When is the deadline for VAT payment for the tax period of September 2024 in Vietnam?

When is the deadline for VAT payment for the tax period of September, 2024 in Vietnam?

Based on Clause 1, Article 4 of Decree 64/2024/ND-CP regulating the extension of deadlines for tax and land rent payments:

Article 4. Tax and land rent deferral

1. For value-added tax (excluding VAT at the import stage):

a) The deadline for VAT payment for the amount arising from the tax periods from May to September 2024 (for taxpayers filing VAT declarations monthly) and for the second quarter of 2024 and the third quarter of 2024 (for taxpayers filing VAT declarations quarterly) of the enterprises and organizations specified in Article 3 of this Decree is extended. The extension period is 5 months for the VAT amount of May 2024, June 2024, and the second quarter of 2024, 4 months for the VAT amount of July 2024, 3 months for the VAT amount of August 2024, and 2 months for the VAT amount of September 2024 and the third quarter of 2024. The extension period mentioned herein shall be counted from the end date of the VAT payment deadline stipulated by the tax management law.

The enterprises and organizations eligible for the extension must still declare and submit VAT declarations monthly and quarterly as per the current legal provisions, but the payment of the declared VAT amount is postponed. The extended payment deadlines are as follows:

The VAT payment deadline for the tax period of May 2024 is no later than November 20, 2024.

The VAT payment deadline for the tax period of June 2024 is no later than December 20, 2024.

The VAT payment deadline for the tax period of July 2024 is no later than December 20, 2024.

The VAT payment deadline for the tax period of August 2024 is no later than December 20, 2024.

The VAT payment deadline for the tax period of September 2024 is no later than December 20, 2024.

[...]

Thus, the deadline for VAT payment for the tax period of September 2024 is no later than December 20, 2024.

When is the deadline for VAT payment for the tax period of September 2024 in Vietnam? (Image from the Internet)

Who is subject to VAT in Vietnam?

Based on Article 3 of Circular 219/2013/TT-BTC, the following are subject to VAT:

- Business organizations established and registered according to the law.

- Economic organizations of political organizations, socio-political organizations, social organizations, socio-professional organizations, armed forces units, public service organizations, and other organizations.

- Foreign-invested enterprises and foreign parties involved in business cooperation.- Foreign organizations and individuals doing business in Vietnam without establishing a legal entity in Vietnam.

- Individuals, households, independent business groups, and other entities engaged in production, business, or import activities.

- Organizations and individuals conducting business in Vietnam that purchase services (including those associated with goods) from foreign organizations without a permanent establishment in Vietnam or individuals abroad, who are non-residents of Vietnam. In such cases, the organization or individual purchasing the services is the taxpayer, except where VAT declaration and payment are not required.

- Branches of export processing enterprises established to engage in the purchase, sale of goods, and activities directly related to the purchase, sale of goods in Vietnam according to the laws on industrial parks, export processing zones, and economic zones.

What are newest details of the Form 05/GTGT on VAT declaration in Vietnam?

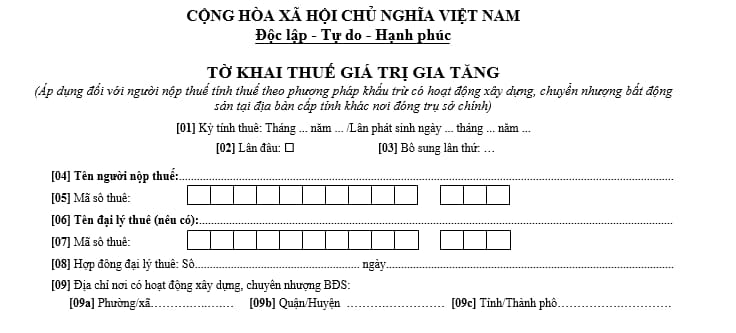

Based on Form 05/GTGT issued with Circular 80/2021/TT-BTC stipulating the VAT declaration form applicable to taxpayers using the credit method for tax calculation that have construction activities, real estate transfers in provincial areas different from their head office as follows:

Download the VAT declaration form applicable to taxpayers using the credit method for tax calculation with construction activities, real estate transfers in provincial areas different from their head office.