The issues related to salary and bonus are always of particular concern to employees as they directly affect their rights and benefits. Below, Thu Ky Luat would like to send to our esteemed members the payrolls,statutory pay rate chart, and region-based minimum wage in Vietnam over the years over the years to observe the changes in wage levels over the years.

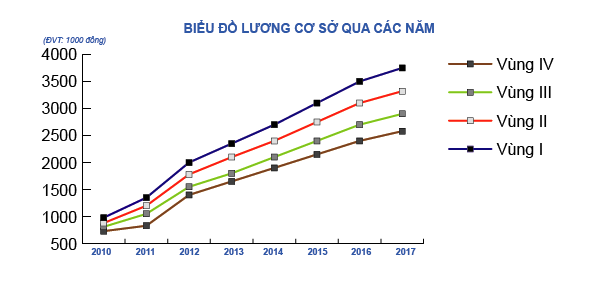

Region-based minimum wage in Vietnam

The region-based minimum wage applies to employees working under labor contracts as stipulated by the Labor Code. It is the wage level used as a basis for enterprises and employees to negotiate and pay wages, in which the wage paid to employees working under normal working conditions, ensuring sufficient working hours in the month, and completing the agreed labor norms or tasks. It is also the basis for social insurance, health insurance, and unemployment insurance contributions for employees working at enterprises. Over the past years, the minimum wage has been gradually adjusted upwards to meet the minimum living needs of employees.

Region-based minimum wage over the years in Vietnam

(From 2010 - 2017)

Unit: 1,000 VND

| Effective Period | Region I | Region II | Region III | Region IV | Legal Basis |

| From January 1, 2010 - December 31, 2010 |

980 | 880 | 810 | 730 | Decree 97/2009/ND-CP |

| From January 1, 2011 - September 30, 2011 | 1,350 | 1,200 | 1,050 | 830 | Decree 108/2010/ND-CP |

| From October 1, 2011 - December 31, 2012 | 2,000 | 1,780 | 1,550 | 1,400 | Decree 70/2011/ND-CP |

| From January 1, 2013 - December 31, 2013 | 2,350 | 2,100 | 1,800 | 1,650 | Decree 103/2012/ND-CP |

| From January 1, 2014 - December 31, 2014 | 2,700 | 2,400 | 2,100 | 1,900 | Decree 182/2013/ND-CP |

| From January 1, 2015 - December 31, 2015 | 3,100 | 2,750 | 2,400 | 2,150 | Decree 103/2014/ND-CP |

| From January 1, 2016 - December 31, 2016 | 3,500 | 3,100 | 2,700 | 2,400 | Decree 122/2015/ND-CP |

| From January 1, 2017 | 3,750 | 3,320 | 2,900 | 2,580 | Decree 153/2016/ND-CP |

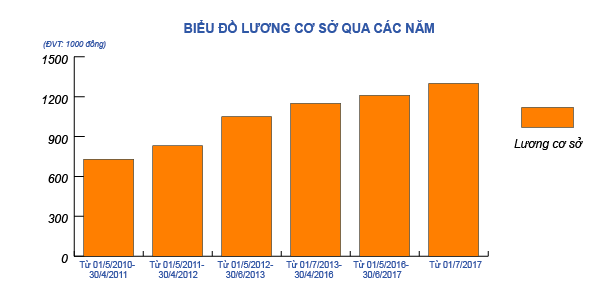

Statutory Pay Rate

The statutory pay rate applies to individuals working in government agencies, receiving salaries from the state budget, or serving in armed forces units, and to employees working in organizations affiliated with political or social organizations (often referred to as officials or public employees in state agencies). It is the wage level used as the basis for calculating wages in salary tables, allowances, other policies, operational costs, contributions, and benefits according to this salary level. It is also the basis for determining contributions to insurance such as social insurance, health insurance, or unemployment insurance for officials and public employees, and armed forces.

Chart of Statutory Pay Rate over the Years (From 2010 - 2017)

| Time Period | From May 1, 2010 – April 30, 2011 | From May 1, 2011 – April 30, 2012 | From May 1, 2012 – June 30, 2013 | From July 1, 2013 – April 30, 2016 | From May 1, 2016 – June 30, 2017 | From July 1, 2017 |

| Statutory Pay Rate (VND) |

730,000 | 830,000 | 1,050,000 | 1,150,000 | 1,210,000 | 1,300,000 |

| Legal Basis | Decree 28/2010/ND-CP | Decree 22/2011/ND-CP | Decree 31/2012/ND-CP | Decree 66/2013/ND-CP | Decree 47/2016/ND-CP | Resolution 27/2016/QH14 |

Article table of contents

Article table of contents