What is the licensing fee for the transfer of land use rights in Vietnam?

What is the licensing fee for the transfer of land use rights in Vietnam?

Pursuant to Article 8 of Decree 10/2022/ND-CP stipulating the licensing fee rate by percentage (%):

Article 8. Licensing Fee Rates by Percentage (%)

- Houses and land: The rate is 0.5%.

- Hunting guns; guns used for training or sports competition: The rate is 2%.

- Ships, including barges, canoes, tugboats, pushers, submarines, submersibles; boats, including yachts; aircraft: The rate is 1%.

- Motorcycles: The rate is 2%.

Specifically:

a) Motorcycles owned by organizations or individuals in centrally-managed cities; provincial cities; district-level towns where the provincial People's Committee is headquartered are subject to an initial licensing fee rate of 5%.

b) For motorcycles paying the licensing fee from the second time onward, the applicable rate is 1%. If the asset owner has already declared and paid a licensing fee for motorcycles at 2%, and then transfers it to an organization or individual in the regions specified in sub-point a of this point, the licensing fee of 5% will apply.

[...]

Therefore, the licensing fee rate for transferring land use rights is 0.5%.

What is the licensing fee for the transfer of land use rights in Vietnam? (Image from the Internet)

Which subjects are exempt from the licensing fee in Vietnam?

Pursuant to Article 10 of Decree 10/2022/ND-CP, certain entities are exempt from licensing fees, including:

- Houses and land that serve as headquarters for the following agencies:

+ Diplomatic missions

+ Consular offices

+ Representative offices of international organizations under the United Nations system

+ Residences of the head of diplomatic missions, consular offices, representative offices of international organizations under the United Nations system in Vietnam.

- Assets (excluding houses and land) of the foreign organizations and individuals below:

+ Diplomatic missions

+ Consular offices

+ Representative offices of international organizations under the United Nations system

+ Diplomatic officers, public employees of consular offices, administrative technical staff of diplomatic missions, consular offices

+ Members of representative offices of international organizations under the United Nations system and their family members who are not Vietnamese citizens or not permanently residing in Vietnam and who are granted diplomatic or official identity cards by the Vietnamese Ministry of Foreign Affairs.

+ Foreign organizations and individuals not belonging to foreign entities but are exempted or not required to pay licensing fees according to international commitments in which the Socialist Republic of Vietnam is a member.

- Land allocated or leased by the State with land rent paid once for the entire lease period for the following purposes:

+ Utilized for public purposes as prescribed by land law.

+ Exploration and mineral extraction; scientific research per a permit or approval by competent state authorities.

+ Investment in infrastructure construction, housing construction for transfer. These cases, if registered for ownership or use for leasing or self-use, must pay licensing fees.

+ Land assigned, leased, or recognized for agriculture, forestry production, aquaculture, or salt-making.

+ Agricultural land use rights exchanged among households and individuals within the same commune, ward, or commune-level town to facilitate agricultural production as prescribed.

- Agricultural land reclaimed by households and individuals in line with the approved land use plan, without disputes, that is awarded land use rights certificates by competent state authorities.

- Land leased from the State with annual land rent payment, or leased from organizations or individuals having legal land use rights.

- Houses and land used for the community by religious organizations, belief facilities recognized or permitted to operate by the State.

- Land used for cemeteries, burial grounds.

- Houses and land inherited or gifted among the following entities, awarded land use rights, housing ownership, and other attached property certificates by competent state authorities:

+ Husband and wife;

+ Biological parents and children;

+ Adoptive parents and adopted children;

+ Parents-in-law and daughter-in-law;

+ Parents-in-law and son-in-law;

+ Paternal grandparents and grandchildren;

+ Maternal grandparents and grandchildren;

+ Siblings.

- Housing created by households and individuals through forming separate housing projects per regulation.

- Assets under financial leasing transferred to the lessee at the end of the leasing period through asset transfer or sale, the lessee is exempt from paying licensing fees; if the financial leasing company buys assets from an entity that has paid licensing fees, then leases it back to the selling entity, the financial leasing company is exempt from licensing fees.

- Specific houses, land, and assets, specialized assets, assets serving management duties specifically serving national defense and security.

- Houses and land classified as public property, used as agency headquarters for Government bodies, people's armed forces units, public service providers, political organizations, socio-political organizations, socio-political-professional organizations, social organizations, and socio-professional organizations.

- Houses and land compensated or relocated (including houses or land purchased with compensated, assisted funds) when the State recovers houses and land in accordance with the law.

licensing fee exemptions under regulation apply to entities with recovered houses and land.

