What are details of Form 01/LPMB for the declaration of licensing fees in Vietnam and instructions for filling out the form according to Circular 80?

What are details of Form 01/LPMB for the declaration of licensing fees in Vietnam and instructions for filling out the form according to Circular 80?

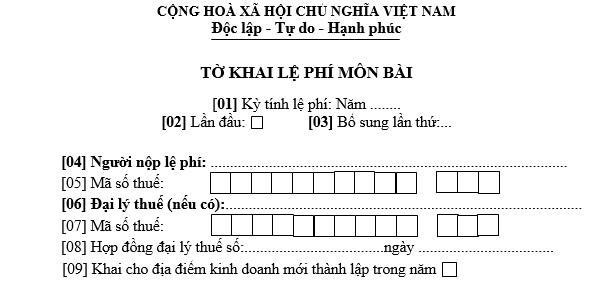

Based on Form 01/LPMB Appendix 2 of the List of Tax Declaration Forms issued together with Circular 80/2021/TT-BTC, the form for the declaration of licensing fees is as follows:

Download Form 01/LPMB declaration of licensing fees according to Circular 80.

Below are the instructions for writing the 2024 declaration of licensing fees, specifically:

- Indicator [01]: Declare the year for which the licensing fee is calculated.

- Indicator [02]: Tick if this is the first time declaring.

- Indicator [03]: Tick if the taxpayer (hereinafter referred to as TP and abbreviated as TP) has submitted the declaration but later found changes in the information of the declaration obligation and re-declared the information for the declared fee calculation period.

Note: TP must choose either one of the indicators [02] or [03], not both concurrently.

- Indicator [04] to Indicator [05]: Declare information according to the taxpayer registration of TP.

- Indicator [06] to Indicator [08]: Declare information of the tax agency (if any).

- Indicator [09]: Tick if TP has declared LPMB and subsequently established a new business location.

What are details of Form 01/LPMB for the declaration of licensing fees in Vietnam and instructions for filling out the form according to Circular 80? (Internet image)

Who is exempt from the licensing fee in Vietnam?

Based on Article 3 of Decree 139/2016/ND-CP amended and supplemented by Clause 1 Article 1 of Decree 22/2020/ND-CP regarding licensing fee exemptions:

Article 3. Licensing fee exemption

Cases eligible for licensing fee exemption include:

- Individuals, groups of individuals, households engaged in production and business activities with annual revenue of 100 million VND or less.

- Individuals, groups of individuals, households engaged in irregular production and business activities; without fixed business locations as guided by the Ministry of Finance.

- Individuals, groups of individuals, households engaged in salt production.

- Organizations, individuals, groups of individuals, households engaged in aquaculture, fishery, and fishing logistics services.

- Cultural postal points; press agencies (print, audio, visual, electronic).

[...]

Thus, entities exempt from licensing fees in Vietnam include:

- Individuals, groups of individuals, households engaged in production and business activities with annual revenue of 100 million VND or less.

- Individuals, groups of individuals, households engaged in irregular production and business activities; without fixed business locations as guided by the Ministry of Finance.

- Individuals, groups of individuals, households engaged in salt production.

- Organizations, individuals, groups of individuals, households engaged in aquaculture, fishery, and fishing logistics services.

- Cultural postal points; press agencies (print, audio, visual, electronic).

- Cooperatives, cooperative unions (including branches, representative offices, business locations) operating in the agricultural sector following the law on agricultural cooperatives.

- People's credit funds; branches, representative offices, business locations of cooperatives, cooperative unions, and private enterprises operating in mountainous areas. Mountainous areas are determined according to the regulations of the Committee for Ethnic Minority Affairs.

- Exemption from licensing fees in the first year of establishment or commencement of production/business activities (from January 1 to December 31) for:

+ Newly established organizations (issued with new tax identification numbers, new business registration).

+ Households, individuals, groups of individuals newly entering into production/business activities.

+ During the licensing fee exemption period, if organizations, households, individuals, groups of individuals establish branches, representative offices, business locations, such branches, representative offices, business locations are also exempt from licensing fees during the period the entities are exempt from licensing fees.

- Small and medium enterprises converting from household businesses (as regulated in Article 16 of the Law on Support for Small and Medium Enterprises 2017) are exempt from licensing fees for 3 years from the date of first business registration certificate issuance.

+ During the licensing fee exemption period, if small and medium enterprises establish branches, representative offices, business locations, they are also exempt from licensing fees during the period the enterprises are exempt from licensing fees.

+ Branches, representative offices, business locations of small and medium enterprises (eligible for licensing fee exemption according to Article 16 of the Law on Support for Small and Medium Enterprises 2017) established before February 25, 2020, have their licensing fee exemption period calculated from February 25, 2020, to the end of the period the enterprises are exempt from licensing fees.

+ Small and medium enterprises converted from household businesses before February 25, 2020, implement licensing fee exemption according to Articles 16 and 35 of the Law on Support for Small and Medium Enterprises 2017.

- Public secondary and pre-school educational institutions.

What are the principles of tax administration in Vietnam?

Based on Article 5 of the Tax Administration Law 2019, tax administration principles in Vietnam are regulated as follows:

- All organizations, households, business households, individuals are obligated to pay taxes as prescribed by law.

- Tax administration agencies, other State agencies assigned with the task of managing revenue implement tax administration in accordance with regulations, ensuring transparency, equality, and the protection of the lawful rights and interests of taxpayers.

- Agencies, organizations, and individuals have the responsibility to participate in tax administration according to the provisions of law.

- Implement reforms in administrative procedures and the application of modern information technology in tax administration; apply tax administration principles according to international practices, including the principle that the substance of activities and transactions determines tax obligations, the principle of risk administration in tax administration, and other principles suitable to the conditions in Vietnam.

- Apply priority measures when carrying out tax procedures for export and import goods according to the Customs Law and regulations of the Government of Vietnam.