What is the rate of salary advance for Lunar New Year 2025 in Vietnam?

What is the rate of salary advance for Lunar New Year 2025 in Vietnam?

Pursuant to Article 90 of the Labor Code 2019 regarding salary:

Article 90. Salary

- Salary is the amount paid by the employer to the employee as agreed to perform the work, including the wage rate for the job or title, salary allowances, and other additional amounts.

- The wage rate for the job or title shall not be lower than the minimum wage.

- The employer must ensure equal pay without gender discrimination for employees performing work of equal value.

Pursuant to Article 101 of the Labor Code 2019 regarding salary advance:

Article 101. Salary advance

- Employees are entitled to a salary advance under conditions agreed upon by both parties and without interest.

- The employer must allow employees to advance salary corresponding to the number of days temporarily off work to perform civic duties for 01 week or more but not exceeding 01 month's salary as per the labor contract, and employees must repay the advanced amount.

Employees enlisted in accordance with the Military Service Law are not entitled to a salary advance.

- During annual leave, employees are entitled to an advance of at least the salary amount for the days off.

According to the above provisions, salary is the amount paid to the employee to perform the work agreed with the employer.

Employees can agree with the enterprise to advance their salary. The salary advance amount for the Lunar New Year 2025 will be mutually agreed upon by the employee and the enterprise without legal limitations.

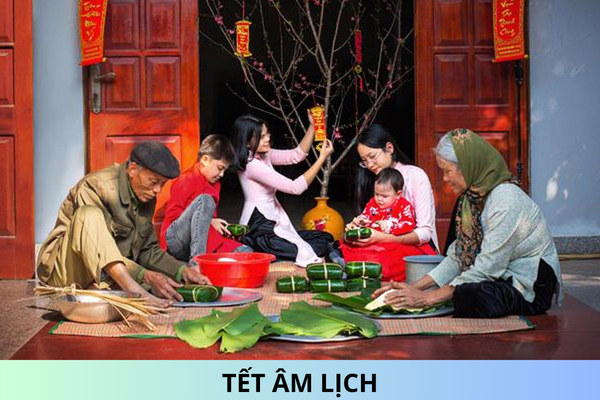

What is the rate of salary advance for Lunar New Year 2025 in Vietnam? (Image from the Internet)

What are methods for paying salary for the employee in Vietnam?

Pursuant to Article 96 of the Labor Code 2019 regarding forms of payment:

Article 96. Forms of payment

- Employers and employees agree on the form of payment by time, product, or fixed task.

- Salary is paid in cash or transferred to the employee's personal account opened at a bank.

In the case of salary payment through the employee's personal bank account, the employer must bear all related fees for opening the account and transferring the salary.

- The Government of Vietnam details this Article.

According to the above provisions, employees can be paid in cash or through their personal bank accounts.

What are regulations on salary for employees ceasing their work in Vietnam?

Pursuant to Article 99 of the Labor Code 2019 regarding wages during work cessation:

Article 99. Wages during work cessation

In case of work cessation, employees are entitled to wages as follows:

- If due to the employer's fault, the employee is paid full wages as per the labor contract;

- If due to the employee's fault, that employee is not paid; other employees in the same unit who must cease work are paid at a rate agreed by both parties but not lower than the minimum wage.

- If due to incidents of electricity, water supply not caused by the employer or due to natural disasters, fires, dangerous epidemics, enemy sabotage, relocation of operational locations at the request of competent state authorities, or for economic reasons, both parties shall agree on wages during work cessation as follows:

a) In case of work cessation for up to 14 working days, wages are agreed not to be lower than the minimum wage;

b) In case of work cessation for more than 14 working days, wages are agreed upon by both parties but must ensure wages for the first 14 days are not lower than the minimum wage.

Thus, when ceasing work, employees are still entitled to wages in the following cases:

- If due to the employer's fault, the employee is paid full wages as per the labor contract;

- If due to the employee's fault, that employee is not paid; other employees in the same unit who must cease work are paid at a rate agreed by both parties but not lower than the minimum wage;

- If due to incidents of electricity, water supply not caused by the employer or due to natural disasters, fires, dangerous epidemics, enemy sabotage, relocation of operational locations at the request of competent state authorities, or for economic reasons, both parties shall agree on wages during work cessation as follows:

+ In case of work cessation for up to 14 working days, wages are agreed not to be lower than the minimum wage;

+ In case of work cessation for more than 14 working days, wages are agreed upon by both parties but must ensure wages for the first 14 days are not lower than the minimum wage.