goods with at least two rows of seats, and which have a fixed partition between the passenger compartment and the cargo compartment;

dd) Motorcycles with over 125cc engine capacity;

e) Aircraft, yachts;

g) Various types of gasoline;

h) Air conditioners with a capacity of 90,000 BTU or below;

i) Playing cards;

k) Votive papers and other similar types of votive papers.

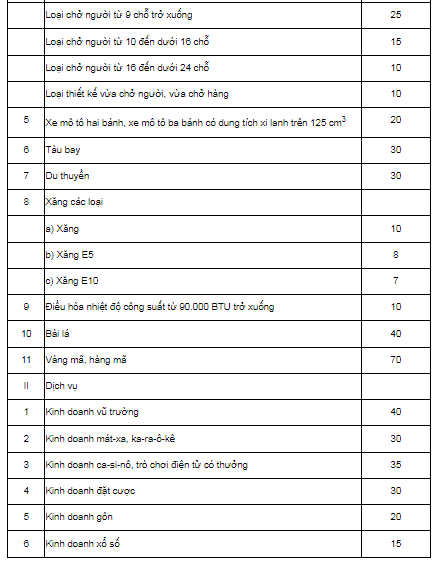

2. Services:

a) Dance hall business;

b) Massage and karaoke business;

c) Casino business; prize-winning electronic games, including jackpot games, slot machines, and similar devices;

d) Betting business;

dd) Golf business, including the sale of membership cards and golf playing tickets;

e) Lottery business.

According to the above regulations, there are six types of services that are subject to special consumption tax:

[1] Dance hall business;

[2] Massage and karaoke business;

[3] Casino business; prize-winning electronic games, including jackpot games, slot machines, and similar devices;

[4] Betting business (including sports betting, entertainment betting, and other forms of betting as stipulated by law);

[5] Golf business, including the sale of membership cards and golf playing tickets;

[6] Lottery business.

Thus, the massage service business is one of the services subject to special consumption tax.

Is massage service business subject to special consumption tax in Vietnam? (Image from the Internet)

How much is the special consumption tax rate for the massage service business in Vietnam?

Based on Article 7 of the Special Consumption Tax Law 2008 (amended by Clause 4, Article 1 of the Amended Special Consumption Tax Law 2014), Clause 2, Article 2 of the Amended Value-Added Tax, Special Consumption Tax, and Tax Administration Law 2016, and Article 8 of the Revised Law on Public Investment, Public-Private Partnership Investment, Investment, Housing, Bidding, Electricity, Enterprises, Special Consumption Tax, and Civil Judgment Execution 2022):

The special consumption tax rate for goods and services is stipulated according to the following Special Consumption Tax Schedule:

Thus, the massage service business is subject to a special consumption tax rate of 30%.

What are cases of special consumption tax refund in Vietnam?

Based on Article 8 of the Special Consumption Tax Law 2008, the cases for tax refund and deduction are stipulated as follows:

- Special consumption taxpayers are eligible for a refund of the tax already paid in the following cases:

[1] Goods temporarily imported for re-export;

[2] Imported goods used as raw materials for the production and processing of export goods;

[3] Tax finalization upon merger, consolidation, division, split, dissolution, bankruptcy, ownership conversion, enterprise conversion, or cessation of operations with excess tax paid;

[4] Tax refund decisions by competent authorities in accordance with the law and cases of special consumption tax refunds according to international treaties to which the Socialist Republic of Vietnam is a party.

Special consumption tax refunds stipulated at Points a and b of this clause only apply to actually exported goods.

In addition, the procedures for tax refunds and deductions are specifically guided by Article 6 of Decree 108/2015/ND-CP (amended by Clause 2, Article 1 of Decree 14/2019/ND-CP) as follows:

The special consumption tax refund is executed according to the provisions of Article 8 of the Special Consumption Tax Law 2008.

- For goods temporarily imported for re-export stipulated in Point a, Clause 1, Article 8 of the Special Consumption Tax Law 2008, including:

+ Imported goods that have paid special consumption tax but are still stored in warehouses and under the supervision of customs authorities at the port and are re-exported out of the country;

+ Imported goods that have paid special consumption tax to deliver or sell to foreign entities through agents in Vietnam; imported goods sold to the vehicles of foreign enterprises or Vietnamese enterprises on international transport routes as stipulated by law;

+ Temporarily imported goods for re-export under the mode of temporary import for re-export business, the paid special consumption tax is refunded corresponding to the actual quantity of re-exported goods;

+ Imported goods that have paid special consumption tax but are re-exported out of the country are refunded the paid special consumption tax for the quantity of goods returned abroad;

+ Temporarily imported goods for exhibits, displaying, introducing products, or other work purposes within a certain period as stipulated by law and having paid special consumption tax, when re-exporting are refunded tax.

If the temporarily imported goods for re-export are actually re-exported within the tax payment deadline stipulated by the law on import and export duties, they will not be subject to the corresponding special consumption tax on the actually re-exported quantity.

- Imported goods used as raw materials for the production and processing of export goods are refunded the paid special consumption tax corresponding to the quantity of raw materials used to produce the actually exported goods.

- Procedures, dossiers, sequence, and authority to handle special consumption tax refunds:

+ The procedures, dossiers, sequence, and authority to handle special consumption tax refunds for goods temporarily imported for re-export stipulated in Clause 1 of this Article are conducted as for import duty refunds.

+ The procedures, dossiers, sequence, and authority to handle special consumption tax refunds for goods used as raw materials for the production and processing of export goods are specified.

In the case of import declarations including import duty and special consumption tax requested for refund, the import duty refund dossier simultaneously serves as the special consumption tax refund dossier.

- Enterprises handle tax finalizations upon merger, consolidation, division, split, dissolution, bankruptcy, ownership conversion, or state-owned enterprise transformation that have overpaid special consumption tax.

- Tax refunds stipulated in Point d, Clause 1, Article 8 of the Special Consumption Tax Law 2008 include:

+ Tax refunds by decision of competent authorities in accordance with the law;

+ Tax refunds according to international treaties to which the Socialist Republic of Vietnam is a party;

+ Tax refunds in cases where the paid special consumption tax amount is greater than the payable special consumption tax amount according to the law.