What are guidelines on online submission of unemployment benefits application in Vietnam in 2025? Are unemployment benefits subject to personal income tax?

What are guidelines on online submission of unemployment benefits application in Vietnam in 2025?

Based on Official Dispatch 1399/LD-TBXH-VL 2022 regarding the reception and processing of unemployment benefits on the National Public Service Portal issued by the Ministry of Labor, Invalids and Social Affairs.

Participants in social insurance, upon termination of their labor contracts and meeting the conditions for unemployment benefits, can proceed with online procedures for unemployment benefits on the National Public Service Portal.

Here are the latest guidelines on how to submit an unemployment benefits application online in Vietnam:

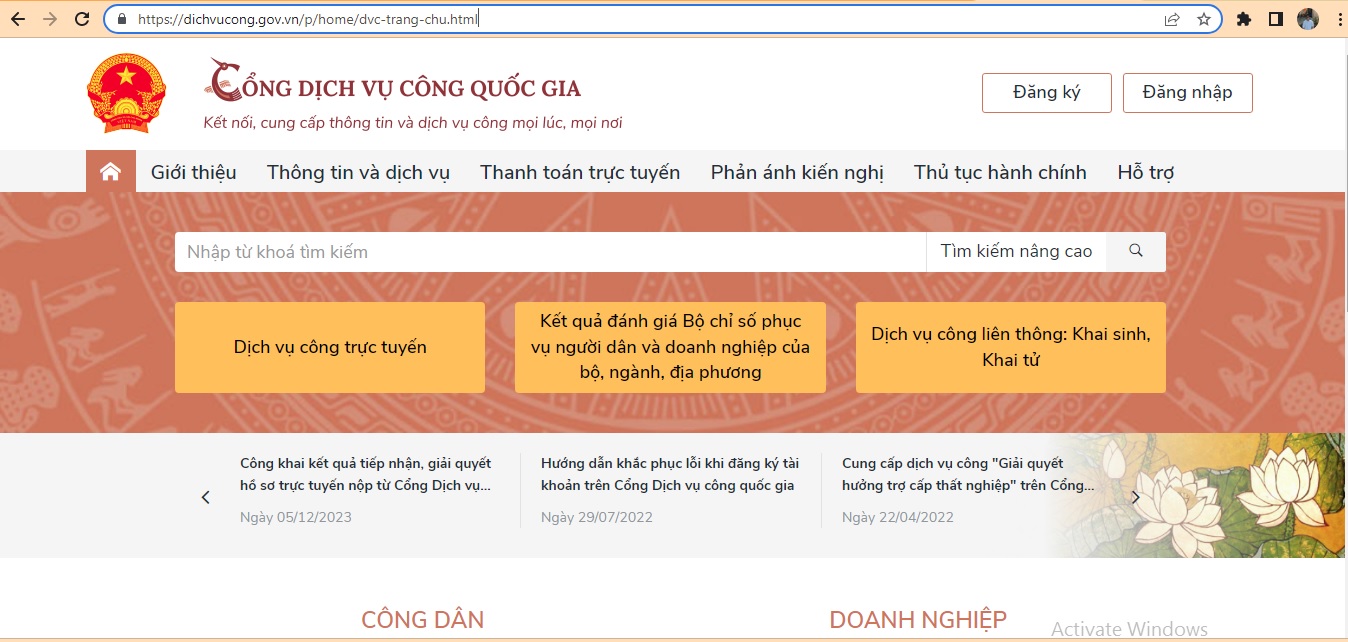

Step 1: Access the link of the National Public Service Portal at: https://dichvucong.gov.vn/p/home/dvc-trang-chu.html

