What are details of Form 02/DK-TDT - Application form for change or addition to the information registered for e-tax transactions in Vietnam?

What are details of Form 02/DK-TDT - Application form for change or addition to the information registered for e-tax transactions in Vietnam?

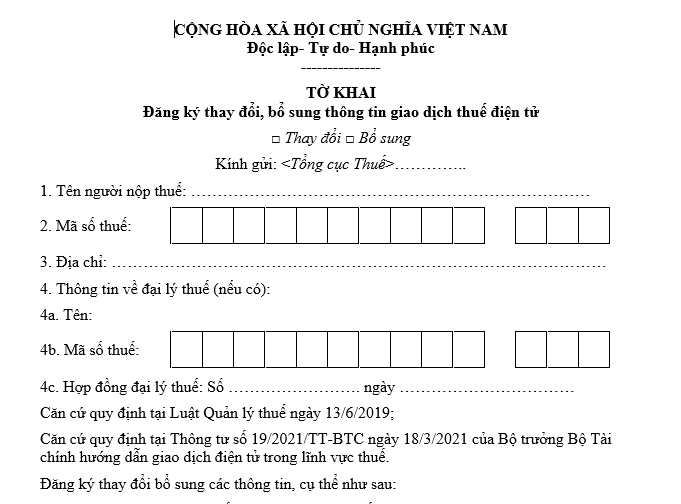

Based on Form 02/DK-TDT from the List of Forms issued along with Circular 19/2021/TT-BTC, the Application form for change or addition to the information registered for e-tax transactions in Vietnam is stipulated as follows:

Download Form 02/DK-TDT Application form for change or addition to the information registered for e-tax transactions in Vietnam

What are details of Form 02/DK-TDT - Application form for change or addition to the information registered for e-tax transactions in Vietnam? (Image from the Internet)

Where do taxpayers in Vietnam register changes and additions to e-transaction information?

Based on Article 11 of Circular 19/2021/TT-BTC stipulating registration for changes and additions to e-transaction information in Vietnam:

Article 11. Registration for changes and additions to e-transaction information

1. Taxpayers who have been granted an electronic tax transaction account according to the provisions of Article 10 of this Circular, if there is a change or addition to the registered electronic tax transaction information with the tax authority, are responsible for promptly updating the information immediately upon any changes. Taxpayers will access the electronic portal of the General Department of Taxation to update, change, and add the registered electronic tax transaction information with the tax authority (according to Form 02/DK-TDT issued with this Circular), electronically sign and send it to the tax authority.

No later than 15 minutes from the receipt of taxpayer's change or addition information, the electronic portal of the General Department of Taxation will send a notification (according to Form 03/TB-TDT issued with this Circular) regarding the acceptance or rejection of the change or addition information to the taxpayer.

2. Taxpayers who have registered transactions with the tax authority using electronic methods through the electronic portal of a competent state authority, if there is a change or addition to the registered information, shall comply with the regulations of the competent state authority.

[...]

Taxpayers access the electronic portal of the General Department of Taxation to update, change, and add the registered electronic tax transaction information with the tax authority, electronically sign, and send it to the tax authority.

Do e-documents need to be signed in Vietnam?

Based on Article 8 of the Tax Administration Law 2019 stipulating e-transactions in taxation in Vietnam:

Article 8. E-transactions in taxation

1. Taxpayers, tax administration authorities, state management agencies, organizations, and individuals meeting the conditions for electronic transactions in the field of taxation must conduct electronic transactions with the tax administration authority in accordance with this Law and the law on electronic transactions.

2. Taxpayers who conduct electronic transactions in the field of taxation do not have to perform transactions using other methods.

3. The tax administration authority, when receiving and returning results of tax administrative procedures to taxpayers via electronic methods, must confirm the completion of the taxpayer's electronic transactions, ensuring the taxpayer's rights as stipulated in Article 16 of this Law.

4. Taxpayers must comply with the requirements of the tax administration authority as stated in electronic notifications, decisions, and documents as with paper notifications, decisions, and documents.

5. Electronic documents used in electronic transactions must be electronically signed in accordance with the law on electronic transactions.

6. Agencies and organizations that connect electronic information with the tax administration authority must use electronic documents during transactions with the tax administration authority; use electronic documents provided by the tax administration authority to resolve administrative procedures for taxpayers and must not require taxpayers to submit paper documents.

7. The tax administration authority organizes an electronic information system with the following responsibilities:

a) Guiding, assisting taxpayers, service providers related to electronic transactions in the field of taxation, banks, and relevant organizations to conduct electronic transactions in the field of taxation;

b) Building, managing, and operating a system for receiving and processing electronic tax data to ensure security, safety, confidentiality, and continuity;

[...]

According to the above regulations, electronic documents used in electronic transactions must be electronically signed in accordance with the law on electronic transactions.