What date is the 11th of the 11th lunar month in 2024? What are details of the lunar calendar for November in 2024?

What date is the 11th of the 11th lunar month in 2024? What are details of the lunar calendar for November in 2024?

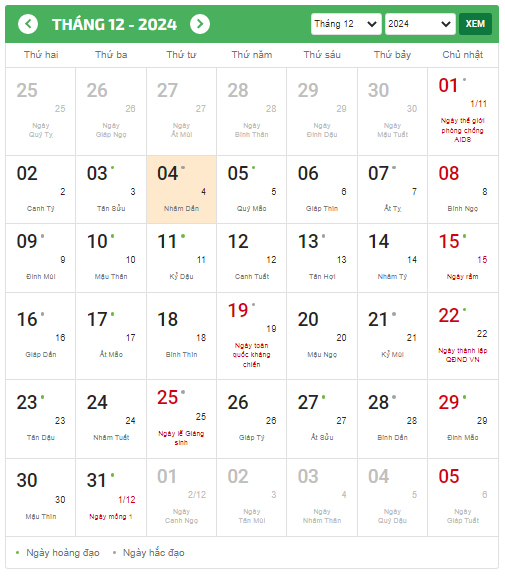

According to the Perpetual Calendar, the 11th lunar month of 2024 begins on December 1, 2024, and ends on December 30, 2024, in the Gregorian calendar. Therefore, the 11th day of the 11th lunar month 2024 corresponds to December 11, 2024, in the Gregorian calendar.

The lunar calendar for November 2024 is as follows:

The 11th lunar month of 2024 includes 30 days. It starts from November 1, 2024, in the lunar calendar, falling on December 1, 2024, in the Gregorian calendar, and the 30th day of the 11th lunar month is December 30, 2024, in the Gregorian calendar.

What date is the 11th of the 11th lunar month in 2024? What are details of the lunar calendar for November in 2024? (Image from Internet)

What is the deadline for filing tax returns for November in Vietnam?

Based on Article 44 of the Law on Tax Administration 2019, the deadline for filing tax returns is stipulated as follows:

Article 44. Deadline for submitting tax returns

- The deadline for submitting tax returns for taxes declared on a monthly or quarterly basis is as follows:

a) No later than the 20th day of the month following the month in which the tax obligation arises for monthly declarations and payments;

b) No later than the last day of the first month of the quarter following the quarter in which the tax obligation arises for quarterly declarations and payments.

- The deadline for submitting tax returns for taxes calculated on an annual basis is as follows:

a) No later than the last day of the third month from the end of the calendar year or fiscal year for annual tax finalization returns; no later than the last day of the first month of the calendar year or fiscal year for annual tax return declarations;

b) No later than the last day of the fourth month from the end of the calendar year for individual income tax finalization returns of individuals directly finalizing taxes;

c) No later than December 15 of the preceding year for the fixed tax return of business households and individual business taxpayers paying tax by the fixed rate method; in case of new business, no later than 10 days from the start of business for submitting the fixed tax return.

[...]

Based on the above regulation, the deadline for filing tax returns for taxes declared on a monthly basis for November is no later than December 20.

Can taxpayers in Vietnam extend the deadline for submitting tax returns?

According to Article 46 of the Law on Tax Administration 2019, the extension of the deadline for submitting tax returns is regulated as follows:

Article 46. Extension of the deadline for submitting tax returns

- Taxpayers who are unable to submit tax returns on time due to natural disasters, catastrophes, epidemics, fires, or unexpected accidents may have their deadline for submitting tax returns extended by the head of the directly managing tax authority.

- The extension period may not exceed 30 days for monthly, quarterly, annual tax return submissions, or each tax obligation occurrence; 60 days for annual tax finalization return submissions from the deadline for submitting tax returns.

- Taxpayers must send the tax authority a written request for an extension before the deadline for submitting the tax return, clearly stating the reason for the extension request, certified by the commune-level People's Committee or Police where the case eligible for an extension occurs under Clause 1 of this Article.

- Within 3 working days from the date of receiving the request for an extension of the tax return submission deadline, the tax authority must respond in writing to the taxpayer on whether the extension is accepted or not.

As per the above regulation, taxpayers are allowed to extend the time for submitting tax returns in cases of natural disasters, catastrophes, epidemics, fires, or unexpected accidents that prevent timely tax return submission.

Note: The extension period for monthly tax return submissions may not exceed 30 days.

Taxpayers wishing to extend the tax return submission deadline must send the tax authority a written request for an extension before the deadline, clearly stating the reason for the request. This must be certified by the commune-level People's Committee or Police where the case eligible for an extension occurs.