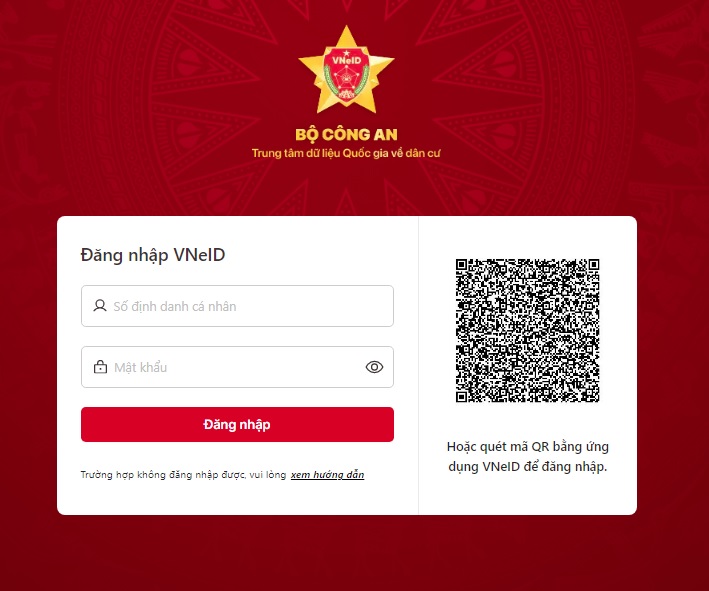

Step 2: Select the "Login" option at the top right corner of the screen, then choose to log in with an "Electronic identification account issued by the Ministry of Public Security for citizens."

Step 3: Next, citizens should enter their identification number and password for the VNeID account or scan the QR Code using the VNeID application on a smartphone to log in.

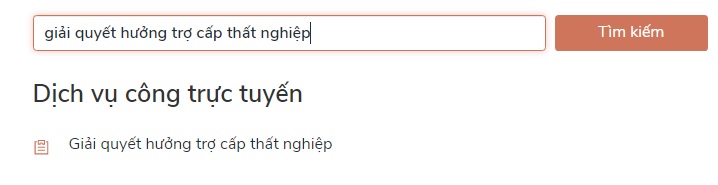

Step 4: After successful login, select submit online public services and enter the keyword: "Resolve unemployment benefit claims" in the search bar.

Step 5: Select the directory "Resolve unemployment benefit claims" that just appeared.

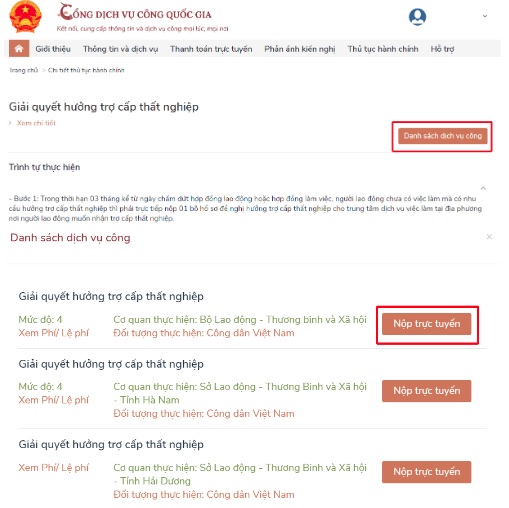

Step 6: Choose the list of public services, then select Submit Online at the Ministry of Labor, Invalids and Social Affairs or the Department of Labor, Invalids and Social Affairs.

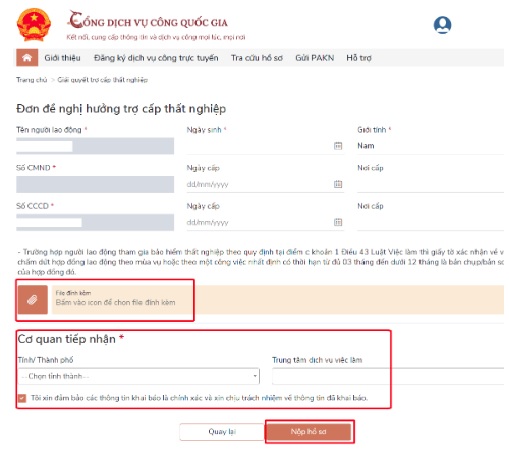

Step 7: Enter information in the unemployment benefits application form, then select submit the application to complete the procedure.

Note: Information marked with * is mandatory.

- Attach documents: Photographs or scans of documents proving the termination of labor contracts or work contracts as prescribed (Resignation Decision, Dismissal Decision, Disciplinary Dismissal Decision, Notice or agreement to terminate a labor contract or work contract, etc.)

