Which public property housing is exempt from value-added tax in Vietnam?

Which public property housing is exempt from value-added tax in Vietnam?

Pursuant to Article 5 of the Law on Value-Added Tax 2024 stipulating subjects not subject to tax:

Article 5. Subjects not subject to tax

- Products from crops, planted forests, livestock, aquaculture that are either unprocessed or only undergo simple processing steps by organizations or individuals self-producing, catching for sale, and at the import stage.

- Breeding product as per the legal regulations on livestock, breeding materials for crops as per the legal regulations on cultivation.

- Animal feed according to the legal regulations on animal husbandry; Aquatic feed as per legal regulations on fisheries.

- Salt products made from seawater, natural rock salt, refined salt, and iodized salt with sodium chloride (NaCl) as the main component.

- Public property housing sold by the State to existing tenants.

- Water supply and drainage; land plowing; canal, and intra-field draught cleaning serving agricultural production; agricultural product harvesting services.

- Transfer of land use rights.

[...]

According to the above regulations, public property housing sold by the State to existing tenants is exempt from value-added tax.

Which public property housing is exempt from value-added tax in Vietnam? (Image from Internet)

Which subjects are subject to a value-added tax rate of 5% in Vietnam?

According to Clause 2, Article 9 of the Law on Value-Added Tax 2024 stipulating the tax rate:

Article 9. Tax Rates

[...]

- The 5% tax rate applies to the following goods and services:

a) Clean water for production and domestic use, excluding bottled water, packaged water, and other soft drinks;

b) Fertilizers, ores for fertilizer production, plant protection drugs, and animal growth stimulants as per legal regulations;

c) Excavation, dredging services of canals, ditches, ponds serving agricultural production; breeding, caring, pest prevention for plants; preliminary processing, preservation of agricultural products;

d) Products from crops, planted forests (excluding timber, bamboo shoots), livestock, aquaculture that are not processed into other products or only undergo simple processing steps, except for products specified in Clause 1, Article 5 of this Law;

[...]

Thus, subjects subject to a 5% value-added tax rate include:

[1] Clean water for production and domestic use, excluding bottled water, packaged water, and other soft drinks

[2] Fertilizers, ores for fertilizer production, plant protection drugs, and animal growth stimulants as per legal regulations

[3] Excavation, dredging services of canals, ditches, ponds serving agricultural production; breeding, caring, pest prevention for plants; preliminary processing, preservation of agricultural products

[4] Products from crops, planted forests (excluding timber, bamboo shoots), livestock, aquaculture that are not processed into other products or only undergo simple processing, except for products from crops, planted forests, livestock, aquaculture that are not processed into other products or only undergo simple processing by organizations or individuals self-producing, catching for sale, and at the import stage.

[5] Rubber latex in crepe rubber, sheet rubber, noodle rubber, and lump rubber form; nets, rigging, and rope for knitting fishing nets

[6] Products made from jute, rush, bamboo, rattan, leaves, straw, coconut shells, coconut, water hyacinth, and other handicraft products made from agricultural residuals; raw cotton scoured; newsprint

[7] Fishing vessels at sea; specialized machinery and equipment for agricultural production as regulated by the Government of Vietnam

[8] Medical equipment as per legal regulations on medical equipment management; medicines for disease prevention and treatment; pharmaceuticals, and medicinal materials as raw materials for drug production for disease prevention and treatment

[9] Teaching and learning equipment including models, drawings, boards, chalk, rulers, compasses

[10] Traditional and folk art performance activities

[11] Children's toys; books of all kinds, except political books, textbooks, legal documents, books serving foreign information, books printed in minority languages, and propaganda posters including tapes or discs recording sound, images, electronic data; currency, money printing.

[12] Scientific, technological services as per regulations

[13] Sale, leasing, lease-purchase of social housing as per regulations

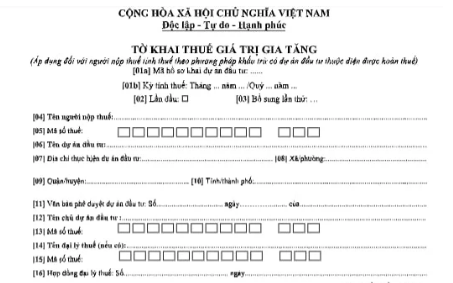

What is the Form 02/GTGT - Value-added tax Return according to Circular 80?

Based on Appendix 2 issued together with Circular 80/2021/TT-BTC stipulating Form 02/GTGT - Value-added tax Return:

Download the Form 02/GTGT - Value-added tax Return according to Circular 80