- Assets of organizations and individuals granted ownership and use certificates, when re-registering ownership or use entailed in additional land, upgraded or replaced assets, are exempted from licensing fees in these cases:

+ Assets certified by competent authorities from the Democratic Republic of Vietnam, the Government of the Revolutionary Vietnam, the Government of the Provisional Republic of South Vietnam, the State of the Socialist Republic of Vietnam, or competent authorities of old policies, currently updated to new certificates without changing ownership.

+ Assets of state enterprises, public service providers that are equitized into joint-stock companies or reorganized as per the law.

+ Assets granted joint ownership and use certificates within a family, when distributed as per the law for members to re-register; consolidated marital assets post-marriage; divided assets post-divorce per court judgments or decisions.

+ Reissuance of ownership or use certificates for assets due to loss, damage, wear, or destruction. Entities need not declare or process exemption when reissuance relates only to maintaining existing ownership or use rights.

+ When reissuing land use certificates involves additional land area without changing parcel boundaries, the additional area is exempt from licensing fees.

+ Organizations or individuals transitioning from state-allocated land (with issued certificates) to leasing with a one-time land rent payment for the full term per the Land Law from the effective date of this Decree.

+ On re-registration of land use rights following state-approved land use conversion without changing the land user and not incurring land levy according to land levy law for usage conversion.

- Assets that were subjected to licensing fees (excluding those exempted) transferring to other organizations or individuals registering for ownership or use exemption under the following scenarios:

+ Organizations, individuals, cooperative members allocate their assets to businesses, credit institutions, cooperatives or the dissolution, division, withdrawal of assets from these entities.

+ Companies allocate assets internally, or administrative agencies allocate assets internally based on decisions from authoritative levels.

- Organization or individual-owned assets already subjected to licensing fees divided, merged, renamed by authority decision.

- Organization or individual-owned assets subject to licensing fees transferred to another locality without changing ownership.

- Housing for humanitarian aid, solidarity, or housing under support initiatives with title registrations held under beneficiary names.

- Fire trucks, ambulances, X-ray vehicles, rescue vehicles (including recovery vehicles and transport vehicles);

- Garbage trucks, water-spraying vehicles, watering vehicles, water-spray tank vehicles, road-sweeping vehicles, vacuum vehicles, or wastewater suction vehicles;

- Special-use cars, motorcycles for war veterans, invalids, and disabled persons registered in their names.

- Aircraft used for commercial freight and passenger transport.

- Fishing boats (including fishery harvest boats and fishery logistic vessels) with replaced hulls, engine assemblies, and frames needing re-registration with competent authorities.

- Hulls, frame assemblies, engine assemblies, engine blocks, allowable replacements requiring re-registration during the warranty period.

- Industrial production facilities;

- Warehouses, dining areas, and parking facilities for production and business units.

- Housing and homestead land belonging to impoverished households;

- Housing and homestead land of ethnic minorities in communes, wards, or townships in difficult areas in the Central Highlands;

- Housing and homestead land of households and individuals in communes under the socio-economic development program especially difficult areas, mountainous and remote regions.

- Non-motorized ships and boats with a total load not exceeding 15 tons;

- Motorized ships and boats with a main engine capacity not exceeding 15 horsepower;

- Passenger capacity of 12 people or less;

- High-speed passenger ships, garbage collection ships, or vessel or boat transporting container transport.

- Facilities performing private investment in education, vocational training; health; culture; sports; the environment as mandated by law is registered for land use rights and house ownership for related activities.

- Extracurricular facilities registered for land use rights and house ownership for activities in education, vocational training; health; culture; sports; science and technology; environment; society; population and family; child protection under regulatory standards.

- Science and technology enterprises registered for land use rights and house ownership according to law.

- Public transport vehicles using clean energy, specifically buses.

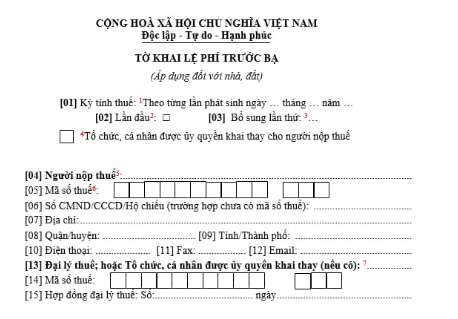

What are details of the Form 01/LPTB - Declaration of licensing fee for to houses and land in Vietnam?

Based on Form 01/LPTB issued with Circular 80/2021/TT-BTC prescribing the Declaration of licensing fee for to houses and land in Vietnam:

Download Form 01/LPTB - Declaration of licensing fee for to houses and land in Vietnam