What is the license fee rate for 2025 in Vietnam?

What are details of the license fee declaration form for the year 2025 in Vietnam?

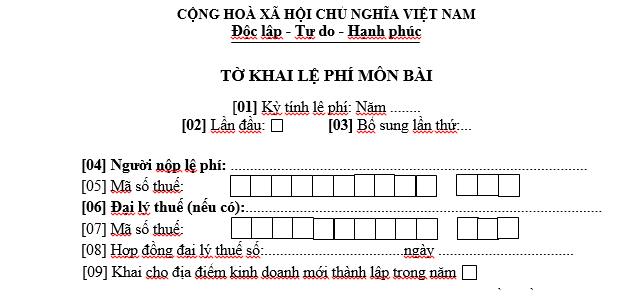

Based on Form 01/LPMB - Appendix 2 attached to Circular 80/2021/TT-BTC, the license fee declaration form is stipulated as follows:

Download the license fee declaration form for the year 2025 in Vietnam

What is the license fee rate for 2025 in Vietnam? (Image from the Internet)

Who is required to pay the license fee in Vietnam?

Based on Article 2 of Decree 139/2016/ND-CP, the entities subject to the license fee are defined as:

Article 2. Entities subject to the license fee

Entities subject to the license fee are organizations and individuals engaging in the production and business of goods and services, except for cases stipulated in Article 3 of this Decree, including:

- Enterprises established under the law.

- Organizations established under the Law on Cooperatives.

- Public service providers established under the law.

- Economic organizations of political organizations, socio-political organizations, social organizations, professional-social organizations, and people's armed units.

- Other organizations engaged in production and business activities.

[...]

The entities subject to the license fee are organizations and individuals engaged in the production and business of goods and services, except for cases exempt from the license fee, including:

[1] Enterprises established under the law.

[2] Organizations established under the Law on Cooperatives.

[3] Public service providers established under the law.

[4] Economic organizations of political organizations, socio-political organizations, social organizations, professional-social organizations, and people's armed units.

[5] Other organizations engaged in production and business activities.

[6] Branches, representative offices, and business locations of the above organizations

[7] Individuals, groups of individuals, and households engaged in production and business activities.

What is the license fee rate for 2025 in Vietnam?

Based on Article 4 of Circular 302/2016/TT-BTC (amended and supplemented by Clause 3; Clause 4 Article 1 of Circular 65/2020/TT-BTC), the license fee rates are stipulated as follows:

Article 4. License fee rates

- The license fee rates for organizations engaged in the production and business of goods and services are as follows:

a) Organizations with charter capital or investment capital over 10 billion VND: 3,000,000 (three million) VND/year;

b) Organizations with charter capital or investment capital up to 10 billion VND: 2,000,000 (two million) VND/year;

c) Branches, representative offices, business locations, public service providers, and other economic organizations: 1,000,000 (one million) VND/year.

[...]

- The license fee rates for individuals, groups of individuals, and households engaged in the production and business of goods and services are as follows:

a) Individuals, groups of individuals, households with revenue over 500 million VND/year: 1,000,000 (one million) VND/year;

b) Individuals, groups of individuals, households with revenue over 300 to 500 million VND/year: 500,000 (five hundred thousand) VND/year;

c) Individuals, groups of individuals, households with revenue over 100 to 300 million VND/year: 300,000 (three hundred thousand) VND/year.

[...]

The license fee rates in 2025 are as follows:

[1] For organizations engaged in the production and business of goods and services

- Organizations with charter capital or investment capital over 10 billion VND: 3,000,000 VND/year

- Organizations with charter capital or investment capital up to 10 billion VND: 2,000,000 VND/year

- Branches, representative offices, business locations, public service providers, and other economic organizations: 1,000,000 VND/year

[2] For individuals, households engaged in the production and business of goods and services

- Individuals, groups of individuals, households with revenue over 500 million VND/year: 1,000,000 VND/year

- Individuals, groups of individuals, households with revenue over 300 to 500 million VND/year: 500,000 VND/year

- Individuals, groups of individuals, households with revenue over 100 to 300 million VND/year: 300,000 VND/year

Note: Small and medium enterprises converted from business households (including branches, representative offices, business locations) when the exempt period of license fee ends (the fourth year since the enterprise establishment): if ending in the first 6 months of the year, pay the entire annual license fee, if ending in the last 6 months of the year, pay 50% of the annual license fee.

Households, individuals, groups of individuals engaged in production and business activities having dissolved and resumed activities in the first 6 months of the year will pay the full annual license fee, in the last 6 months of the year pay 50% of the annual license fee.