What is the form used to make a declaration for VAT reduction in Vietnam from July 1, 2024, to December 31, 2024?

What is the form used to make a declaration for VAT reduction in Vietnam from July 1, 2024, to December 31, 2024?

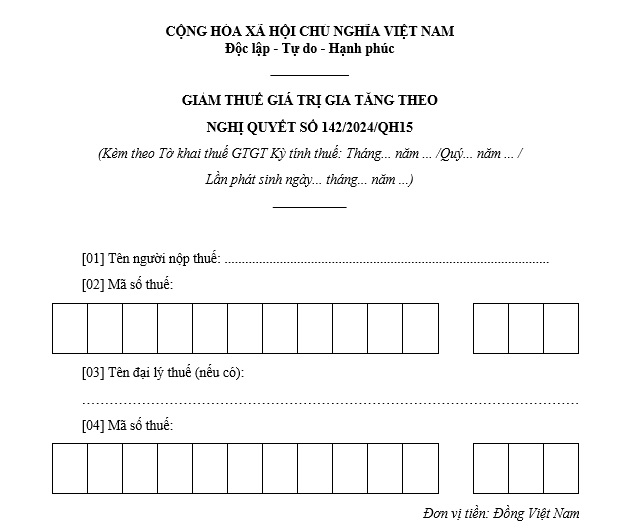

Based on Form No. 01 in Appendix 4 issued together with Decree 72/2024/ND-CP, the form used to make a declaration for VAT reduction in Vietnam from July 1, 2024, to December 31, 2024, is as follows:

Download the form used to make a declaration for VAT reduction in Vietnam from July 1, 2024, to December 31, 2024

What is the form used to make a declaration for VAT reduction in Vietnam from July 1, 2024, to December 31, 2024? (Image from the Internet)

Tax reduction in Vietnam in 2024 applies until when?

Based on Clause 2, Article 1 of Decree 72/2024/ND-CP, the provisions for reducing the Value Added Taxin Vietnam are as follows:

Article 1. Reduction of Value Added Tax

[...]

2. Rate of Value Added Tax Reduction

a) Businesses calculating VAT using the credit method are eligible for a reduced VAT rate of 8% for goods and services specified in Clause 1 of this Article.

b) Businesses (including business households and individual businesses) calculating VAT using a percentage method on revenue are eligible for a 20% reduction in the percentage rate used to calculate VAT when issuing invoices for goods and services entitled to a VAT reduction as specified in Clause 1 of this Article.

[...]

According to Article 2 of Decree 72/2024/ND-CP, the provisions for enforcement and implementation are:

Article 2. Effectiveness and Implementation

1. This Decree shall be effective from July 1, 2024, to the end of December 31, 2024.

2. The ministries, as per their functions and responsibilities, and the People's Committees of provinces and central cities shall direct relevant agencies to disseminate, guide, inspect, and supervise so that consumers understand and benefit from the VAT reduction prescribed in Article 1 of this Decree. Efforts should be concentrated on measures to stabilize the supply and demand of goods and services subject to VAT reduction to maintain price stability (excluding VAT) from July 1, 2024, to the end of December 31, 2024.

3. If there are obstacles during implementation, the Ministry of Finance is responsible for providing guidance and resolution.

4. Ministers, Heads of ministerial-level agencies, Heads of agencies under the Government of Vietnam, Presidents of People's Committees of provinces and central cities, and relevant enterprises, organizations, and individuals are responsible for enforcing this Decree.

Thus, businesses calculating VAT using the credit method may apply a reduced VAT rate of 8% for goods and services in the VAT reduction list.

Businesses (including business households and individual businesses) calculating VAT on a percentage basis on revenue may apply a 20% reduction in the percentage rate used for VAT calculation when invoicing for goods and services eligible for VAT reduction as per the regulations.

The VAT reduction is applicable until the end of December 31, 2024.

0% tax rate applies to which subjects in Vietnam?

Based on Clause 1, Article 8 of Law on Value Added Tax 2008 amended by Clause 3, Article 1 of Law amending Law on Value Added Tax 2013, further amended by Clause 2, Article 1 ofLaw amending AT Law, Excise Tax, and Tax Management Law 2016 specifying the tax rate:

Article 8. Tax Rates

1. The 0% tax rate applies to exported goods and services, international transportation, and goods and services that are not subject to VAT upon export, except for the following cases:

a) Technology transfer and intellectual property rights transfer abroad;

b) Overseas reinsurance services;

c) Credit provision services;

d) Capital transfer;

dd) Derivative financial services;

e) Postal and telecommunication services;

g) Exported products specified in Clause 23, Article 5 of this Law.

Exported goods and services are those consumed outside Vietnam, in non-tariff zones; goods and services provided to foreign customers as regulated by the Government of Vietnam.

[...]

Therefore, the 0% tax rate applies to exported goods and services, international transportation, and goods and services not subject to VAT upon export, except in the following cases:

- Technology transfer and intellectual property rights transfer abroad;

- Overseas reinsurance services;

- Credit provision services;

- Capital transfer;

- Derivative financial services;

- Postal and telecommunication services;

- Exported products specified in Clause 23, Article 5 of Law on Value Added Tax 2008.

Exported goods and services are those consumed outside Vietnam, in non-tariff zones; goods and services provided to foreign customers as regulated by the Government of Vietnam.