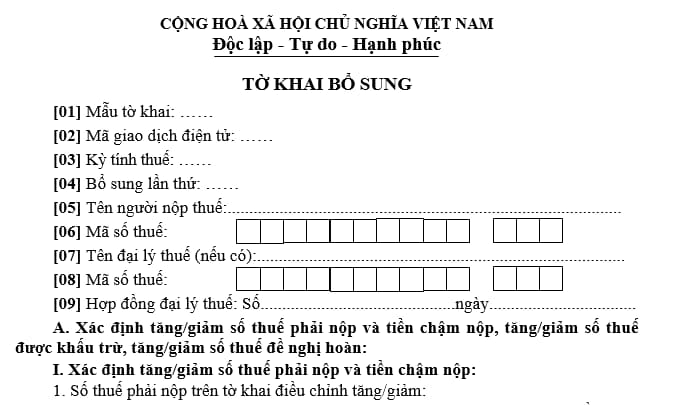

Form 01/KHBS supplementary tax return declaration for the latest tax file in 2024

Form 01/KHBS Supplemental Tax Filing Dossier Updated for 2024

Question: What is the latest form for Supplemental Tax Filing Dossier Form 01/KHBS in 2024? What is the deadline for filing a supplemental tax dossier in case the taxpayer discovers errors?Answer:The Supplemental Tax Filing Dossier Form 01/KHBS has been updated for 2024 to assist taxpayers in the event they need to correct errors in their tax filings. The deadline for submitting a supplemental tax filing dossier is determined based on the nature and timing of the error detection, following the guidelines specified in the relevant tax regulations and decrees.Form 01/KHBS Latest Supplemental Tax Declaration Form for 2024?

Pursuant to Appendix 2, List of Tax Declaration Dossiers issued together with Circular 80/2021/TT-BTC prescribing the supplemental tax declaration dossier as follows:

Download Form 01/KHBS Latest Supplemental Tax Declaration Form for 2024

Note:

* Information <…> is only an example.

* Indicator [01]: The form symbol of the supplemental tax declaration form.

* Indicator [02]: The electronic transaction code of the initial tax declaration that needs supplements or adjustments.

* Indicator [04]: The ordinal number of the supplemental tax declaration compared to the initial tax declaration that has been accepted by the tax authority.

* Indicator A: Determine the payable tax amount, late payment interest (if any), deductible tax amount, or the amount requested for an increased/decreased refund between the supplemental tax declaration and the immediately preceding period declaration that has been submitted and accepted by the tax authority, for example:

- First supplemental declaration: The difference between the first supplemental declaration and the initial declaration of the tax period;

- Second supplemental declaration: The difference between the second supplemental declaration and the first supplemental declaration of the tax period.

- Indicator [10] +[11] = Indicator [07] Appendix 01-1/KHBS.

- Indicator [12] = Indicator [08] Appendix 01-1/KHBS.

- Indicator [13] = Indicator [09] Appendix 01-1/KHBS.

* Indicator B: Recovered tax refunds and late payment interest (if any): Taxpayers declare when they discover that the tax amount refunded is not compliant with laws.

- Recovered refund amount: The difference between the supplemental declaration and the immediately preceding period declaration, for example:

+ First supplemental declaration: The difference between the first supplemental declaration and the initial declaration of the tax period;

+ Second supplemental declaration: The difference between the second supplemental declaration and the first supplemental declaration of the tax period.

- Information on Refund Decisions, Refund Orders following the tax refund amounts. In cases where there are multiple Decisions, Orders refunding, declare multiple lines corresponding to each recovered refund amount.

Form 01/KHBS Latest Supplemental Tax Declaration Form for 2024? (Image from the Internet)

Deadline for Supplemental Tax Declaration in the Event of Errors Detected by Taxpayers

Pursuant to Article 47 Law on Tax Administration 2019 stipulating the supplemental tax declaration:

Supplemental Tax Declaration

1. Taxpayers who discover that the filed tax declaration dossier has errors are allowed to submit a supplemental tax declaration within 10 years from the date of the deadline for submission of the tax declaration dossier for the mistaken tax period but before the tax authority or a competent authority announces a decision on inspection or audit.

- When the tax authority or a competent authority has announced a decision on tax inspection or audit at the taxpayer's premises, the taxpayer is still allowed to submit a supplemental tax declaration; the tax authority shall impose administrative penalties for tax enforcement violations as stipulated in Articles 142 and 143 of this Law.

- After the tax authority or a competent authority has issued a conclusion or decision on tax settlement following the inspection or audit at the taxpayer's premises, the following provisions shall apply for supplemental tax declarations:

a) Taxpayers are allowed to submit a supplemental tax declaration to increase the payable tax amount, decrease the deductible tax amount, or decrease the exempted, reduced, or refunded tax amount and shall be penalized for administrative violations as stipulated in Articles 142 and 143 of this Law;

b) In cases where taxpayers discover errors in the tax declaration dossier that, if amended, would reduce the payable tax amount or increase the deductible tax amount, increase the exempted, reduced, or refunded tax amount, they must follow the regulations on tax appeals.

...

According to the above regulation, the deadline for submitting a supplemental tax declaration in the event that the taxpayer discovers errors in the tax declaration dossier submitted to the tax authority is 10 years from the date of the deadline for submission of the tax declaration dossier for the mistaken tax period but before the tax authority or a competent authority announces a decision on inspection or audit.

Deadline for Tax Payment in the Event of a Supplemental Tax Declaration

Pursuant to Article 55 Law on Tax Administration 2019 stipulating the tax payment deadline:

Tax Payment Deadline

- Where taxpayers calculate the tax, the tax payment deadline shall be the latest on the last day of the deadline for submission of the tax declaration dossier. In cases of a supplemental tax declaration, the tax payment deadline shall be the deadline for submission of the tax declaration dossier for the mistaken tax period.

In the case of corporate income tax, provisional tax payments shall be made on a quarterly basis, with the latest deadline being the 30th of the first month of the following quarter.

For crude oil, the tax payment deadline for natural resource tax and corporate income tax per sale shipment is 35 days from the date of sale for domestic sales or from the date of customs clearance for exports following the laws on customs for exported crude oil.

For natural gas, the tax payment deadline for natural resource tax and corporate income tax is monthly.

- In cases where the tax authority calculates the tax, the tax payment deadline shall be the deadline specified in the tax authority’s notification.

...

Thus, the tax payment deadline in the event of a supplemental tax declaration is the deadline for submission of the tax declaration dossier for the mistaken tax period.