The region-based minimum wage and statutory pay rate are two basic types of wages mentioned in statutory legal documents. The region-based minimum wage and statutory pay rate are fundamentally different concepts in terms of nature, applicable subjects, and specific wage levels. However, many people often confuse these two types of wages.

Below is the comparison table of region-based minimum wage and statutory pay rate:

| No. | Criteria | Region-based minimum wage | Statutory pay rate |

|---|---|---|---|

| 1 | Definition | The region-based minimum wage is the minimum level used as a basis for enterprises and employees to negotiate and pay wages. The wage paid to employees working under normal labor conditions, ensuring full normal working time in a month, and completing the agreed-upon labor norm or job must meet the following criteria: - Not lower than the region-based minimum wage for untrained employees performing the simplest jobs; - At least 7% higher than the region-based minimum wage for trained employees as stipulated in Clause 2 of this Article. |

It is the salary used as a basis for calculating wages in salary scales, allowances, and implementing other policies; calculating expenses, living expenses; and calculating deductions and policies enjoyed based on this salary level. |

| 2 | Nature | - It is the basis for employees and enterprises to negotiate, ensuring employee benefits. - This wage is also the basis for paying and enjoying social insurance, health insurance, unemployment insurance of employees. |

- It is the basis for calculating social insurance, health insurance, unemployment insurance for officials and public employees, armed forces. - This salary is the basis for calculating salary scales, salary tables, and allowances. |

| 3 | Applicable Subjects | - Enterprises established, managed, and operating under the Law on Enterprises. - Cooperatives, unions of cooperatives, cooperative groups, farms, households, individuals, and other organizations in Vietnam that employ workers under labor contracts. - Foreign agencies and organizations, international organizations, and foreign individuals in Vietnam employing workers under labor contracts (except in cases where international treaties to which the Socialist Republic of Vietnam is a member have different provisions from this Decree). |

- Officials from the central to the district level as stipulated in Clause 1 and Clause 2 Article 4 of the Law on Officials and Public Employees 2008. - Commune-level officials as stipulated in Clause 3 Article 4 of the Law on Officials and Public Employees 2008. - Public employees in public service providers as stipulated in the Law on Public Employees 2010. - Persons working under labor contract policies paid according to Decree204/2004/ND-CP - Persons working in payroll quotas in associations supported by the state budget as stipulated in Decree45/2010/ND-CP - Officers, professional soldiers, non-commissioned officers, conscripts, defense workers, contract workers in the Vietnam People’s Army. - Officers, salaried non-commissioned officers, non-commissioned officers, conscripts, police workers, contract workers in the People's Public Security. - Persons working in cryptographic organizations. - Persons working unofficially at the commune level, in villages, and residential groups. |

| 4 | Application Principle | Applied according to the area. To be specific:: - Enterprises operating in any area shall apply the region-based minimum wage stipulated for that area. - Enterprises having units or branches operating in various areas with different region-based minimum wage levels shall apply the region-based minimum wage stipulated for each respective area. - Enterprises operating in industrial parks, export processing zones, economic zones, and high-tech zones located in areas with different region-based minimum wage levels shall apply the highest region-based minimum wage level. - Enterprises operating in areas with name changes or divisions shall temporarily apply the region-based minimum wage level stipulated for the area before the name change or division until the Government of Vietnam introduces new regulations. - Enterprises operating in newly established areas from one or multiple areas with different region-based minimum wage levels shall apply the region-based minimum wage level according to the area with the highest wage level. - Enterprises operating in cities under provinces newly established from one or multiple areas belonging to region IV shall apply the region-based minimum wage level stipulated for the remaining city under the province in Item 3 of the Annex issued with this Decree. |

Salary calculation based on the statutory pay rate and the salary coefficient of officials, public employees, and armed forces |

| 5 | Change Cycle | Usually, the region-based minimum wage changes once a year. However, there is no specific document stipulating this change cycle. | There is no fixed change cycle. |

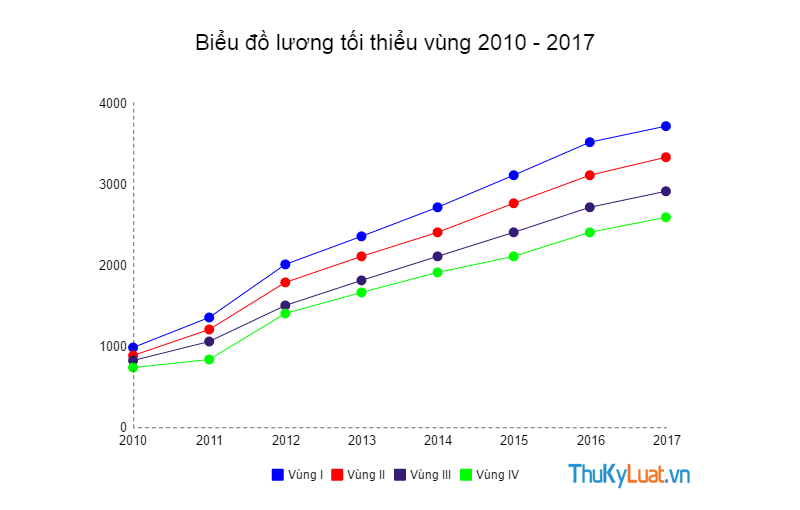

| 6 | Current Applicable Wage Level | - Region I: 3,500,000 VND/month. - Region II: 3,100,000 VND/month - Region III: 2,700,000 VND/month. - Region IV: 2,400,000 VND/month |

