What are details of Form 01-DK-TCT - application form for tax registration in Vietnam under Circular 105?

What are details of Form 01-DK-TCT - application form for tax registration in Vietnam under Circular 105?

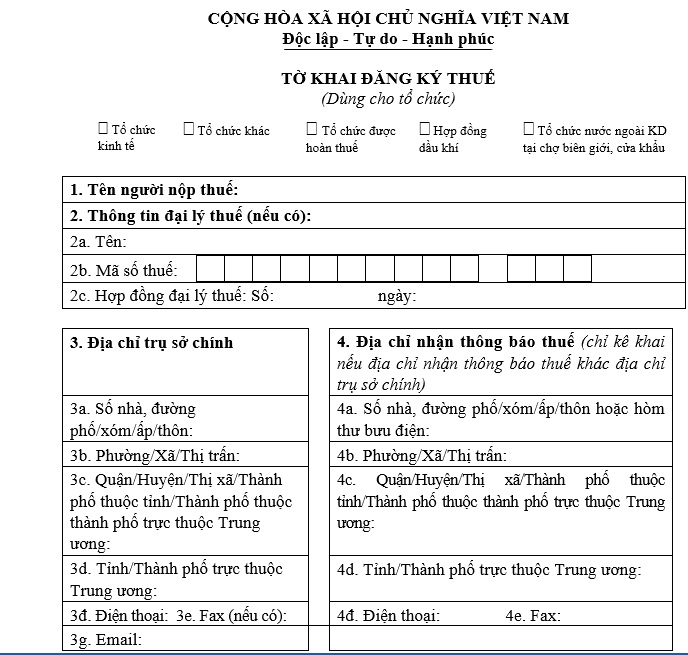

Based on Form 01-DK-TCT Appendix 2 List of forms issued together with Circular 105/2020/TT-BTC stipulating the application form for tax registration in Vietnam for organizations:

Download Form 01-DK-TCT application form for tax registration in Vietnam in accordance with Circular 105

Note: The taxpayer must select one of the appropriate boxes before declaring the detailed information. To be specific:

- “Economic organization”

- “Other organization”

- “Tax refund organization”

- “Petroleum contract”

- “Foreign organization doing business at border markets, border gates”

What are details of Form 01-DK-TCT - application form for tax registration in Vietnam under Circular 105? (Image from the Internet)

What documents are included in the application for first-time tax registration of the organization?

Based on Article 31 of the Law on Tax Administration 2019 stipulating the application for first-time tax registration as follows:

Article 31. Application for first-time tax registration

1. Taxpayers registering for taxpayer registration together with enterprise registration, cooperative registration, and business registration shall use the enterprise registration, cooperative registration, and business registration dossier as the Application for tax registration in accordance with the law.

2. Taxpayers who are organizations registering directly with the tax authority shall use the following Application for tax registration:

a) application form for tax registration in Vietnam;

b) A copy of the establishment and operation license, establishment decision, investment registration certificate, or other equivalent documents issued by the competent authority that are still valid;

c) Other relevant documents.

3. Taxpayers who are households, household businesses, and individuals registering directly with the tax authority shall use the following Application for tax registration:

a) application form for tax registration in Vietnam or tax declaration form;

b) A copy of the identity card, a copy of the citizen identification card, or a copy of the passport;

c) Other relevant documents.

4. The connection of information between state management agencies and tax authorities to receive tax registration dossiers and issue tax codes through the one-stop-shop mechanism via the electronic portal shall be implemented in accordance with relevant laws.

Thus, the application for first-time tax registration for organizations registering directly with the tax authority includes the following documents:

- application form for tax registration in Vietnam- A copy of the establishment and operation license, establishment decision, investment registration certificate, or other equivalent documents issued by the competent authority that are still valid- Other relevant documents

Where do organizations submit their application for first-time tax registration in Vietnam?

Based on Article 32 of the Law on Tax Administration 2019 stipulating the locations for submitting the application for first-time tax registration in Vietnam:

Article 32. Locations for submitting the application for first-time tax registration

1. Taxpayers registering for taxpayer registration together with enterprise registration, cooperative registration, and business registration shall submit the tax registration dossier at the location stipulated for submitting the enterprise registration, cooperative registration, and business registration dossier according to the law.

2. Taxpayers registering directly with the tax authority shall submit the tax registration dossier at the following locations:

a) Organizations, household businesses, and individual businesses shall submit the tax registration dossier at the tax authority where such organizations, household businesses, and individual businesses are based;

b) Organizations and individuals responsible for withholding and paying taxes on behalf of others shall submit the tax registration dossier at the tax authority managing such organizations and individuals;

c) Non-business households and individuals shall submit the tax registration dossier at the tax authority where taxable income arises, where they have permanent residence registration, where they have temporary residence registration, or where they have obligations with the state budget.

3. Individuals authorizing organizations or individuals paying income on their behalf and their dependents shall submit the tax registration dossier through the organizations or individuals paying income. The organizations or individuals paying income are responsible for consolidating and submitting the tax registration dossiers on behalf of individuals to the tax authority managing such income-paying organizations or individuals.

According to the above regulations, organizations registering directly with the tax authority shall submit their application for first-time tax registration at the tax authority where such organizations are based.