What is the deadline for payment of value-added tax in Vietnam for the third quarter of 2024?

What is the deadline for payment of value-added tax in Vietnam for the third quarter of 2024?

Based on Clause 1 Article 4 Decree 64/2024/ND-CP on the tax and land rent deferral in Vietnam:

Article 4. Tax and land rent deferral

1. For value-added tax (excluding value-added tax at the import stage)

a) The deadline for payment of value-added tax incurred for May to September 2024 (for those declaring value-added tax monthly) and the second quarter of 2024, the third quarter of 2024 (for those declaring value-added tax quarterly) for the enterprises and organizations specified in Article 3 of this Decree. The extension period is 05 months for the value-added tax of May 2024, June 2024, and the second quarter of 2024; the extension period is 04 months for the value-added tax of July 2024; the extension period is 03 months for the value-added tax of August 2024; the extension period is 02 months for the value-added tax of September 2024 and the third quarter of 2024. The extension period at this point is calculated from the end date of the value-added tax payment deadline according to tax management laws.

[...]

The deadline for payment of value-added tax for the third quarter of 2024 is no later than December 31, 2024.

[...]

According to the above regulation, the deadline for payment of value-added tax in Vietnam for the third quarter of 2024 is no later than December 31, 2024.

What is the deadline for payment of value-added tax in Vietnam for the third quarter of 2024? (Internet image)

Who is not subject to value-added tax?

Based on Article 5 of the Law on Value-Added Tax 2008 supplemented by Clause 1 Article 3 of the Law on Amending Laws on Tax 2014 and Clause 1 Article 1 of the Law on Amending the Law on Value-Added Tax, the Law on Special Consumption Tax and the Law on Tax Administration 2016 and Clause 1 Article 1 of the Law on Amending the Law on Value-Added Tax 2013, the non-subjects of VAT include:

[1] Products of cultivation, husbandry, aquaculture, catching not yet processed into other products or only through normal preliminary processing by organizations or individuals that self-produce, catch for sale, including imports.

Enterprises, cooperatives buying unprocessed or preliminarily processed agricultural, husbandry, aquaculture products for sale to other enterprises or cooperatives are not required to declare, calculate and pay value-added tax but are entitled to deduct input value-added tax.

[2] Products being breeds of livestock, plants including egg breeds, animal breeds, saplings, seeds, semen, embryos, genetic materials.

[3] Water irrigation, drainage; ploughing, harrowing land; dredging inner-field channels, ditches for agricultural production; harvesting services for agricultural products.

[4] Fertilizers; specialized machinery and equipment for agricultural production; offshore fishing vessels; animal, poultry and other animal feeds.

[5] Salt products produced from seawater, naturally occurring rock salt, refined salt, iodized salt with the main ingredient being sodium chloride (NaCl).

[6] State-owned houses sold by the State to current tenants.

[7] Transfer of land use rights.

[8] Life insurance, health insurance, student insurance, other insurance services related to people; livestock insurance, plant insurance, other agricultural insurance services; insurance for ships, boats, equipment, and other necessary tools directly used for fishing; reinsurance.

[9] The following financial, banking, and securities services:- Credit granting services.- Lending services by non-credit institutions.- Securities trading.- Capital transfer.- Debt trading.- Foreign exchange trading.- Derivative financial services.- Sale of secured assets of debts of organizations wholly-owned by the Government of Vietnam established to handle bad debts of Vietnamese credit institutions.

[10] Medical services, veterinary services, including diagnosis, treatment, and disease prevention for people and pets; elder care, disability care services.

[11] Public postal, telecommunications, and Internet services as per programs by the Government of Vietnam.

[12] Services maintaining zoos, gardens, parks, street greenery, public lighting; funeral services.

[13] Maintenance, repair, and construction using contributed capital from the people, humanitarian aid for cultural, art works, public service projects, infrastructure and housing for social policy subjects.

[14] Education and vocational training according to law.

[15] Broadcasting by state budget.

