Are votive papers subject to excise tax up to 70% in Vietnam?

Are votive papers subject to excise tax up to 70% in Vietnam?

Based on Article 2 of the Law on excise tax 2008 (amended by Clause 1, Article 1 of the Law on amending excise tax 2014), the objects subject to excise tax are prescribed as follows:

Taxable objects

1. Goods:

a) Cigarettes, cigars, and other tobacco preparations used for smoking, inhaling, chewing, sniffing, and sucking;

b) Alcohol;

c) Beer;

d) Automobiles with less than 24 seats, including those that carry both people and goods with more than two rows of seats and have a fixed partition between the passenger and cargo areas;

đ) Motorcycles with cylinder capacity over 125 cm3;

e) Airplanes, yachts;

g) Various types of gasoline;

h) Air conditioners with capacity of 90,000 BTU or less;

i) Playing cards;

k) votive papers.

2. Services:

a) Operating nightclubs;

b) Operating massage parlors, karaoke;

c) Operating casinos; electronic games with prizes including jackpot machines, slot machines, and similar machines;

d) Betting operations;

đ) Golf business, including membership card sales, golfing fees;

e) Lottery business.

In addition, according to Article 7 of the Law on excise tax 2008 (amended by Clause 4, Article 1 of the Law on Amending excise tax 2014), clause 2, Article 2 of the Law on Value Added Tax, Law on excise tax and Law on Tax Administration Amendments 2016 and Article 8 of the Law Amending Law on Public Investment, Law on Public-Private Partnership Investment, Investment Law, Housing Law, Bidding Law, Electricity Law, Enterprise Law, Law on excise tax, and Civil Judgment Execution Law 2022) as follows:

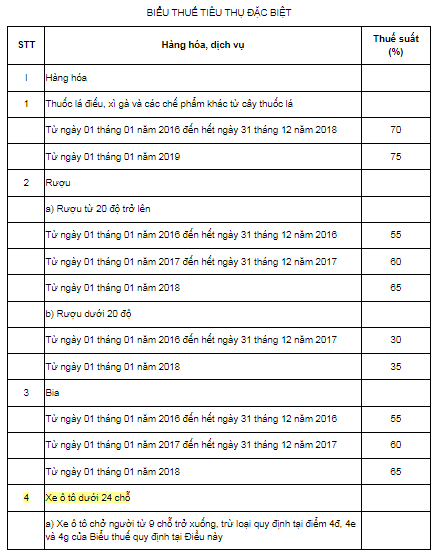

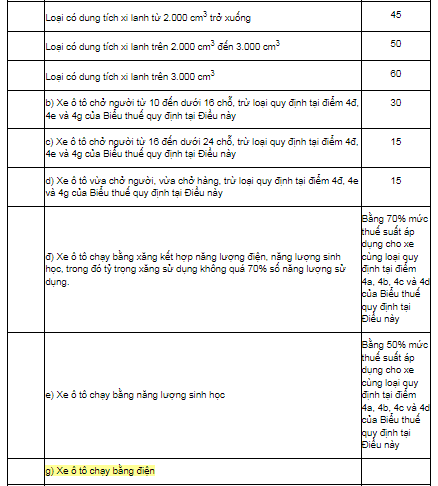

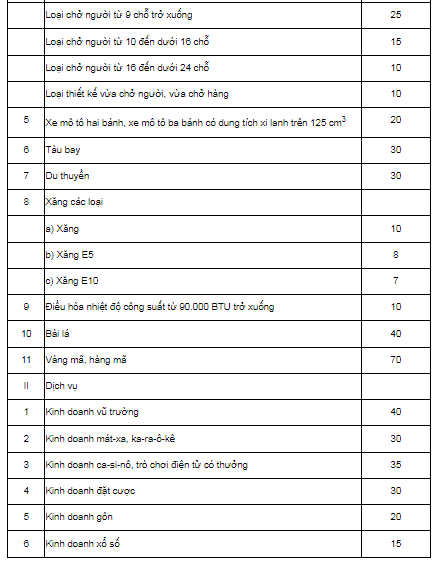

The excise tax rates for goods and services are prescribed in the following excise tax Table:

Thus, it can be seen that votive papers are subject to a excise tax rate of up to 70%.

Are votive papers subject to excise tax up to 70% in Vietnam? (Image from the Internet)

What are 4 cases of excise tax refund in Vietnam?

