Form 01/DK-TDKTT Request for Changing the Tax Period from Month to Quarter according to Circular 80

Form 01/DK-TDKTT - Request Document for Changing Tax Period from Monthly to Quarterly According to Circular 80?

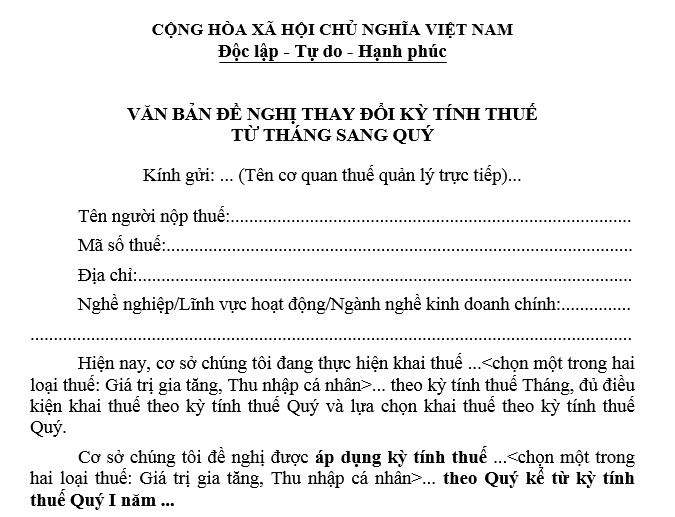

Based on Form 01/DK-TDKTT issued together with Circular 80/2021/TT-BTC, the document format for requesting a change in the tax period from monthly to quarterly is as follows:

Download the form for requesting a change in the tax period from monthly to quarterly.

Form 01/DK-TDKTT - Request document for changing the tax period from monthly to quarterly according to Circular 80? (Image from the Internet)

When is the deadline to submit tax declarations for quarterly tax calculations?

Based on Article 44 of the Tax Administration Law 2019, the deadline for submitting tax declarations is defined as follows:

Article 44. Deadline for submitting tax declarations

- The deadline for submitting tax declarations for taxes declared monthly or quarterly is specified as follows:

a) No later than the 20th of the following month for monthly tax declarations;

b) No later than the last day of the first month of the following quarter for quarterly tax declarations.

- The deadline for submitting tax declarations for taxes with an annual tax period is specified as follows:

a) No later than the last day of the third month from the end of the calendar year or fiscal year for annual tax statements; no later than the last day of the first month of the calendar year or fiscal year for annual tax declarations;

b) No later than the last day of the fourth month from the end of the calendar year for personal income tax statements directly settled by individuals;

c) No later than December 15 of the preceding year for tax declarations of business households and individual businesses taxed according to the flat-rate method; in cases where business households or individual businesses are newly established, the deadline for submitting the flat-rate tax declaration is no later than 10 days from the start of the business.

[...]

Thus, the deadline for submitting tax declarations for taxes declared quarterly is no later than the last day of the first month of the following quarter in which the tax obligation arises.

What rights do taxpayers have?

Based on Article 16 of the Tax Administration Law 2019, the rights of taxpayers are defined as follows:

- To receive support and guidance in fulfilling tax obligations; to provide information and documents to fulfill tax obligations and rights.

- To receive documents related to tax obligations from competent authorities during inspections, audits, and audits.

- To request tax authorities to explain tax calculations and tax assessments; to request verification of exported or imported goods quantity, quality, and type.

- To keep information confidential, except for information required to be provided to competent state agencies or publicly disclosed following the law.

- To enjoy tax incentives and tax refunds according to the tax laws; to know the deadline for tax refunds, the amount of non-refundable tax, and the legal basis for any non-refundable tax amount.

- To sign contracts with businesses offering tax procedure services, customs agents to perform tax agent services and customs procedures.

- To receive tax handling decisions, tax audit reports, inspection reports; to request explanations of tax handling decisions; to reserve opinions in tax audit and inspection reports; to receive tax inspection and audit conclusions and post-inspection/audit handling decisions from tax authorities.

- To be compensated for damages caused by tax authorities and tax officials following the law.

- To request tax authorities to certify the fulfillment of their tax obligations.

- To complain and file lawsuits against administrative decisions, administrative actions related to their legitimate rights and interests.

- Not to be subject to administrative penalties for tax violations, not to incur late payment interest if the taxpayer complies with written guidance and handling decisions of tax authorities and competent state agencies related to determining the taxpayer's tax obligations.

- To report violations of the law by tax officials and other organizations and individuals under the law on denunciations.

- To access, review, and print all electronic documents they have sent to the tax authorities' electronic portals following this Law and the law on electronic transactions.

- To use electronic documents in transactions with tax authorities and related agencies and organizations.