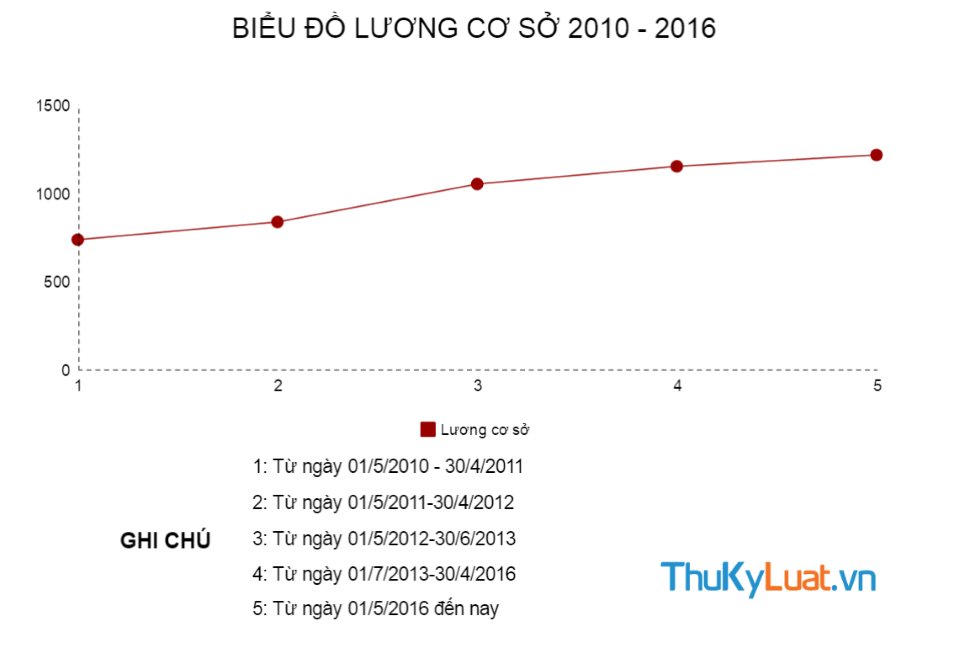

1,210 VND/month |

| 7 | Legal Basis | Decree 122/2015/ND-CP stipulating the region-based minimum wage for employees working in enterprises, unions of cooperatives, cooperatives, cooperative groups, farms, households, individuals, and foreign agencies and organizations using employees under labor contracts. | Decree 47/2016/ND-CP stipulating the statutory pay rate for officials, public employees, and armed forces. |

Recently, the Ministry of Labor, War Invalids and Social Affairs has issued the Draft Decree stipulating the region-based minimum wage for employees working in enterprises, unions of cooperatives, cooperatives, cooperative groups, farms, households, individuals, and foreign agencies and organizations using employees under labor contracts for 2017, with an average increase of 7.3% compared to 2016. To be specific::

- Region I: 3,750,000 VND/month (an increase of 250,000 VND/month compared to 2016);

- Region II: 3,320,000 VND/month (an increase of 220,000 VND/month compared to 2016);

- Region III: 2,900,000 VND/month (an increase of 200,000 VND/month compared to 2016);

- Region IV: 2,580,000 VND/month (an increase of 180,000 VND/month compared to 2016).

If the draft Decree is approved, the above region-based minimum wage levels will be applied in 2017.

As for the statutory pay rate, there is currently no official document stipulating an increase in the statutory pay rate from 2017. However, the statutory pay rate in 2017 may increase as per Conclusion 63-KL/TW dated May 27, 2013 on the reform of salary policies, social insurance, preferential treatment for people with meritorious services and orientation for reform until 2020, which stipulates: “Annually, allocate a certain percentage of the increase in the central budget revenue (the increase in the estimated revenue of the following year compared to the previous year and the increase in the actual revenue compared to the estimate) to implement salary reform before allocating it to other tasks.”

Additionally, according to Circular 91/2016/TT-BTC Guiding the preparation of the state budget estimate for 2017 by the Ministry of Finance, it is mentioned: “In 2017, continue to implement the mechanism of creating a source for salary reform to adjust the statutory pay rate to increase compared to the current rate of 1,210,000 VND/month (if any) as prescribed.”

Follow the statutory pay rate chart and the region-based minimum wage chart over the years to see the changes in these two types of wages over different periods.

Article table of contents

Article table of contents

.Medium.png)

.Medium.png)

.Medium.png)

.Medium.png)