What are details of Form 05-DK-TCT used to make application for tax registration in Vietnam under Circular 105? What is detailed guidance on filling out the form?

What are details of Form 05-DK-TCT used to make application for tax registration in Vietnam under Circular 105? What is detailed guidance on filling out the form?

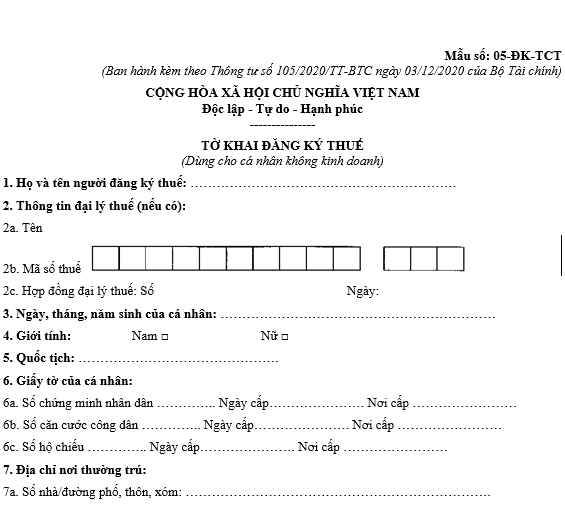

According to Appendix 2 of the list of forms issued together with Circular 105/2020/TT-BTC which stipulates the Form 05-DK-TCT used to make application for tax registration in Vietnam

Download Form 05-DK-TCT used to make application for tax registration in Vietnam under Circular 105

* Instructions for completing Form 05-DK-TCT

-

Full name of the taxpayer: Clearly write the full name of the taxpayer in uppercase letters.

-

Tax agent information: Fully enter information about the tax agent in case the tax agent contracts with the taxpayer to perform taxpayer registration procedures on behalf of the taxpayer according to the provisions of the Tax Management Law.

-

Date of birth of the individual: Clearly enter the date, month, and year of birth of the taxpayer.

-

Gender: Tick one of the two boxes Male or Female.

-

Nationality: Clearly enter the nationality of the taxpayer.

-

Individual’s identification documents: Fully enter the information on the individual's identification documents according to the regulations in this Circular.

-

Permanent address: Fully enter information about the permanent address of the individual as recorded in the household registration book or in the national population database.

-

Current address: Fully enter information about the current residential address of the individual (only enter if this address differs from the permanent address).

-

Contact phone number, email: Enter the phone number and email address (if any).

-

Income-paying organization at the time of taxpayer registration: Enter the income-paying organization at which the taxpayer is currently working at the time of taxpayer registration (if any).

-

Tax agent employee: In case the tax agent declares on behalf of the taxpayer, enter this information.

What are details of Form 05-DK-TCT used to make application for tax registration in Vietnam under Circular 105? What is detailed guidance on filling out the form? (Image from the Internet)

Where do non-business individuals submit their application for tax registration in Vietnam?

Based on Article 32 of the Law on Tax Administration 2019 which stipulates the receiving authorities for application for tax registration in Vietnam:

Article 32. Receiving authorities

1. Taxpayers registering alongside business registration, cooperative registration, or business operation registration shall submit their application for tax registration at the location where they submit their business registration, cooperative registration, or business operation registration files according to the provisions of the law.

2. Taxpayers registering directly with tax authorities shall submit their application for tax registration at the locations specified as follows:

a) Organizations, business households, and business individuals shall submit their application for tax registration at the tax authority where the organization, business household, or business individual is headquartered;

b) Organizations and individuals responsible for withholding and paying taxes on behalf of taxpayers shall submit their application for tax registration at the tax authority managing the withholding organization or individual;

c) Households and individuals not engaged in business shall submit their application for tax registration at the tax authority of the location where taxable income arises, where they register their permanent residence, or where they register their temporary residence, or where their obligations to the state budget arise.

3. Individuals authorizing organizations or individuals to pay income to register for taxpayer registration on behalf of themselves and their dependents shall submit their application for tax registration through the organization or individual paying income. The organization or individual paying income is responsible for compiling and submitting application for tax registration on behalf of the individuals to the tax authority directly managing the organization or individual paying the income.

According to the above regulations, non-business individuals submit their application for tax registration at the tax authority of the location where taxable income arises, where they register their permanent residence, or where they register their temporary residence, or where their obligations to the state budget arise.

What information is included in the taxpayer registration certificate in Vietnam?

Based on Article 34 of the Law on Tax Administration 2019 which stipulates that the taxpayer registration certificate includes the following information:

- Name of the taxpayer

- Tax identification number

- Number, date, month, and year of the business registration certificate or establishment and operation license or investment registration certificate for organizations and business individuals

- Number, date, month, and year of the establishment decision for organizations not subject to business registration

- Information on the identity card, citizen identification card, or passport for individuals not subject to business registration

- Tax authority managing the taxpayer directly