What are details of Form 01/DK-TDT - application for registration for transactions with the tax authorities by electronic means in Vietnam?

What are details of Form 01/DK-TDT - application for registration for transactions with the tax authorities by electronic means in Vietnam?

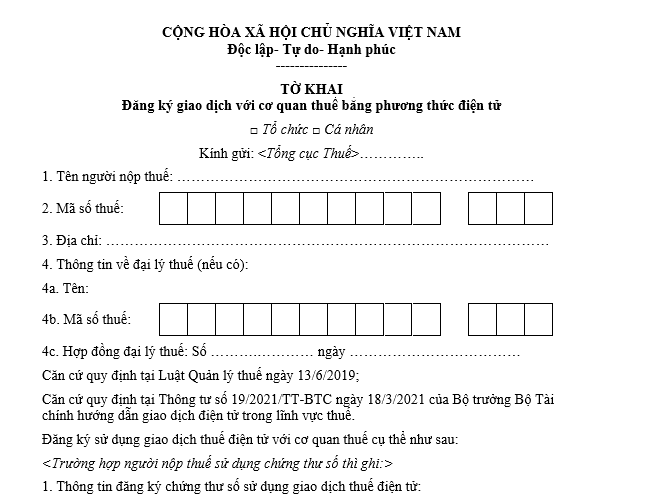

Based on Form 01/DK-TDT as listed in the catalog of forms issued with Circular 19/2021/TT-BTC which regulates the form of registration declaration for transactions with the tax authorities by electronic means:

Download Form 01/DK-TDT - Application for registration for transactions with the tax authorities by electronic means in Vietnam

What are details of Form 01/DK-TDT - application for registration for transactions with the tax authorities by electronic means in Vietnam? (Internet image)

When can taxpayers in Vietnam carry out electronic tax transactions?

Based on Article 8 of Circular 19/2021/TT-BTC which provides the method to determine the time for submission of electronic tax dossiers, electronic tax payment by taxpayers, and the time the tax authorities send notifications, decisions, documents to taxpayers:

Article 8. Method to determine the time of submission of electronic tax dossiers, electronic tax payment by taxpayers, and the time the tax authorities send notifications, decisions, documents to taxpayers

1. Time of submission of electronic tax dossiers, electronic tax payment

a) Taxpayers can carry out electronic tax transactions 24 hours a day (from 00:00:00 to 23:59:59) and 7 days a week, including weekends, holidays, and Tet. The time the taxpayer submits the dossier is determined as in the day if the dossier is successfully signed and sent from 00:00:00 to 23:59:59 of the day.

b) The time for confirming electronic tax dossier submission is determined as follows:

b.1) For electronic taxpayer registration dossiers: it is the date the tax authority's system receives the dossier and is recorded on the Electronic Taxpayer Registration Dossier Receipt Notification sent to the taxpayer (as per Form No. 01-1/TB-TDT issued with this Circular).

b.2) For tax declaration dossiers (except for tax declaration dossiers in cases where the tax management authority calculates the tax and issues a tax payment notice as stipulated in Article 13 of Decree No. 126/2020/ND-CP): it is the date the tax authority's system receives the dossier and is recorded on the Electronic Tax Declaration Dossier Receipt Notification sent to the taxpayer (as per Form No. 01-1/TB-TDT issued with this Circular) if the tax declaration is accepted by the tax authority as confirmed in the Electronic Tax Declaration Dossier Acceptance Notification sent to the taxpayer (as per Form No. 01-2/TB-TDT issued with this Circular).

[...]

Thus, taxpayers can carry out electronic tax transactions 24 hours a day (from 00:00:00 to 23:59:59) and 7 days a week, including weekends, holidays, and Tet.

Can taxpayers who have carried out electronic transactions use other transaction methods in Vietnam?

Based on Article 8 of the Tax Administration Law 2019 which regulates electronic transactions in the field of tax:

Article 8. Electronic transactions in the field of tax

1. Taxpayers, tax management authorities, state management agencies, organizations, and individuals who meet the conditions for carrying out electronic transactions in the tax field must conduct electronic transactions with the tax authorities in accordance with this Law and the laws on electronic transactions.

2. Taxpayers who have carried out electronic transactions in the tax field are not required to carry out other transaction methods.

3. When the tax management authority receives and provides results of tax administrative procedure resolution to taxpayers by electronic means, it must confirm the completion of the electronic transactions by taxpayers, ensuring the rights of taxpayers as stipulated in Article 16 of this Law.

4. Taxpayers must comply with the requirements of the tax management authority as stated in electronic notifications, decisions, and documents as they do with paper-based notices, decisions, and documents from the tax authority.

5. E-documents used in electronic transactions must be electronically signed in accordance with the laws on electronic transactions.

6. Agencies and organizations that have connected electronic information with the tax management authority must use E-documents in the process of conducting transactions with the tax management authority; use E-documents provided by the tax management authority to resolve administrative procedures for taxpayers and are not allowed to require taxpayers to submit physical documents.

[...]

According to the above regulations, taxpayers who have carried out electronic transactions in the tax field are not required to carry out other transaction methods.