Based on Article 8 of the Law on excise tax 2008, the cases for tax refund and tax deduction are prescribed as follows:

- Taxpayers of excise tax shall be refunded the tax already paid in the following cases:

+ Temporary import, re-export goods;

+ Goods as imported materials for producing or processing export goods;

+ Tax finalization upon merger, consolidation, division, separation, dissolution, bankruptcy, conversion of ownership, enterprise conversion, or cessation of operations with overpaid tax;

+ Having tax refund decisions by competent authorities as per the law and the excise tax refund under international treaties to which the Socialist Republic of Vietnam is a member.

The refund of excise tax implemented per points a and b of this clause only applies to actually exported goods.

In addition, the refund and deduction of tax are specifically guided by Article 6 of Decree 108/2015/ND-CP (amended by Clause 2, Article 1 of Decree 14/2019/ND-CP) as follows:

The excise tax refund is implemented according to stipulations in Article 8 of the Law on excise tax 2008.

- For temporary import, re-export goods stipulated in point a, Clause 1, Article 8 of the Law on excise tax 2008, includes:

+ Imported goods that have paid excise tax but are stored at the warehouses at the port under the supervision of the customs authority and are re-exported abroad;

+ Imported goods that have paid excise tax for delivery, sale to foreign countries through agents in Vietnam; imported goods to be sold to foreign firms’ vessels on routes through Vietnamese ports or Vietnamese vessels on international routes as per the law;

+ Temporary import goods for re-export business when re-exported are refunded the excise tax paid corresponding to the actually re-exported goods;

+ Imported goods that have paid excise tax but are re-exported abroad are refunded the excise tax paid for those exported goods;

+ Temporary import goods to participate in fairs, exhibitions, product introductions or serve other work within a fixed period as per the law and have paid excise tax when re-exported are refunded.

In case temporary import goods are actually re-exported within the tax payment period as prescribed by the law on export tax, import tax, excise tax shall not be paid on the actual re-exported goods.

- Goods that are imported materials for producing, processing export goods are refunded the excise tax paid corresponding to the materials used to produce actually exported goods.

- Procedures, dossiers, order, and authority to settle excise tax refund:

+ Procedures, dossiers, order, and authority to settle the excise tax refund for temporary import, re-exported goods stipulated in Clause 1 of this Article shall be implemented as the regulations on import tax refund.

+ Procedures, dossiers, order, and authority to settle the excise tax refund for goods as imported materials for producing, processing export goods.

In cases where import declarations include import tax and excise tax requesting a refund, the import tax refund dossier is also the excise tax refund dossier.

- Production and business organizations settle tax finalization upon merger, division, separation, dissolution, bankruptcy, conversion of ownership forms, transfer, sale, lease or contracting state enterprises with overpaid excise tax.

- The refund prescribed in point d Clause 1 Article 8 of the Law on excise tax 2008 includes:

+ Refund according to decisions from competent authorities as per the law;

+ Refund under international treaties to which the Socialist Republic of Vietnam is a member;

+ Refund in cases where the excise tax paid is higher than the excise tax payable as per the law.

When is the latest deadline for excise tax payment of the tax calculation period in Vietnam of September 2024?

Based on Article 3 of Decree 65/2024/ND-CP, there is a stipulation on the extension of the excise tax payment deadline for domestically produced or assembled automobiles as follows:

Extension of tax payment deadline

1. The extension of tax payment deadlines for excise tax payments due arising in the tax calculation periods of May, June, July, August, and September 2024 for domestically produced or assembled automobiles. The extension period is from the end of the excise tax payment deadline as prescribed by tax management law until November 20, 2024. Specifically:

a) The deadline for excise tax payments due arising in the tax calculation period of May 2024 is no later than November 20, 2024.

b) The deadline for excise tax payments due arising in the tax calculation period of June 2024 is no later than November 20, 2024.

c) The deadline for excise tax payments due arising in the tax calculation period of July 2024 is no later than November 20, 2024.

d) The deadline for excise tax payments due arising in the tax calculation period of August 2024 is no later than November 20, 2024.

đ) The deadline for excise tax payments due arising in the tax calculation period of September 2024 is no later than November 20, 2024.

2. Provisions for specific cases:

a) In case the taxpayer supplements the tax declaration dossier of the tax calculation period extended, leading to an increase in excise tax payable and sending it to the tax authority before the expiration of the extended payment period, the extended tax includes the additional tax payable due to the supplementation.

[...]

Thus, the latest deadline for the excise tax payment arising from the tax calculation period of September 2024 is no later than November 20, 2024.