- Select the receiving agency for processing the application.

- Check the box stating I confirm that the information declared is accurate and take responsibility for the information provided, then select Submit application.

The National Public Service Portal automatically transfers employee information (including full name, ID/CCCD/passport number, social insurance book number, date of labor contract/work contract termination) to the social insurance agency's system.

Note: The information is for reference purposes only!

What are guidelines on online submission of unemployment benefits application in Vietnam in 2025? (Image from the Internet)

Are unemployment benefits subject to personal income tax in Vietnam?

According to point b, clause 2, Article 2 of Circular 111/2013/TT-BTC (amended in Circular 92/2015/TT-BTC), provisions are made on allowances and subsidies not subject to personal income tax as follows:

Income from salaries, wages

Income from salaries, wages refers to income employees receive from employers, including:

...

b) Allowances, subsidies, excluding the following allowances, subsidies:

b.1) Monthly preferential allowances and one-time subsidies as prescribed by the law on preferential treatment towards people with meritorious services.

b.2) Monthly allowances, one-time subsidies for those who participated in the resistance, national defense, international missions, and youth voluntarism upon mission completion.

b.3) Defense, security allowances; allowances for armed forces.

b.4) Hazardous, dangerous allowances for professions, jobs, or working locations with hazardous, dangerous elements.

b.5) Attraction allowances, regional allowances.

b.6) Emergency hardship subsidies, work accident subsidies, occupational disease subsidies, one-time childbirth or adoption subsidies, maternity policies benefits, post-maternity care and rehabilitation subsidies, disability reduction subsidies, one-time retirement subsidies, monthly death benefits, severance allowances, job loss allowances, unemployment benefits, and other allowances as specified in the Labor Code and Social Insurance Law.

b.7) Allowances for social protection subjects as prescribed by law.

b.8) Service allowances for senior leaders.

b.9) One-time allowance for individuals transferring work to areas with particularly difficult socio-economic conditions, one-time support for officials involved in sovereignty issues as prescribed by law. One-time relocation allowance for foreigners residing in Vietnam, Vietnamese working abroad, or Vietnamese residing abroad long term returning to work in Vietnam.

b.10) Allowances for village health workers.

b.11) Industry-specific special allowances.

Allowances, subsidies not included in taxable income guided at point b, clause 2, of this Article must be regulated by the competent state agency.

In the event the guidance on allowances, subsidies, and allowance, subsidy levels applies to the state sector, other economic entities and business establishments may apply this guidance to the state sector as a basis for deductions.

In the case where the allowance or subsidy received exceeds the allowance or subsidy level as guided above, the excess amount must be included in taxable income.

Individually negotiated one-time relocation allowances for foreigners residing in Vietnam and Vietnamese working overseas are deducted according to levels stated in the labor contract or collective labor agreement.

Thus, according to the regulation above, unemployment benefits are subsidies not subject to personal income tax.

How is the Duration of unemployment benefits Calculated?

According to Article 50 of the Employment Law 2013, regulations on unemployment benefit duration are as follows:

Level, duration, and timing of unemployment benefit enjoyment

- The monthly unemployment benefit is 60% of the average monthly salary of the last 6 months before unemployment but not exceeding 5 times the statutory pay rate for employees under the salary policies set by the State or not exceeding 5 times the regional minimum salary according to the Labor Code for employees paying unemployment insurance under salary policies decided by the employer at the time of labor contract or work contract termination.

2. The unemployment benefit duration is calculated based on the number of months paying unemployment insurance, for every 12 months to 36 months, 03 months of unemployment benefits are entitled, and then for every additional 12 months paid, 01 month of unemployment benefits is provided, but no more than 12 months in total.

- The timing of unemployment benefits is calculated from the 16th day, starting from the date of fully submitting the unemployment benefits dossier as prescribed in clause 1, Article 46 of this Law.

Hence, if you are eligible for unemployment benefits, for every 12 months to 36 months of insurance contributions, 3 months of benefits are granted.

Thereafter, for every additional 12 months paid, 1 month of unemployment benefits is granted, but no more than a total of 12 months.