Regulations on selling tax authority-ordered printed invoices in Vietnam

What are the regulations on selling tax authority-ordered printed invoices in Vietnam? - Hoang Kim (Tien Giang, Vietnam)

Regulations on selling tax authority-ordered printed invoices in Vietnam (Internet image)

Regarding this issue, LawNet would like to answer as follows:

1. Use of tax authority-ordered printed invoices in Vietnam

According to Article 23 of Decree 123/2020/ND-CP, the Departments of Taxation in provinces and centrally-affiliated cities (hereinafter referred to as “provincial Departments of Taxation”) may order the printing of invoices resold to the following entities:

(1) Enterprises, business entities, and household or individual businesses mentioned in Clause 1 Article 14 of Decree 123/2020/ND-CP if they do not have electronic transactions with tax authorities, IT infrastructure, accounting software systems or e-invoicing software functioning as the tools of using e-invoices and transmitting e-invoice data to buyers and tax authorities.

Enterprises, business entities, and household or individual businesses may buy invoices from tax authorities for a period of up to 12 months while tax authorities must have solutions for gradually converting to the use of e-invoices.

Before using e-invoices, business entities, and household or individual businesses must apply for use of authenticated or unauthenticated e-invoices (if eligible) in accordance with the provisions in Article 15 of Decree 123/2020/ND-CP.

(2) Enterprises, business entities, and household or individual businesses during the period of failure of the tax authority’s authentication code issuing system as prescribed in Clause 2 Article 20 of Decree 123/2020/ND-CP.

2. Regulations on selling tax authority-ordered printed invoices in Vietnam

Regulations on selling tax authority-ordered printed invoices in Vietnam according to Article 24 of Decree 123/2020/ND-CP are as follows:

- An enterprise, business entity, or household or individual business that is eligible to buy invoices from the tax authority (hereinafter referred to as “buyer”) shall submit an application for invoice purchase (using Form No. 02/DN-HDG in Appendix IA enclosed with Decree 123/2020/ND-CP), accompanied by the following documents, to the tax authority:

|

Form No. 02/DN-HDG |

+ The buyer (the applicant or person authorized in writing by the enterprise, business entity, or household or individual business as prescribed by law) shall present his/her unexpired ID card or citizen’s identity card;

+ The buyer that buys invoices for the first time shall provide a commitment (using Form No. 02/CK-HDG in Appendix IA enclosed with Decree 123/2020/ND-CP) on its business location which must be same as that specified in

|

Form No. 02/CK-HDG |

The certificate of enterprise registration, certificate of branch registration, certificate of household business registration, taxpayer registration certificate, TIN notification, investment registration certificate, certificate of cooperative registration or establishment decision issued by a competent authority;

+ The buyer shall take responsibility to write or stamp name, address and TIN on copy 2 of every purchased invoice before taking them from the tax authority’s premises.

- Invoices shall be sold to eligible buyers on a monthly basis.

No more than a book of invoices, including 50 invoice numbers of a type, shall be sold to an buyer for the first time. In case the quantity of invoices sold in the first time is not enough for the buyer to use until the end of month, the tax authority shall decide the quantity of invoices sold to the buyer in the following time based on the time and quantity of used invoices.

With regard to the following purchases of invoices, after checking the use of invoices and tax declaration and payment, and based on the written request for purchase of invoices, the tax authority shall sell invoices to the buyer within a day. The quantity of invoices sold to the buyer shall not exceed that sold to it in the previous month.

If the buyer wants to use e-invoices, it must terminate the use of tax authority-ordered printed invoices from the date of commencement of use of e-invoices in accordance with the provisions in Article 15 of Decree 123/2020/ND-CP.

In case a household or individual business wishes to use separate invoices instead of booked invoices, the tax authority shall separately provide e-invoices in accordance with the provisions in Clause 2 Article 13 of Decree 123/2020/ND-CP.

- Invoices printed for sale according to orders placed by each Provincial Department of Taxation shall be published on the web portal of the General Department of Taxation;

The Provincial Department of Taxation shall post an announcement of invoice issue, using Form No. 02/PH-HDG in Appendix IB enclosed with Decree 123/2020/ND-CP, and the sample invoice on web portal of the General Department of Taxation before its first sale.

|

Form No. 02/PH-HDG |

An announcement of invoice issue includes the following information: Name of the Provincial Department of Taxation, TIN, address, telephone, types o invoices issued (name, reference number, form number, date of commencement of use, quantity of invoices issued under this announcement (from number…..to number…)), name and TIN of printing service provider (for tax authority-ordered printed invoices), date of the announcement, name and signature of legal representative, and tax authority’s seal.

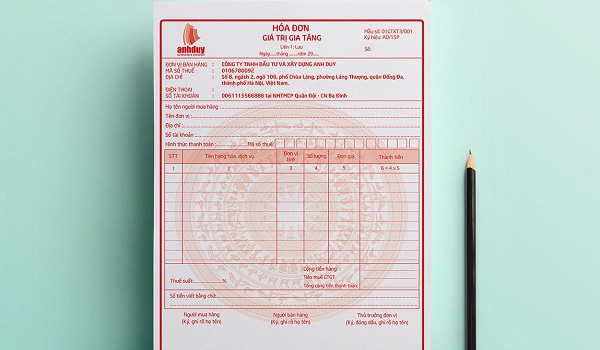

A sample invoice is a printed invoice that accurately and adequately reflects all items of an invoice given to a buyer, and bears the number which is a series of "0" and the printed or stamped word “Mẫu” (“sample”).

The announcement of invoice issue and the sample invoice must be openly and clearly posted at premises of affiliated units of the Provincial Department of Taxation throughout the use of such invoices.

In case there is any change in the announcement of issue of invoices or the sample invoice, the Provincial Department of Taxation shall repeat the procedures for announcement of invoice issue prescribed in this Article.

- Physical invoices printed according to orders placed by the Provincial Department of Taxation shall be sold without profitable aims at prices sufficient to cover actual costs.

The Director of the Provincial Department of Taxation shall decide and openly post the invoice selling price according to the abovementioned rule. Subordinate tax authorities may not collect any amounts other than the posted prices.

All affiliated units of a Provincial Department of Taxation shall sell or provide the same type of invoices issued by the Provincial Department of Taxation.

- Penalties for fraudulent activities on e-commerce platforms in Vietnam

- Guidance on issuing driver licenses for individuals with expired driver licenses in Vietnam

- Cases of verification of driver licenses in Vietnam according to Circular 35

- Proposal on night shift allowance policies and meal support for healthcare employees in Vietnam

- What is Pi Network? Is Pi Network legal in Vietnam?

- Proposal to lower health insurance contribution rates to alleviate economic burden on citizens in Vietnam

-

- Destruction of tax authority-ordered printed invoices ...

- 14:10, 12/11/2022

-

- Resolution 190: Guidance on citizen reception ...

- 09:00, 22/02/2025

-

- Provisions on naming and use of seals after the ...

- 08:00, 22/02/2025

-

- Continue to implement regulations related to the ...

- 17:30, 21/02/2025

-

- Amendments to regulations on the salary scale ...

- 17:30, 21/02/2025

-

- Supreme People's Court of Vietnam will conducting ...

- 17:00, 21/02/2025

Article table of contents

Article table of contents