What is the template of Power of Attorney for establishing a household business in accordance with legal standards in 2025 in Vietnam?

What is the template of Power of Attorney for establishing a household business in accordance with legal standards in 2025 in Vietnam?

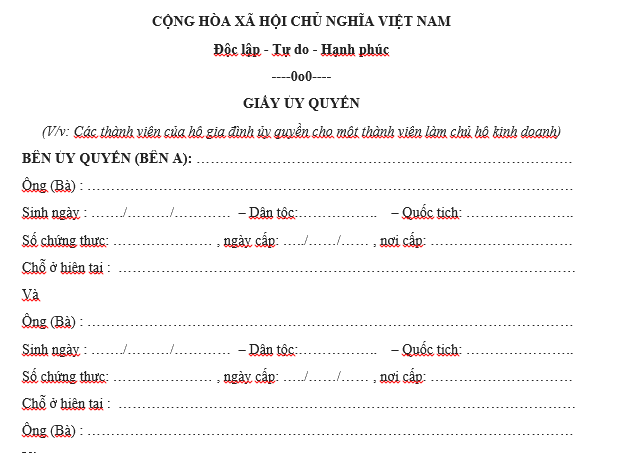

Below is the template of Power of Attorney for establishing a household business in accordance with legal standards in 2025 in Vietnam:

Download the template of Power of Attorney for establishing a household business in accordance with legal standards in 2025 in Vietnam

What is the template of Power of Attorney for establishing a household business in accordance with legal standards in 2025 in Vietnam? (Image from Internet)

What documents are included in the Household Business Registration Dossier in Vietnam?

Based on Article 87 of Decree 01/2021/ND-CP concerning household business registration:

Article 87. Registration of Household Business

- The registration for a household business is executed at the district-level business registration authority where the household business's headquarters is located.

- The registration dossier for a household business includes:

a) Application for household business registration;

b) Legal documents of individuals concerning the household business owner, family members registering the household business in case family members register a household business;

c) Copy of the meeting minutes of the family members about establishing the household business in case the family members register a household business;

d) Copy of the authorization document from family members to one member to act as the household business leader in case family members register a household business.

- Upon receiving the dossier, the district-level business registration authority issues a Receipt and grants the Household Business Registration Certificate to the household business within 3 working days from the date of receiving a valid dossier.

In the case of invalid dossiers, within 3 working days from the date of receiving the dossier, the district-level business registration authority must notify in writing to the submitter or founder of the household business. The notification must state clearly the reasons and any requirements for amending, supplementing the dossier (if any).

- If after 3 working days from the date of submitting the household business registration dossier, the applicant does not receive the Household Business Registration Certificate or a notification requesting amendments or supplements to the registration dossier, the household business founder or the household business has the right to file a complaint, denounce according to the law on complaints and denunciations.

- During the first working week of each month, the district-level business registration authority sends a list of household businesses registered in the previous month to the relevant Tax Department, Business Registration Office, and specialized management agencies at the provincial level.

According to the above regulations, the registration dossier for a household business includes the following documents:

[1] Application for household business registration

[2] Legal documents of individuals concerning the household business owner, family members registering the household business, in the case of family members registering a household business

[3] Copy of the meeting minutes of the family members about establishing the household business in the case of family members registering a household business

[4] Copy of the authorization document from family members to one member to act as the household business leader in case of family members registering a household business.

How many household businesses can be registered in Vietnam?

Based on Article 80 of Decree 01/2021/ND-CP concerning the right to establish and the obligation to register household businesses:

Article 80. Right to Establish and Obligation to Register a Household Business

- Vietnamese citizens who are individuals or family members with full civil capacity according to the Civil Code are entitled to establish a household business as prescribed in this Chapter, except in the following cases:

a) Minors, people with restricted civil capacity; people who have lost civil capacity; people with difficulties in perception, control of behavior;

b) Individuals under criminal prosecution, detention, serving a prison sentence, under mandatory administrative treatment at compulsory detoxification or education centers, or under court-imposed occupational or professional restrictions;

c) Other cases as prescribed by relevant laws.

- Individuals, family members as specified in clause 1 of this Article, are only allowed to register one household business nationwide and are entitled to contribute capital, purchase shares, buy equity in enterprises as individuals.

- Individuals, family members registering a household business are not allowed to be simultaneously the owner of a private enterprise, a general partner of a partnership company, except with the consent of other general partners.

According to the above regulations, individuals, and family members are only allowed to register one household business nationwide and are entitled to contribute capital, purchase shares, and buy equity in businesses as individuals.