What documents are included in the Application for dependent deductions for taxpayers in 2025 in Vietnam?

What documents are included in the Application for dependent deductions for taxpayers in 2025 in Vietnam?

According to Subsection 3, Section 3 of Official Dispatch 883/TCT-DNNCN of 2022 guiding the personal income tax finalization:

III. FAMILY CIRCUMSTANCE DEDUCTION

[...]

- Documents for Family Circumstance Deduction for Dependents

a) For individuals submitting the dependent registration dossier directly at the tax authority, the dossier includes:

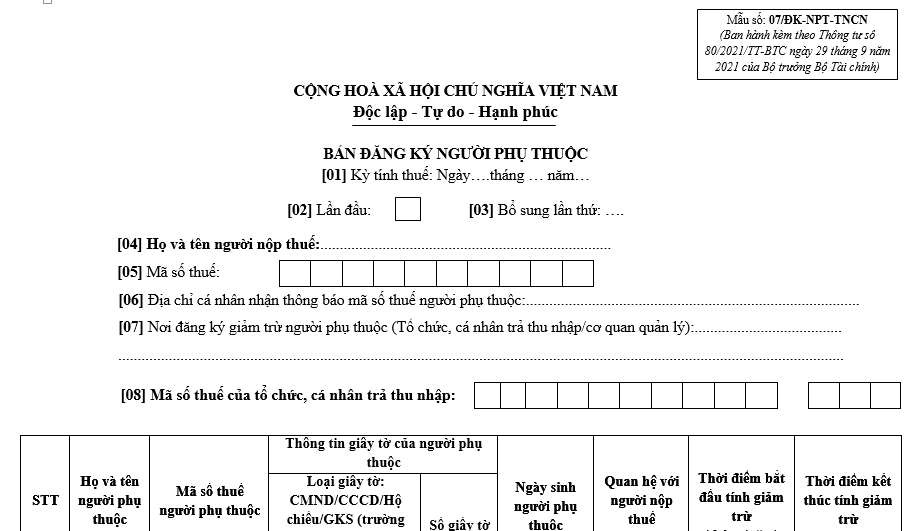

+ Dependent registration form according to Form No. 07/DK-NPT-TNCN issued with Appendix II of Circular No. 80/2021/TT-BTC dated September 29, 2021, by the Ministry of Finance.

+ Documents proving the dependent as guided at point g, Clause 1, Article 9 of Circular No. 111/2013/TT-BTC dated August 15, 2013, by the Ministry of Finance.

+ In cases where the dependent is directly supported by the taxpayer, a certification from the People's Committee of the commune/ward where the dependent resides must be obtained according to Form No. 07/XN-NPT-TNCN issued with Appendix II of Circular No. 80/2021/TT-BTC dated September 29, 2021, by the Ministry of Finance.

b) In case individuals register family circumstance deduction for dependents through organizations or individuals paying income, they shall submit the dependent registration dossier as guided at point a, clause 3, Section III of this dispatch to the income-paying organizations or individuals. The income-paying organizations or individuals will compile based on Appendix of the Summary Table of Dependent Registration for Family Circumstance Deduction according to Form No. 07/THDK-NPT-TNCN issued with Appendix II of Circular No. 80/2021/TT-BTC dated September 29, 2021, by the Ministry of Finance and submit it to the tax authority as prescribed.

Thus, the Application for dependent deductions for taxpayers in 2025 includes the following documents:

[1] For individuals submitting dependent registration dossier directly at the tax authority

- Dependent registration form

- Documents proving the dependent

Note: In cases where the dependent is directly supported by the taxpayer, certification from the People's Committee of the commune/ward where the dependent resides is required.

[2] For individuals registering family circumstance deduction for dependents through organizations or individuals paying income

- Dependent registration form

- Documents proving the dependent

Note: In cases where the dependent is directly supported by the taxpayer, certification from the People's Committee is required.

The organization or individual paying income compiles according to the Appendix of the Summary Table of Dependent Registration for Family Circumstance Deduction according to Form No. 07/THDK-NPT-TNCN.

What documents are included in the Application for dependent deductions for taxpayers in 2025 in Vietnam? (Image from the Internet)

What are details of the Form 07/DK-NPT-TNCN - Dependent Registration Form according to Circular 80?

Based on Form 07/DK-NPT-TNCN Appendix 2 of the Tax Declaration Document List issued with Circular 80/2021/TT-BTC, the dependent registration form is regulated as follows:

Download the Form 07/DK-NPT-TNCN - Dependent Registration Form according to Circular 80

Do dependents in Vietnam have tax identification numbers?

According to Clause 3, Article 30 of the Law on Tax Administration 2019 regulating taxpayer registration and tax identification number issuance:

Article 30. Taxpayer Registration and Tax Identification Number Issuance

[...]

- Tax identification numbers are issued as follows:

a) Enterprises, economic organizations, and other organizations are issued one unique tax identification number to use throughout their operations from taxpayer registration until the cessation of the tax identification number's effect. Taxpayers with branches, representative offices, or directly affiliated units fulfilling tax obligations are issued dependent tax identification numbers. In cases where enterprises, organizations, branches, representative offices, or units dependent on taxpayer registration under a one-stop shop mechanism along with enterprise registration, cooperative registration, and business registration, the number recorded on the enterprise registration certificate, cooperative registration certificate, or business registration certificate is also the tax identification number;

b) Individuals are issued one unique tax identification number to use throughout their lifetime. Dependents of the individual are issued a tax identification number to apply for family circumstance deduction for personal income tax. The tax identification number issued to the dependent is also the tax identification number of the individual when the dependent incurs obligations to the state budget;

c) Enterprises, organizations, or individuals responsible for withholding and paying taxes on behalf of others are issued substitute tax identification numbers to carry out tax declarations and tax payments on behalf of taxpayers;

[...]

According to the above regulation, dependents of individuals are issued a tax identification number for family circumstance deduction for personal income tax. The tax identification number issued to the dependent is also the tax identification number of the individual when the dependent incurs obligations to the state budget.