[16] Publishing, importing, and distributing newspapers, journals, specialized newsletters, political books, textbooks, curriculums, law books, scientific-technical books, books printed in minority languages, promotional and propaganda posters, including on audio, video tapes or discs, electronic data; currency, printing money.

[17] Public passenger transportation by bus, electrified railways.

[18] Machinery, equipment, spare parts, and materials not yet produced domestically that need to be imported for direct use in scientific research, technology development; machinery, equipment, replacement parts, specialized vehicles, and materials not yet produced domestically that need to be imported for oil and gas exploration, extraction, and field development; aircrafts, rigs, ships that are not yet produced domestically that need to be imported for creating fixed assets of enterprises or rented from abroad for production, business, leasing, and sub-leasing.

[19] Specialized weapons and equipment for national defense and security.

[20] Imports under humanitarian or non-refundable aid; gifts for state agencies, political organizations, socio-political organizations, socio-political-professional organizations, social organizations, socio-professional organizations, people's armed forces units; gifts for individuals in Vietnam according to the regulations of the Government of Vietnam; goods for foreign organizations, individuals per diplomatic immunity; goods brought along in tax-exempt luggage limits.

Goods and services sold to foreign organizations, individuals, and international organizations for humanitarian or non-refundable aid to Vietnam.

[21] Goods in transit through Vietnam; temporary imports for re-export; temporary exports for re-import; raw materials imported for producing or processing export goods under production and processing contracts with foreign parties; goods, services traded between foreign countries and non-tariff areas and between non-tariff areas.

[22] Technology transfer as defined by the Law on Technology Transfer; transfer of intellectual property rights as defined by the Law on Intellectual Property; computer software.

[23] Imported gold in the form of bars or ingots not yet processed into artifacts, jewelry, or other products.

[24] Exported products are unprocessed or only preliminarily processed from extracted resources and minerals; exported products are goods processed from resources and minerals with the total value of resources, minerals plus energy cost accounting for 51% or more of product cost.

[25] Artificial products used to replace human body parts; crutches, wheelchairs, and specialized tools for disabled people.

[26] Goods and services provided by business households and individuals with annual revenue of one hundred million VND or less.

Businesses engaged in goods and services not subject to VAT as specified in this Article are not entitled to deduct and refund input VAT, except in cases where the 0% tax rate is applied.

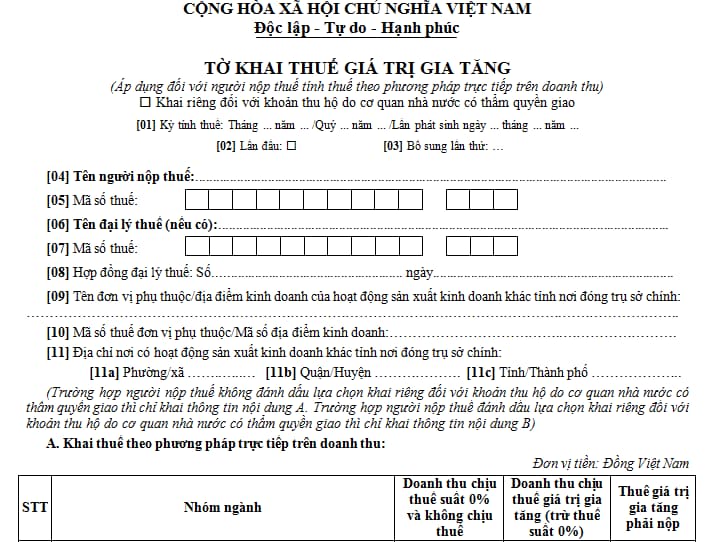

What are details of Form 04/GTGT - latest value-added tax declaration form in Vietnam in 2024?

Based on Form 04/GTGT issued with Circular 80/2021/TT-BTC stipulating Form 04/GTGT for value-added tax declaration applicable to taxpayers calculating tax based on the direct method on revenue as follows:

Download the Form 04/GTGT - latest value-added tax declaration form in Vietnam in 2024