Cases exempted from real estate licesing fees in Vietnam in 2025

What cases are exempted from real estate licesing fees in Vietnam in 2025?

Based on Article 10 of Decree 10/2022/ND-CP stipulating exemption from licensing fees:

Article 10. Exemption from licensing fees

- Houses and land used as the headquarters of Diplomatic missions, Consulates, and Representative offices of international organizations under the United Nations system, and houses of the heads of these entities in Vietnam.

- Assets (excluding houses and land) belonging to the following foreign organizations and individuals:

a) Diplomatic missions, Consulates, and Representative offices of international organizations under the United Nations system.

b) Diplomatic officials, consular officers, and administrative-technical staff of Diplomatic missions, Consulates, and members of Representatives of international organizations under the United Nations system, and members of their families who are not Vietnamese citizens or not residing permanently in Vietnam, granted diplomatic or official identity cards by the Ministry of Foreign Affairs of Vietnam.

c) Foreign organizations and individuals not covered by point a and point b in this section but exempted or not liable to pay licensing fees according to international commitments to which the Socialist Republic of Vietnam is a member.

[...]

The cases exempt from licensing fees for real estate in 2025 include:

- Houses and land used as the headquarters of Diplomatic missions, Consulates, and Representative offices of international organizations under the United Nations system, and houses of the heads of these entities in Vietnam.

- Land allocated or leased by the State with a one-time land rent payment for the entire lease period for the following purposes:

+ Use for public purposes according to land law.

+ Mineral exploration and exploitation; scientific research as licensed or confirmed by competent state authorities.

+ Investment in infrastructure construction (regardless of whether the land is in or out of industrial zones, export processing zones), investment in housing construction for transfer, including cases where organizations or individuals receive the transfer to continue investing in infrastructure or housing construction for transfer. If registering ownership or usage rights for lease or self-use, licensing fees must be paid.

- Land allocated, leased, or recognized by the State for agricultural, forestry, aquaculture, salt production.

- Agricultural land transferred between households, individuals in the same commune, ward, commune-level town for agricultural production facilitation.

- Agricultural land reclaimed by households, individuals in line with approved land use planning, not disputed, granted land use right certificates by competent state authorities.

- Land leased from the State with annual land rent payment or leased from organizations or individuals with legal land use rights.

- Houses and land used for community purposes by religious organizations, belief establishments recognized or permitted to operate by the State.

- Land for cemeteries, graveyards.

- Houses and land inherited or gifted between spouses; biological parents and children; adoptive parents and adopted children; parents-in-law and daughters-in-law; parents-in-law and sons-in-law; grandparents and grandchildren; siblings, granted land use right certificates, house ownership rights, and other assets attached to land by competent state authorities.

- Houses of families, individuals separately developed according to the Housing Law.

- Houses, land, special properties, specialized assets serving national defense, security administration by used specialized for management purposes.

- Public property used as the headquarters of state agencies, armed forces units, public service providers, political organizations, socio-political organizations, socio-political-professional organizations, social organizations, professional-society organizations.

- Houses and land compensated, resettled (including houses, land purchased with compensation funds) when the State acquires real estate according to law. Exemption applies to entities whose property was acquired.

- Property of organizations, individuals with ownership, usage rights certificates, exempted from licensing fees in the following scenarios:

+ Property certified by competent authorities of the Democratic Republic of Vietnam, the Provisional Revolutionary Government of the Republic of Southern Vietnam, the Socialist Republic of Vietnam, or recognized by former regimes’ policies, now granted new ownership, usage certificates with unchanged owners.

+ Property of state enterprises, public service providers privatized into joint-stock companies or restructured following legal regulations.

+ Property entitled to family or family member registration when divided among family members according to legal regulations; property of spouses combined post-marriage; assets divided upon divorce per a legally effective court judgment or decision.

+ Property with certificates reissued due to lost, damaged, or blurred documents. Exempt from declaration or licensing fee exemption procedures when reissuing certificates in this context.

+ Increased land area from reissuing certificates without boundary changes exempted from licensing fees for the augmented area.

+ Organizations, individuals granted land by the State and certified, transitioning to one-time payment for land rent for the entire lease under the Land Law.

+ Cases re-registering land use rights without changing users, not subject to land levy when changing usage as per land levy law.

- Charity houses, solidarity houses, and humanitarian-supported houses, including accompanying registered land under the donor's name.

- Workshops in production establishments; warehouses, canteens, garages in production, business establishments. Workshops specified under this section are determined per construction classification law.

- Houses, homestead land of impoverished households; houses, homestead land of ethnic minorities in hardship communes, wards, commune-level towns in the Central Highlands; houses, homestead land of families, individuals in communes under the socio-economic development program in specially difficult, mountainous, remote areas.

- Houses, land of private investment entities in education-training, vocational training; healthcare; culture; sports; environment sectors as per law, registering land use or house ownership rights for these activities.

- Houses, land of non-public establishments registered for use or ownership rights for activities in education-training; healthcare; culture; sports; science and technology; environment; society; population, family, child protection and care per law; except as stipulated in Clause 28, Article 10 of Decree 10/2022/ND-CP.

- Houses, land of science and technology enterprises registered according to law.

Cases exempted from real estate licesing fees in Vietnam in 2025 (Image from Internet)

What is the licensing fee rate for real estate in Vietnam?

Based on Article 8 of Decree 10/2022/ND-CP (amended by Article 1 Decree 41/2023/ND-CP) stipulating the licensing fee rate by percentage (%):

Article 8. Licensing fee Rate by Percentage (%)

- Houses, land: The rate is 0.5%.

- Hunting rifles; sports practicing and competition guns: The rate is 2%.

- Ships, including barges, canoes, tugboats, push boats, submarines, submersibles; boats, including yachts; aircraft: The rate is 1%.

- Motorcycles: The rate is 2%.

Specifically:

a) Motorcycles owned by organizations or individuals located in centrally-run cities, provincial cities, district-level towns where the provincial People's Committee is headquartered must pay an initial licensing fee rate of 5%.

b) For motorcycles subject to their second or subsequent licensing fee payment, the rate applied is 1%. If the asset owner has declared and paid a 2% licensing fee for the motorcycle and then transfers it to organizations or individuals in the area specified in point a of this section, then the licensing fee rate is 5%.

...

The licensing fee is a charge that owners of fixed assets such as cars, motorcycles, real estate, etc., must declare and pay to the tax authority before putting them into use. According to the above regulation, the licensing fee rate for real estate is 0.5%.

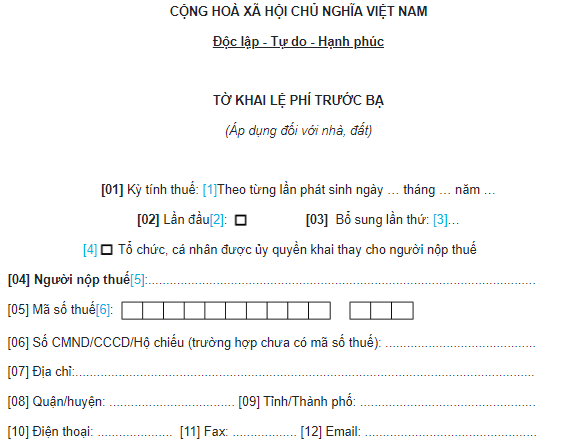

What are details of the Form 01/LPTB - Declaration of licensing fee applicable to real estate in Vietnam?

Based on Form 01/LPTB issued together with Circular 80/2021/TT-BTC stipulating the licensing fee declaration form for houses and land:

Download Form 01/LPTB - Declaration of licensing fee applicable to real estate in Vietnam Here