Electronic bill in Vietnam

-

- 10 new points in Circular 78/2021/TT-BTC of Vietnam on electronic invoices and documents

- 10:22, 05/11/2021

- The General Department of Taxation of Vietnam has just released Official Dispatch 4144/TCT-CS sent to Tax Departments of provinces and cities about the introduction of contents new at Circular 78/2021/TT-BTC instructions on invoices and documents.

-

- Schedule to apply electronic invoices under Vietnam's Circular 78/2021/TT-BTC

- 09:20, 30/09/2021

- Circular 78/2021/TT-BTC stipulating the schedule for implementing E-invoice application details are as follows:

-

- Instructions for identifying symbols on e-invoices in Vietnam

- 10:55, 29/09/2021

- Recently, the Ministry of Finance of Vietnam has promulgated Circular 78/2021/TT-BTC instructions on some contents of invoices and documents as prescribed at Law on Tax Administration 2019 and Decree 123/2020/ND-CP. In particular, a number of contents about e-invoices such as denominator symbols and e-invoice symbols are guided very specifically.

-

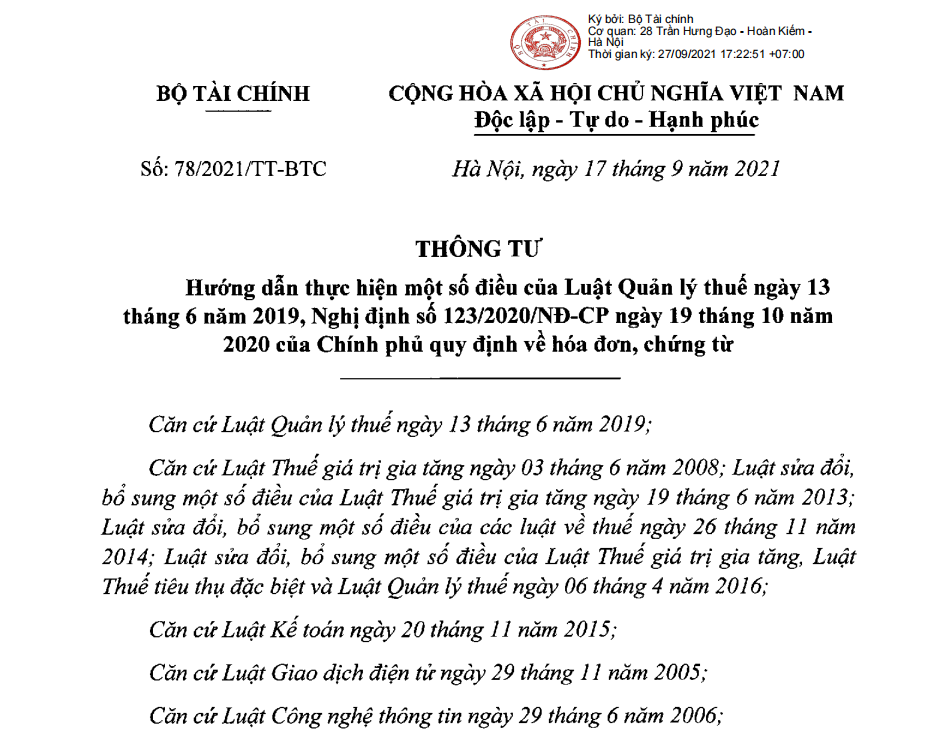

- Vietnam: Circular 78/2021/TT-BTC has been issued guiding the implementation of electronic invoices

- 08:55, 29/09/2021

- The Ministry of Finance of Vietnam has promulgated Circular 78/2021/TT-BTC on direction guide to implement some things of the Law on Tax Management, Decree 123/2020/ND-CP on invoices and documents.

Most view

SEARCH ARTICLE