Circular 65: Responsibilities of Traders in the Temporary Purchase of Paddy and Rice

On May 19, 2014, the Ministry of Finance issued Circular 65/2014/TT-BTC providing guidance on interest rate support for bank loans to purchase temporary storage of paddy and rice for the 2013-2014 Winter-Spring crop.

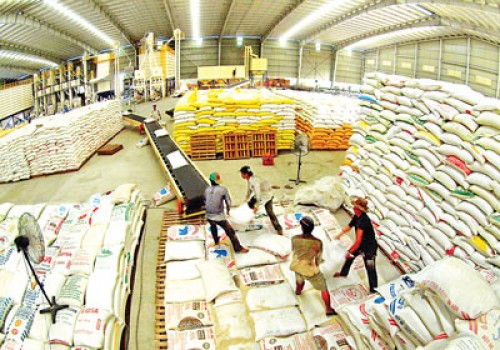

Circular 65: Responsibility of Merchants in Purchasing Temporary Rice Storage (Illustrative Image)

Circular 65/2014/TT-BTC stipulates the responsibilities of merchants in purchasing temporary rice storage. To be specific:

Execute the purchase of temporary rice storage as directed by the Prime Minister of the Government of Vietnam in Decision 373a/QD-TTg with the supervision of the Ministry of Agriculture and Rural Development, the Ministry of Industry and Trade, the People's Committees of provinces and centrally-run cities in the Mekong Delta, and the Vietnam Food Association.

Be responsible for the authenticity of the import, export, and inventory of temporary rice storage and the credit contracts for purchasing temporary rice storage. Additionally, be accountable for the accuracy of the reported figures in the interest rate support application dossier.

Keep records, and documents of import, export, and bank loans, and maintain separate accounting books for the purchase of temporary rice storage as per the directives of the Prime Minister of the Government of Vietnam in Decision 373a/QD-TTg.

Be responsible for the business efficiency concerning the purchase of temporary rice storage.

Be legally responsible if violating financial and accounting regulations in the execution of temporary rice storage.

Must return to the state budget the interest rate support funds granted if state management agencies inspect and detect any violations. Additionally, the merchant must pay late payment interest on the amount to be refunded.

Note: The determination of late payment interest is calculated from when the merchant received the funds until the refund to the state budget at an interest rate of 150% of the average loan interest rate at the commercial banks that the merchant borrowed to purchase temporary storage.

Details can be found at Circular 65/2014/TT-BTC which took effect on May 19, 2014.

Ty Na

- Regulations on passenger transportation business by contract in Vietnam from January 1, 2025

- Regulations on passenger transport business by fixed-route automobile in Vietnam from January 1, 2025

- Technical procedures for transporting hazardous waste from households and individuals from collection areas to treatment facilities or hazardous waste storage areas in Vietnam

- Guidelines on thematic communication regarding the Law on Social Insurance 2024 in Vietnam

- Duties of the provincial-level Steering Committee for Anti-Corruption and Negative Conduct in Vietnam

- Regulations on the collection, registration, storage, and disclosure of information on scientific and technological tasks within the Ministry of National Defense of Vietnam

-

- Regulations on passenger transport business by ...

- 08:00, 24/12/2024

-

- Technical procedures for transporting hazardous ...

- 19:30, 23/12/2024

-

- Guidelines on thematic communication regarding ...

- 18:59, 23/12/2024

-

- Duties of the provincial-level Steering Committee ...

- 18:34, 23/12/2024

-

- Regulations on the collection, registration, storage ...

- 18:00, 23/12/2024

Article table of contents

Article table of contents