What is the template of Application for early retirement in Vietnam according to Decree 177/2024?

What is the template of Application for early retirement in Vietnam according to Decree 177/2024?

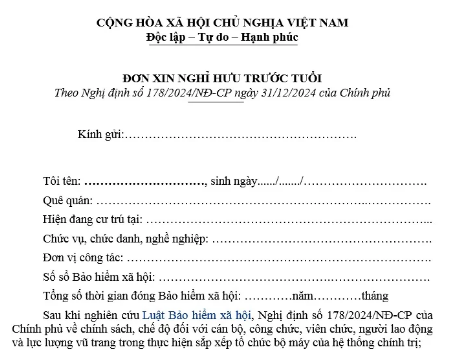

Below is the application form for early retirement according to Decree 177/2024:

Download Application for early retirement in Vietnam according to Decree 177/2024

Note: The application form for early retirement according to Decree 178 is for reference only! Vietnamese official and public employee, employees can adjust the contents in the form to best fit their situation.

What is the template of Application for early retirement in Vietnam according to Decree 177/2024? (Image from the Internet)

Which policies are entitled for early retirement in Vietnam?

Based on Clause 2, Article 3 of Decree 177/2024/ND-CP stipulating the policies enjoyed upon early retirement:

- Entitled to a pension, other policies as prescribed by the law on social insurance and not subject to a reduction in the percentage of pension benefits due to early retirement for a period of up to 5 years (60 months).

- A subsidy of 5 months' current salary at the time of retirement for each year of early retirement is provided.

- A subsidy of 5 months' current salary for the first 20 years of service with mandatory social insurance contributions; from the 21st year onward, each year of service with mandatory social insurance contributions will receive a subsidy of 0.5 months' current salary.

If an individual has 15 years or more of service with mandatory social insurance contributions and is eligible for a pension according to the law on social insurance at the time of resignation, they are granted a subsidy of 5 months' current salary for the first 15 years of service.

From the 16th year onward, each year of service with mandatory social insurance contributions will receive a subsidy of 0.5 months' current salary.

- For those ranked according to their position, if they have held the first rank of their current title for 48 months or more, they will be promoted to the second rank of their current title upon retirement.

- For those ranked according to their professional capacity and receiving a leadership position allowance, if they have not yet reached the final salary rank in their current grade and are lacking from 1 to 12 months for a regular salary increase according to the regulations, they will receive a preterm salary increase.

- Early retirement time can be added to service time for commendation consideration if under the category of commendation according to the law on emulation and commendation.

- Eligibility for military rank promotion, salary rank increase according to the law.

- For commune-level officials working in areas with particularly difficult socio-economic conditions (including time working in area coefficients of 0.7 or higher before January 01, 2021), or those who have served in the army or police and were awarded medals by the State, but lack up to 30 months of social insurance contributions to qualify for retirement policies, they are granted a one-time social insurance contribution for the remaining time to qualify for a pension.

For time exceeding 30 months, individuals can make a one-time voluntary social insurance contribution for the exceeded duration; the payment method, level of contribution, level of benefits, and other related contents are implemented according to the law on social insurance.

- Not subject to a reduction in the percentage of pension benefits due to early retirement for the exceeding years over 5 if making a one-time voluntary social insurance contribution for the exceeded time; the payment method, contribution level, benefit level, and other related contents are implemented according to the law on social insurance.

- The contribution period for social insurance is preserved, and a one-time allowance is granted for each work year with mandatory social insurance contributions calculated at 0.5 months of current salary.

- A one-time social insurance benefit according to the law on social insurance is provided.

Can employees of retirement age in Vietnam unilaterally terminate their labor contract?

Based on Clause 2, Article 35 of the Labor Code 2019 governing the right to unilaterally terminate the labor contract of an employee:

Article 35. Right of the employee to unilaterally terminate the labor contract

[...]

- The employee has the right to unilaterally terminate the labor contract without prior notice in the following cases:

a) Not being arranged according to agreed work, workplace, or not assured working conditions according to the agreement, except for cases prescribed in Article 29 of this Code;

b) Not being paid in full or on time, except for cases stipulated in Clause 4 of Article 97 of this Code;

c) Being abused, beaten, or having insults, acts impacting health, dignity, or being forced labor;

d) Being sexually harassed at the workplace;

dd) Female employees must resign according to the provisions of Clause 1 of Article 138 of this Code;

e) Reaching retirement age according to Article 169 of this Code, unless otherwise agreed by the parties;

g) The employer provides false information according to Clause 1 of Article 16 of this Code affecting the performance of the labor contract.

According to these regulations, employees of retirement age have the right to unilaterally terminate their labor contracts without prior notice.