Which Cases Must Terminate Tax Code Validity in 2024?

In 2024, what are cases of TIN deactivation in Vietnam?

Based on Article 39 of the Law on Tax Administration 2019 regarding the TIN deactivation:

Article 39. TIN deactivation

1. Taxpayers registering along with enterprise registration, cooperative registration, business registration shall terminate the validity of the tax code in the following cases:

a) Termination of business activities or dissolution, bankruptcy;

b) Revocation of the enterprise registration certificate, cooperative registration certificate, business registration certificate;

c) Division, merger, consolidation.

2. Taxpayers registering directly with the tax authorities shall terminate the validity of the tax code in the following cases:

a) Termination of business activities, no longer incurring tax obligations for non-business organizations;

b) Revocation of the business registration certificate or equivalent license;

[...]

Thus, the cases for TIN deactivation are regulated as follows:

[1] For taxpayers registering along with enterprise registration, cooperative registration, business registration

- Termination of business activities or dissolution, bankruptcy

- Revocation of the enterprise registration certificate, cooperative registration certificate, business registration certificate

- Division, merger, consolidation

[2] For taxpayers registering directly with the tax authorities

- Termination of business activities, no longer incurring tax obligations for non-business organizations

- Revocation of the business registration certificate or equivalent license

- Division, merger, consolidation

- Tax authorities issue a notice that the taxpayer is not operating at the registered address

- Individuals deceased, missing, or lost civil act capacity according to the law

- Foreign contractors upon completion of the contract

- Contractors, investors participating in petroleum contracts upon completion of the contract or transferring all rights under the petroleum contract

In 2024, what are cases of TIN deactivation in Vietnam? (Internet image)

What are taxpayers subject to direct tax registration with tax authorities in Vietnam?

According to Clause 2, Article 4 of Circular 105/2020/TT-BTC regulating taxpayers subject to direct tax registration with tax authorities:

[1] Enterprises operating in insurance, accounting, auditing, legal services, notary services or other specialized fields not required to register through business registration agencies according to specialized regulations.

[2] Public service units, economic organizations of the armed forces, economic organizations of political, socio-political, social, socioprofessional organizations conducting business activities according to the law but not required to register through business registration agencies.

Organizations from countries sharing land borders with Vietnam engaged in purchasing, selling, and exchanging goods at border markets, border-gate markets, and markets in border economic zones.

Representative offices of foreign organizations in Vietnam.

Cooperatives established and operating according to regulations.

[3] Organizations established by competent authorities without production or business activities but incurring obligations with the state budget.

[4] Foreign organizations and individuals in Vietnam using humanitarian aid, non-refundable aid from abroad to buy goods and services subject to value-added tax in Vietnam for non-refundable aid and humanitarian aid purposes.

Diplomatic missions, consulates, and representative offices of international organizations in Vietnam subject to value-added tax refunds for diplomatic immunity privileges.

ODA project owners eligible for value-added tax refunds, representative offices of ODA project sponsors, organizations designated by the foreign sponsor to manage ODA programs and projects without refunds.

[5] Foreign institutions without legal status in Vietnam, foreign individuals independently conducting business in Vietnam in accordance with Vietnamese law, earning income in Vietnam, or incurring tax obligations in Vietnam.

[6] Foreign suppliers without a fixed address in Vietnam conducting e-commerce, digital platform-based business, and other services with organizations and individuals in Vietnam.

[7] Enterprises, cooperatives, economic organizations, other organizations, and individuals responsible for deducting and paying taxes on behalf of other taxpayers must declare and determine separate tax obligations from the taxpayer's obligations according to tax management laws (except income-paying organizations when deducting and paying personal income tax).

Commercial banks, intermediary payment service providers, or organizations and individuals authorized by foreign suppliers responsible for declaring, deducting, and paying taxes on behalf of foreign suppliers.

Income-paying organizations using the issued tax code to declare and pay deducted personal income tax on behalf of taxpayers.

[8] Operators, joint operating companies, joint-venture enterprises, and organizations entrusted by the Government of Vietnam to receive Vietnam’s share in overlapping oil and gas fields, contractors, investors engaged in petroleum contracts, Vietnam National Petroleum Group (Petrovietnam), acting as the host country's representative to receive profit shares from petroleum contracts.

[9] Households or individuals conducting production and business of goods and services, including individuals from countries sharing land borders with Vietnam engaging in purchasing, selling, exchanging goods at border markets, border-gate markets, and markets in border economic zones.

[10] Individuals with taxable incomes (excluding business individuals).

[11] Individuals who are dependents according to personal income tax law.

[12] Organizations and individuals authorized by tax authorities to collect taxes.

[13] Other organizations, households, and individuals with obligations to the state budget.

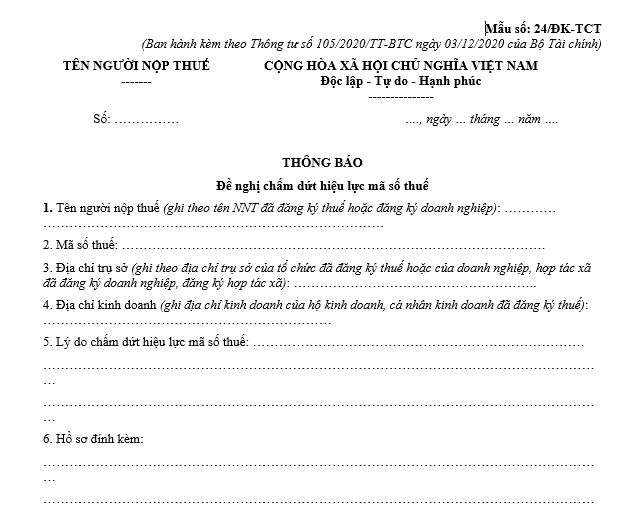

Latest application form for TIN deactivation in Vietnam in 2024?

According to Form No. 24/DK-TCT issued with Circular 105/2020/TT-BTC, the application form for TIN deactivation in Vietnam is regulated as follows:

Download the latest application form for TIN deactivation in 2024.