What are details of the Form 03-DK-TCT - Taxpayer registration declaration form for households, individual businesses in Vietnam according to Circular 86?

What are details of the Form 03-DK-TCT - Taxpayer registration declaration form for households, individual businesses in Vietnam according to Circular 86?

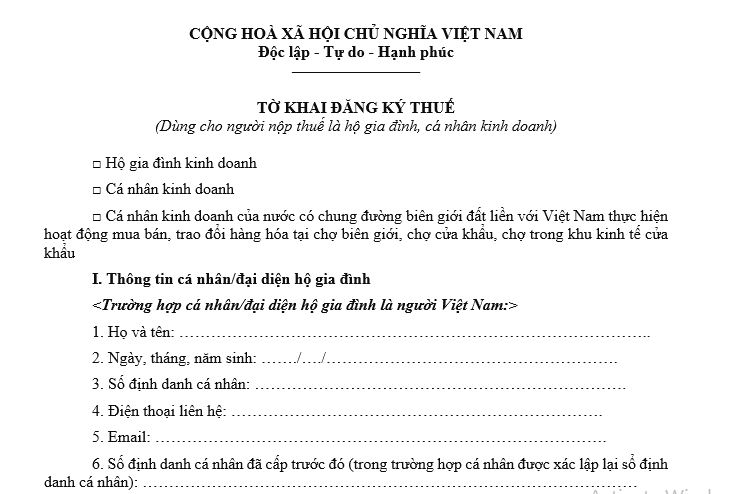

Pursuant to Form 03-DK-TCT - Annex 2 issued together with Circular 86/2024/TT-BTC stipulating the taxpayer registration declaration form for households, individual businesses:

Download the Form 03-DK-TCT - Taxpayer registration declaration form for households, individual businesses in Vietnam according to Circular 86

What are details of the Form 03-DK-TCT - Taxpayer registration declaration form for households, individual businesses in Vietnam according to Circular 86? (Image from Internet)

What are instructions for filling out Form 03-DK-TCT - Taxpayer registration declaration form for households, individual businesses according to Circular 86?

Form 03-DK-TCT - Taxpayer registration declaration form for households, individual businesses according to Circular 86 is filled out as follows:

Taxpayers must check one of the appropriate boxes before entering detailed information. To be specific:

- Business households

- Individual business

- Individual businesses from countries sharing a land border with Vietnam engaging in buying, exchanging goods at border markets, border gates, markets in the border gate economic zone

I. Personal information/business household head

- In the case of individuals/representatives of households being Vietnamese, fill in the indicators from 1 to 5 below:

-

Full name: Clearly and fully write in uppercase the name of the individual/representative of the household taxpayer registration.

-

Date of birth: Clearly write the date of birth of the individual/representative of the household taxpayer registration.

-

Personal identification number: Enter the personal identification number of the individual/representative of the household taxpayer registration.

Note: Individuals/representatives of households must accurately fill in their name, date of birth, and personal identification number compared to the information stored in the National Population Database.

-

Contact phone: Accurately enter the phone number of the individual/representative of the household (if any).

-

Email: Accurately enter the email address of the individual/representative of the household (if any).

- In the case of individuals with foreign nationality or those with Vietnamese nationality living abroad without a personal identification number, fill in the indicators from 1 to 8 below:

-

Full name: Clearly and fully write in uppercase the name of the individual taxpayer registration.

-

Date of birth: Clearly write the date of birth of the individual taxpayer registration.

-

Gender: Check one of the boxes Male or Female.

-

Nationality: Clearly state the nationality of the individual taxpayer registration.

-

Legal documents: Check one of the types of documents passport/laissez-passer/border ID card/other valid identity documents of the individual and clearly write the number, date of issue, information “place of issue” only write the province, city of issue.

-

Permanent address: Fully write the information about the personal permanent residence address

-

Current address: Fully write the information about the current residence address of the individual

(only write this if the address is different from the permanent residence address).

- Other information: Write the phone number, email address (if any).

II. Tax agency information: Fully record the information of the tax agency in case the tax agency signs a contract with the taxpayer to perform taxpayer registration procedures on behalf of the taxpayer as stipulated in the Law on Tax Administration.

III. Information about the business location

In the case the taxpayer is a household, individual business but does not register business through the business registration agency according to the regulations of the Government of Vietnam on household businesses, the business activity information is declared as follows:

-

Store/brand name: Name of the store or brand of the business location.

-

Business address:

- In the case of a regular business activity and a fixed business location; individuals leasing real estate shall clearly write the business address of the household, individual business, or the address where the individual leases real estate including: house number, street/hamlet/village/ward/commune/commune-level town, district/district-level town/provincial city, province/city. If there is a phone number, Fax number, write the area code - phone number/Fax number.

- In case of regular business without a fixed business location, clearly write the place of residence of the individual business.

-

Tax notification address: If there is an address for receiving the tax authority's notices different from the business address, clearly write the tax notification address for the tax authority to contact.

-

Main business line: Clearly write 01 actual main line being conducted at the business location.

-

Start date of operation: Clearly write the start date of operation of the business location.

-

VAT calculation method: Choose one of the 2 methods of calculating VAT - declaration or estimation.

* Section for the representative of the household/individual business to sign, clearly write the full name: The representative of the household/individual business must sign and clearly write the full name in this section.

* Tax agency employee: In case the tax agency declares on behalf of the taxpayer, declare this information.

Where is the initial taxpayer registration dossier submitted when registering directly with the tax authority in Vietnam?

Based on Article 32 of the Law on Tax Administration 2019 stipulating the first-time taxpayer registration submission location:

Article 32. First-time taxpayer registration submission location

- Taxpayers registering taxpayer registration together with enterprise registration, cooperative registration, or business registration, the taxpayer registration submission location is the same as the enterprise registration, cooperative registration, or business registration submission location in accordance with the law.

- Taxpayers registering taxpayer registration directly with the tax authority, the submission location is stipulated as follows:

a) Organizations, business households, individual businesses submit taxpayer registration documents at the tax authority where the organization, business household, individual business has its headquarters;

b) Organizations, individuals responsible for withholding and paying tax on behalf of others submit taxpayer registration documents at the tax authority directly managing them;

c) Households, individuals not doing business submit taxpayer registration documents at the tax authority where taxable income arises, where permanent residence or temporary residence is registered, or where obligations with the state budget arise.

- Individuals authorize organizations, individuals paying income to register taxpayer registration on behalf of themselves and dependents submit taxpayer registration documents through the organization, individual paying income. The organization, individual paying income is responsible for compiling and submitting registration documents on behalf of individuals to the tax authority directly managing them.

The first-time taxpayer registration submission location for direct taxpayer registration with the tax agency is as follows:

- Organizations, business households, individual businesses submit taxpayer registration documents at the tax authority where the organization, business household, individual business has its headquarters

- Organizations, individuals responsible for withholding and paying tax on behalf of others submit taxpayer registration documents at the tax authority directly managing them

- Households, individuals not doing business submit taxpayer registration documents at the tax authority where taxable income arises, where permanent residence or temporary residence is registered, or where obligations with the state budget arise.