What are details of Form 07/DK-NPT-TNCN for registration of dependents in Vietnam in accordance with Circular 80?

What are details of Form 07/DK-NPT-TNCN for registration of dependents in Vietnam in accordance with Circular 80?

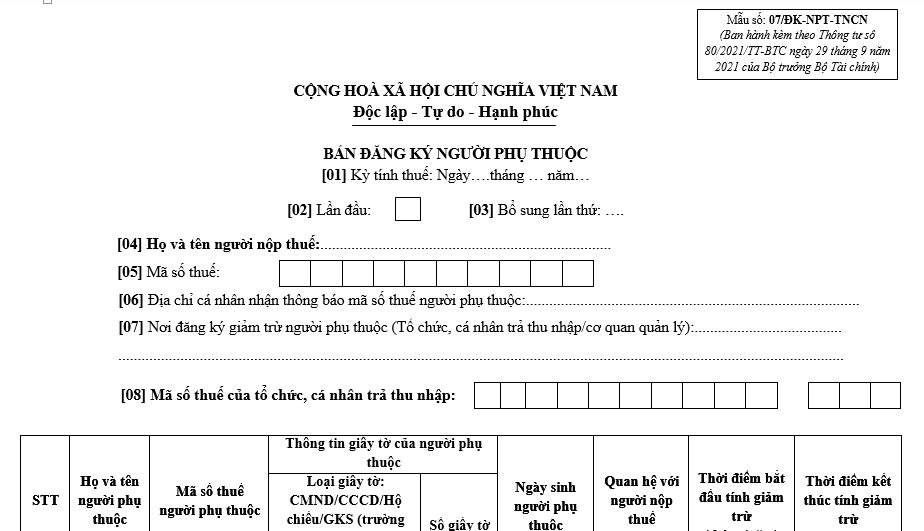

Pursuant to Form 07/DK-NPT-TNCN Appendix 2 of the List of Tax Declaration Dossiers issued with Circular 80/2021/TT-BTC, the dependent registration form in Vietnam is prescribed as follows:

Download Form 07/DK-NPT-TNCN Dependent Registration Form According to Circular 80

What are details of Form 07/DK-NPT-TNCN for registration of dependents in Vietnam in accordance with Circular 80? (Image from the Internet)

What does application for registration of dependents in Vietnam include?

Pursuant to Subsection 3, Section 3 of Official Dispatch 883/TCT-DNNCN in 2022, the provisions are as follows:

III. PERSONAL DEDUCTIONS

...

3. Personal deduction files for dependents

a) For individuals submitting dependent registration documents directly at the tax office, the dossier includes:

+ Dependent registration form according to Form 07/DK-NPT-TNCN issued with Appendix II, Circular No. 80/2021/TT-BTC dated September 29, 2021, by the Ministry of Finance.

+ Documents proving dependents as guided at point g, Clause 1, Article 9 of Circular No. 111/2013/TT-BTC dated August 15, 2013, by the Ministry of Finance.

+ In case the dependent is directly fostered by the taxpayer, it is necessary to obtain confirmation from the People's Committee of the commune/ward where the dependent resides according to Form 07/XN-NPT-TNCN issued with Appendix II, Circular No. 80/2021/TT-BTC dated September 29, 2021, by the Ministry of Finance.

b) In the case of individuals registering for personal deductions for dependents through an organization or individual paying income, the individual submits the dependent registration dossier as guided at point a, Clause 3, Section III of this official dispatch to the organization or individual paying income. The organization or individual paying income compiles according to the Appendix Summary Table of Dependent Registration for Personal Deductions Form 07/THDK-NPT-TNCN issued with Appendix II, Circular No. 80/2021/TT-BTC dated September 29, 2021, by the Ministry of Finance and submits to the tax authority as prescribed.

Thus, the application for registration of dependents in Vietnam includes the following documents:

[1] For individuals submitting dependent registration documents directly at the tax office

- Dependent registration form

- Documents proving dependents

Note: In the case the dependent is directly fostered by the taxpayer, it is necessary to obtain confirmation from the People's Committee of the commune/ward where the dependent resides.

[2] For individuals registering for personal deductions for dependents through an organization or individual paying income

- Dependent registration form

- Documents proving dependents

Note: In the case the dependent is directly fostered by the taxpayer, it is necessary to obtain confirmation from the People's Committee.

- Summary table of dependent registration for personal deductions.

How many dependents can a person have when calculating personal deductions in Vietnam?

Pursuant to point c, clause 1, Article 9 of Circular 111/2013/TT-BTC, relevant content related to personal income tax for individuals doing business in this Article is annulled by clause 6, Article 25 of Circular 92/2015/TT-BTC, stipulating deductions as follows:

Article 9. Deductions

- Personal deductions

c) Principles for calculating personal deductions

c.2) Personal deductions for dependents

c.2.1) A taxpayer is entitled to personal deductions for dependents if the taxpayer has registered taxpayer registration and been issued a tax code.

c.2.2) When a taxpayer registers for personal deductions for dependents, the tax authority issues a tax code for the dependents and the taxpayer is provisionally entitled to deductions in the year from the time of registration. For dependents already registered for personal deductions before the effective date of this Circular, they continue to be deducted until being issued a tax code.

c.2.3) In the case a taxpayer has not calculated personal deductions for dependents in the tax year, it is permissible to calculate deductions for dependents from the month of arising nurturing obligations when the taxpayer finalizes the tax return and registers for deductions for dependents. Particularly for other dependents as guided in subsection d.4, point d, clause 1, this Article, the deadline for registering deductions is no later than December 31 of the tax year; beyond this deadline, deductions for the tax year are not allowed.

c.2.4) Each dependent can only be counted once for deduction by one taxpayer in the tax year. In cases where multiple taxpayers have the same dependent, they must mutually agree on who will register the deduction.

[...]

According to the above regulations, the law stipulates that each dependent can only be counted once for deduction by one taxpayer in the tax year.

In cases where multiple taxpayers have the same dependent, they must mutually agree on who will register the deduction.

Thus, a taxpayer can have many dependents. Conversely, each dependent can only be counted once for deduction by one taxpayer in the tax year.