What are cases of applying 50% reduction to non-agricultural land use tax in Vietnam?

What are cases of applying 50% reduction to non-agricultural land use tax in Vietnam?

Based on Article 10 of the Law on on Non-Agricultural Land Use Tax 2010, cases of applying 50% reduction to non-agricultural land use tax in Vietnam include:

- Land of investment projects in sectors encouraged for investment; investment projects in areas with difficult socio-economic conditions; land of enterprises using 20% to 50% of their workforce as war invalids and sick soldiers.

- Residential land within the limit in areas with difficult socio-economic conditions.

- Residential land within the limit of 3/4 and 4/4 rank war invalids; individuals receiving policies similar to 3/4 and 4/4 rank war invalids; 2/3 and 3/3 rank sick soldiers; children of martyrs not receiving monthly allowance.

- Taxpayers experiencing difficulties due to force majeure events if the damage value to the land and house on the land ranges from 20% to 50% of the taxable value.

What are cases of applying 50% reduction to non-agricultural land use tax in Vietnam? (Image from the Internet)

Who is not liable to non-agricultural land use tax in Vietnam?

Based on Article 3 of Decree 53/2011/ND-CP, the objects not liable to tax are:

Article 3. Objects not liable to tax

Non-agricultural land not used for business purposes as stipulated in Article 3 of the Law on Non-Agricultural Land Use Tax is exempt from tax, specifically:

1. Land used for public purposes including:

a) Land for transportation and irrigation, including land used for the construction of traffic works, bridges, culverts, sidewalks, railways, land for building airport and seaport infrastructure, including land planned for airport and seaport construction but not yet built due to phased investment approved by competent state authorities, land for water supply systems (excluding water production plants), sewage systems, irrigation works, dikes, dams, and land within the safety protection corridors for traffic, and irrigation.

b) Land for cultural, health, education and training, sports works serving public interests, including land used for kindergartens, schools, hospitals, markets, parks, flower gardens, children's playgrounds, squares, cultural works, commune, ward, or commune-level town post and cultural points, monuments, memorial tablets, museums, rehabilitation facilities for the disabled, vocational training centers, drug detoxification centers, reformatories, dignity rehabilitation centers, and nursery homes for elderly people and children in difficult circumstances.

...

Thus, non-agricultural land not serving business purposes is not liable to non-agricultural land use tax in Vietnam. To be specific:

[1] Land used for public purposes including:

- Land for transportation and irrigation including:

+ Land used for the construction of traffic works, bridges, culverts, sidewalks, railways.

+ Land for airport and seaport infrastructure, including land planned for airport and seaport construction but not yet built due to phased investment approved by competent state authorities.

+ Land for water supply systems (excluding water production plants), sewage systems, irrigation works, dikes, dams.

+ Land within the safety protection corridors for traffic and irrigation.

- Land for cultural, health, education and training, sports works serving public interests including:

+ Land used for kindergartens, schools, hospitals, markets, parks, flower gardens, children's playgrounds, squares, cultural works, commune, ward, or commune-level town post and cultural points, monuments, memorial tablets, museums, rehabilitation facilities for the disabled, vocational training centers, drug detoxification centers, reformatories, dignity rehabilitation centers.

+ Nursery homes for elderly people and children in difficult circumstances.

- Land with ranked historical-cultural relics, scenic spots or protected by provincial, city-level People's Committees.

- Land for other public works including:

+ Land for public purposes in urban areas and rural residential areas.

+ Land for common infrastructure in industrial parks, high-tech zones, and economic zones as planned by competent authorities.

+ Land for constructing power lines, communication networks, fuel, oil, and gas pipelines.

+ Land within the protection corridors of the above works.

+ Land for electricity substations, hydroelectric dams, and reservoirs.

+ Land for funeral homes and crematoriums.

+ Land for solid waste disposal sites, landfills, and waste treatment areas approved by competent state authorities.

[2] Land used by religious establishments including land of temples, churches, shrines, monasteries, religious schools, headquarters of religious organizations, and other religious facilities authorized by the State.

[3] Land for cemeteries and graveyards.

[4] Land under rivers, canals, streams, and specialized water surfaces.

[5] Land with worship structures such as communal houses, temples, shrines, family worship houses, including the land area of the parcel where such structures are built.

[6] Land used for the headquarters of state agencies, public non-business units, and for building representative offices of diplomatic missions, consular offices of foreign countries in Vietnam, and intergovernmental international organizations enjoying similar privileges and immunities.

[7] Land used for defense and security purposes including:

- Land for barracks and military headquarters.

- Land for military bases.

- Land for constructing national defense structures, and special defense and security works.

- Land for military ports and stations.

- Land for industrial, scientific, and technological works directly serving defense and security.

- Land for warehouses of armed forces units.

- Land for firing ranges, training grounds, weapon testing grounds, and weapon destruction areas.

- Land for guesthouses, public housing, sports facilities, and other facilities within the barracks and headquarters of armed forces units.

- Land for prisons, detention centers, temporary detention houses, and educational facilities managed by the Ministry of National Defense, and Ministry of Public Security.

- Land for constructing combat, operational, and defense security works as prescribed by the Government of Vietnam.

[8] Non-agricultural land used for constructing cooperative facilities serving in fields of agricultural production, forestry, aquaculture, and salt production.

Land in urban areas used for constructing greenhouses and other types of houses for cultivation, including various forms of cultivation not directly on the land.

Land for constructing livestock and poultry pens and other types of animal huts permitted by law.

Land for constructing stations, and agricultural, forestry, and fisheries research and experimental estates.

Land for constructing plant nurseries, and breeding facilities.

Land for constructing warehouses and houses of households and individuals to store agricultural products, pesticides, fertilizers, machinery, and agricultural production tools.

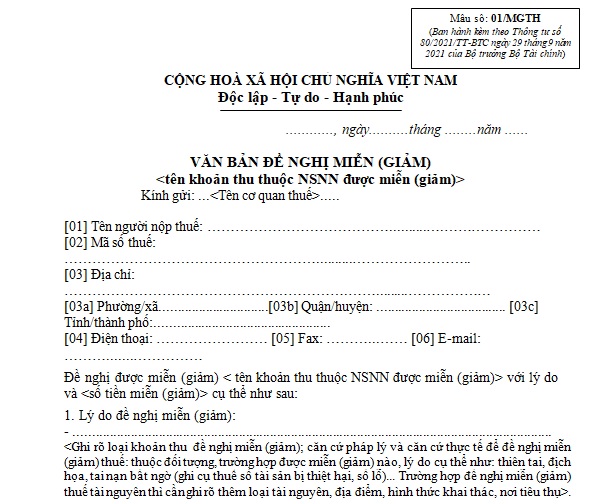

What are details of form of application for exemption or reduction of non-agricultural land use tax in Vietnam according to Circular 80?

Based on Form No. 01/MGTH Appendix 1 issued with Circular 80/2021/TT-BTC, the form of application for exemption or reduction of non-agricultural land use tax in Vietnam is as follows:

Download the form of application for exemption or reduction of non-agricultural land use tax in Vietnam according to Circular 80.