What is the value-added tax rate on rubber latex in Vietnam?

What is the value-added tax rate on rubber latex in Vietnam?

Pursuant to Clause 2, Article 9 of the Value Added Tax Law 2024 stipulating tax rates:

Article 9. Tax Rates

[...]

- The 5% tax rate applies to the following goods and services:

a) Clean water used for production and daily activities except bottled, jugged drinking water and other soft drinks;

b) Fertilizers, ores to produce fertilizers, plant protection drugs, and livestock growth stimulants as prescribed by law;

c) Services of excavation, dredging of canals, ditches, ponds for agricultural production; cultivating, caring for, pest prevention for plants; preliminary processing, preservation of agricultural products;

d) Products from planted crops, forests (except timber, bamboo shoots), livestock, aquaculture, capture that have not been processed into other products or only undergone ordinary processing, except for products specified in Clause 1, Article 5 of this Law;

dd) Rubber latex in the form of crepe latex, sheet latex, lump latex, crumb latex; nets, ropes, and fibers for weaving fishing nets;

e) Products made from jute, rush, bamboo, rattan, leaves, straw, coconut shells, coconut coir, water hyacinth, and other handicraft products made from agricultural by-products; cotton fiber that has undergone rough combing, fine combing; newsprint;

[...]

According to the above regulation, rubber latex in the form of crepe latex, sheet latex, lump latex, crumb latex is subject to a 5% VAT rate.

What is the value-added tax rate on rubber latex in Vietnam? (Image from the Internet)

Which financial, banking, securities trading, and commercial services are exempt from value-added tax in Vietnam?

Pursuant to Clause 9, Article 5 of the Value Added Tax Law 2024 stipulating non-taxable subjects:

Article 5. Non-Taxable Subjects

[...]

- The following financial, banking, securities, and commercial services:

a) Credit services as prescribed by the law on credit institutions and specific fees stated in the Credit Agreement of the Government of Vietnam with the foreign Lender;

b) Loan services provided by taxpayers who are not credit institutions;

c) Securities trading including securities brokerage, securities dealing, securities issuance underwriting, investment advisory on securities, securities investment fund management, securities portfolio management according to the law on securities;

d) Capital transfer including partial or entire transfer of capital invested in other economic organizations (regardless of whether a new legal entity is established or not), transfer of securities, transfer of capital contribution rights, and other capital transfer forms as prescribed by law, including the case of selling a business to another business for production and trading purposes where the purchasing business inherits all the rights and obligations of the selling business as prescribed by law. The capital transfer specified in this point does not include the transfer of investment projects, sale of assets;

[...]

The financial, banking, securities, and commercial services not subject to VAT include:

- Credit services as prescribed by the law on credit institutions and specific fees stated in the Credit Agreement of the Government of Vietnam with the foreign Lender

- Loan services provided by taxpayers who are not credit institutions

- Securities trading including securities brokerage, securities dealing, securities issuance underwriting, investment advisory on securities, securities investment fund management, securities portfolio management according to the law on securities

- Capital transfer including partial or entire transfer of capital invested in other economic organizations (regardless of whether a new legal entity is established or not), transfer of securities, transfer of capital contribution rights, and other capital transfer forms as prescribed by law, including the case of selling a business to another business for production and trading purposes where the purchasing business inherits all the rights and obligations of the selling business as prescribed by law. The capital transfer specified in this point does not include the transfer of investment projects, sale of assets

- Debt trading including selling payables and receivables

- Foreign exchange trading

- Derivative products as prescribed by the law on credit institutions, securities law, and trade law, including: interest rate swaps; forward contracts; futures contracts; options contracts to buy or sell and other derivative products

- Sale of secured assets of loans of an entity that the state owns 100% charter capital established by the Government of Vietnam with functions to buy and sell debts to handle bad debts of Vietnamese credit institutions

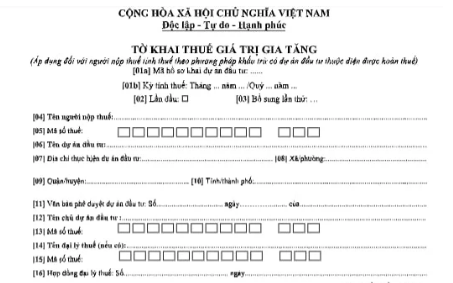

Form 02/GTGT - VAT declaration form according to Circular 80 in Vietnam

Pursuant to Appendix 2 issued together with Circular 80/2021/TT-BTC on the Form 02/GTGT - VAT declaration form:

Download Form 02/GTGT - VAT declaration form according to Circular 80