What is the due date for the excise tax payment for domestically produced or assembled automobiles in Vietnam for the tax period of September 2024?

What is the due date for the excise tax payment for domestically produced or assembled automobiles in Vietnam for the tax period of September 2024?

According to Article 3 of Decree 65/2024/ND-CP, which stipulates the tax deferral in Vietnam:

Article 3. Extension of tax payment deadline

1. Tax deferral for the excise tax payable arising from the tax periods of May, June, July, August, and September 2024 for domestically produced or assembled automobiles. The extension is from the end of the excise tax payment deadline as stipulated by law on tax management until the end of November 20, 2024. Specifically:

a) The deadline for paying the excise tax payable arising from the tax period of May 2024 is no later than November 20, 2024.

b) The deadline for paying the excise tax payable arising from the tax period of June 2024 is no later than November 20, 2024.

c) The deadline for paying the excise tax payable arising from the tax period of July 2024 is no later than November 20, 2024.

d) The deadline for paying the excise tax payable arising from the tax period of August 2024 is no later than November 20, 2024.

dd) The deadline for paying the excise tax payable arising from the tax period of September 2024 is no later than November 20, 2024.

[...]

According to the above regulation, the deadline for paying the excise tax payable arising from the tax period of September 2024 for domestically produced or assembled automobiles is no later than November 20, 2024.

What is the due date for the excise tax payment for domestically produced or assembled automobiles in Vietnam for the tax period of September 2024? (Image from the Internet)

What are objects not subject to the excise tax in Vietnam?

According to Article 3 of the Law on excise tax 2008, amended by Clause 2 of Article 1 of the Law on amendment Law on excise tax 2014, which stipulates the objects not subject to the excise tax in Vietnam:

Article 3. Non-taxable objects

Goods specified in Clause 1, Article 2 of this Law are not subject to excise tax in the following cases:

1. Goods produced or processed directly for export or sold, entrusted for business establishments to export;

2. Imported goods including:

a) Humanitarian aid, non-refundable aid; gifts to state agencies, political organizations, socio-political organizations, socio-political and professional organizations, social organizations, socio-professional organizations, units of the people's armed forces, gifts and donations to individuals in Vietnam within the limits prescribed by the Government of Vietnam;

b) Goods transported in transit or temporarily imported for re-export or temporarily exported for re-import within the time limit prescribed by the law on export and import taxes;

[...]

Thus, entities not subject to the excise tax include:

- Goods produced or processed directly for export or sold, entrusted for business establishments to export

- Imported goods including:

+ Humanitarian aid, non-refundable aid; gifts to state agencies, political organizations, socio-political organizations, socio-political and professional organizations, social organizations, socio-professional organizations, units of the people's armed forces, gifts and donations to individuals in Vietnam within the limits prescribed by the Government of Vietnam

+ Goods transported in transit or temporarily imported for re-export or temporarily exported for re-import within the time limit prescribed by the law on export and import taxes

+ Goods temporarily imported and re-exported and temporarily exported and re-imported that are not subject to import and export taxes within the time limit prescribed by the law on export and import taxes

+ Personal belongings of foreign organizations and individuals according to diplomatic immunity standards; goods brought as part of tax-free luggage regulations; goods imported for sale in tax-free shops according to the law;

- Aircraft, yachts used for business purposes of transporting goods, passengers, tourists, and aircraft used for security and defense purposes

- Ambulance cars; cars for transporting prisoners; funeral cars; cars designed to have both seating and standing spaces for transporting 24 people or more; cars used in amusement parks, entertainment areas, and sports that are not registered for circulation and do not participate in traffic

- Goods imported from abroad into non-tariff zones, goods sold from the domestic market to non-tariff zones and used only within the non-tariff zones, goods traded between non-tariff zones, except for cars with less than 24 seats

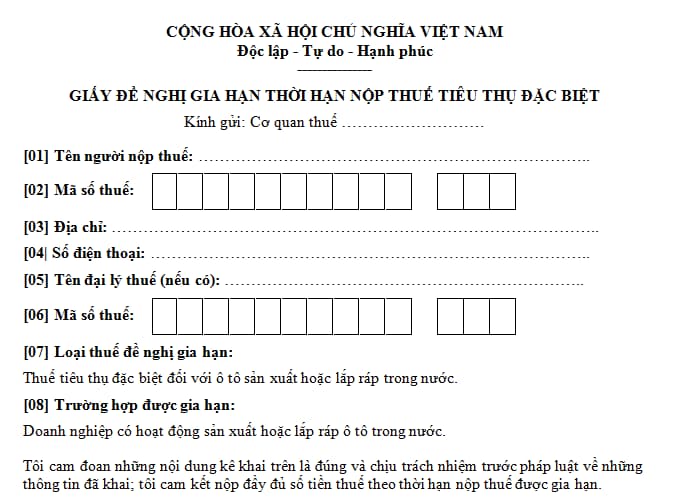

What is the newest application form for tax deferral for domestically produced or assembled automobiles in Vietnam in 2024?

According to the Appendix issued with Decree 65/2024/ND-CP which stipulates the application form for tax deferral in Vietnam as follows:

Download the application form for tax deferral for domestically produced or assembled automobiles in Vietnam.