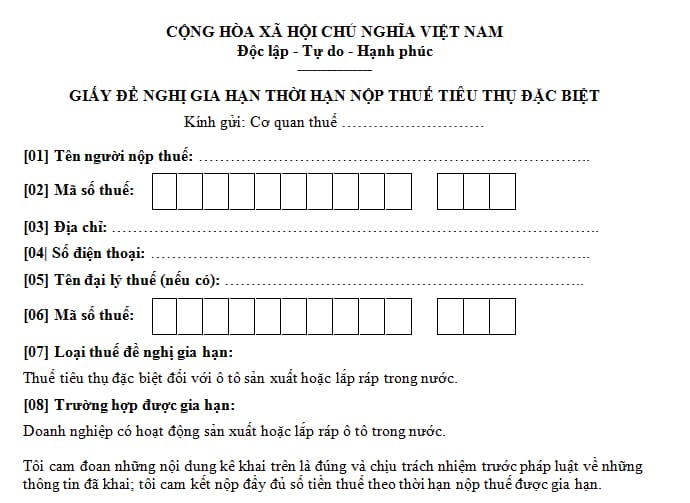

Template for Requesting Extension of Special Consumption Tax Payment Deadline, Latest for 2024

Application Form for Extending the Deadline for Paying Excise Tax 2024

Which entities are subject to excise tax?Latest Special Consumption Tax Payment Extension Request Form for 2024

Based on the Appendix issued together with Decree 65/2024/ND-CP, the form for requesting an extension of the special consumption tax payment deadline is as follows:

Download the form for requesting an extension of the special consumption tax payment deadline

Latest special consumption tax payment extension request form for 2024 (Image from the Internet)

Who is subject to the special consumption tax?

Based on Article 2 Law on Special Consumption Tax 2008 amended by Clause 1 Article 1 Amended Law on Special Consumption Tax 2014, the subjects to tax are defined as follows:

Article 2. Subjects to tax

- Goods:

a) Tobacco products, cigars, and other products processed from tobacco used for smoking, inhaling, chewing, snuffing, sucking;

b) Alcohol;

c) Beer;

d) Automobiles with less than 24 seats, including those that can be used both for carrying people and goods with two rows of seats or more, with a fixed partition between the passenger compartment and the cargo compartment;

e) Motorcycles with cylinder capacities of over 125cm3;

f) Aircraft, yachts;

[...]

Thus, the subjects to the special consumption tax include:

[1] Goods

- Tobacco products, cigars, and other products processed from tobacco used for smoking, inhaling, chewing, snuffing, sucking- Alcohol- Beer- Automobiles with less than 24 seats, including those that can be used both for carrying people and goods with two rows of seats or more, with a fixed partition between the passenger compartment and the cargo compartment- Motorcycles with cylinder capacities of over 125cm3- Aircraft, yachts- Various types of gasoline- Air conditioners with a capacity of 90,000 BTU or less- Playing cards- Votive papers, votive products

[2] Services

- Nightclub business- Massage, karaoke business- Casino business; electronic games with prizes including jackpot machines, slot machines, and similar types of machines- Betting business- Golf business including membership cards, golf playing tickets- Lottery business

When is the deadline for special consumption tax payment incurred for September 2024?

Based on Article 3 Decree 65/2024/ND-CP, the extension of tax payment deadlines is prescribed as follows:

Article 3. Extension of tax payment deadlines

- The extension of tax payment deadlines for special consumption tax payable arising from the tax periods of May, June, July, August, and September 2024 for automobiles produced or assembled domestically. The extension period is from the end of the tax payment deadline prescribed by tax management laws to November 20, 2024. Specifically:

a) The deadline for special consumption tax payable arising from the tax period of May 2024 is no later than November 20, 2024.

b) The deadline for special consumption tax payable arising from the tax period of June 2024 is no later than November 20, 2024.

c) The deadline for special consumption tax payable arising from the tax period of July 2024 is no later than November 20, 2024.

d) The deadline for special consumption tax payable arising from the tax period of August 2024 is no later than November 20, 2024.

e) The deadline for special consumption tax payable arising from the tax period of September 2024 is no later than November 20, 2024.

- Regulations for certain cases:

a) In the case where taxpayers submit additional tax returns for tax periods that are eligible for an extension, resulting in an increase in special consumption tax payable and submit them to the tax authorities before the extended tax payment deadline, the extended tax amount includes the additional tax payable due to the additional declaration.

b) In the case where taxpayers eligible for the extension perform tax declaration and submission of special consumption tax returns as per current regulations, they are not required to pay the special consumption tax payable arising from the declared special consumption tax return within the extension period.

[...]

Thus, the latest deadline for special consumption tax payable arising from the tax period of September 2024 for domestically produced or assembled automobiles is November 20, 2024.