What is the template for Notification of change of business household owner in 2025 in Vietnam?

What is the template for Notification of change of business household owner in 2025 in Vietnam?

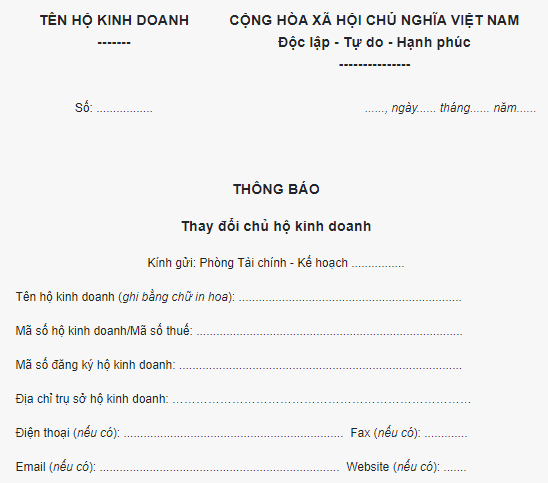

Based on Appendix III-3 issued with Circular 02/2023/TT-BKHDT on the form of Notification for change of business household owner:

Download the Notification for change of business household owner in 2025

What is the template for Notification of change of business household owner in 2025 in Vietnam? (Image from the Internet)

What are the penalties for changing the business household owner without notification in Vietnam?

Based on Article 63 of Decree 122/2021/ND-CP regulating fines for violations concerning the reporting policies of business households:

Article 63. Violations concerning the reporting policies of business households

- A fine ranging from 5,000,000 VND to 10,000,000 VND for any of the following acts:

a) Failing to report business conditions as requested by the district-level business registration authority;

b) Changing the business household owner without submitting notification documentation of changes in business household registration to the district-level business registration authority where registered;

c) Temporarily ceasing business, resuming business before the notified time, yet failing to send a written notification to the district-level business registration authority where registered;

d) Changing business location without notifying the district-level business registration authority;

dd) Terminating business operations in the form of a business household without notifying or failing to return the original Business Household Registration Certificate to the district-level business registration authority;

e) Changing the industry or business sector without sending a notification to the district-level business registration authority where the business household's head office is located;

g) Engaging in business activities at multiple locations without notifying the district-level business registration authority where the business household's head office is located, as well as the tax authority, and market management authority.

In case of a tax law violation, penalties will be applied in accordance with regulations on administrative penalties in the field of taxation.

- Remedies:

a) Must report business conditions as requested for violations specified in point a of clause 1 of this Article;

b) Must notify the district-level business registration authority for violations specified at points b, c, d, đ, e, and g of clause 1 of this Article.

Based on Article 4 of Decree 122/2021/ND-CP regulating fine levels:

Article 4. Fine levels

- The maximum fines for administrative violations under this Decree are specified as follows:

a) In the field of investment, it is 300,000,000 VND;

b) In the field of bidding, it is 300,000,000 VND;

c) In the field of business registration, it is 100,000,000 VND;

d) In the field of planning, it is 500,000,000 VND.

- The fines stipulated in this Decree apply to organizations (except for the penalties stipulated at point c clause 2 of Article 28; points a and b of clause 2 of Article 38; Article 62 and Article 63 of this Decree which apply to individuals). For the same administrative violation, the fine for individuals is 1/2 (one-half) of the fine for organizations.

According to the above regulation, changing the business household owner without submitting notification documentation of changes in business household registration to the district-level business registration authority where registered may result in a fine ranging from 5,000,000 VND to 10,000,000 VND and a mandatory notification to the district-level business registration authority.

Note: The above fine applies to individuals. Organizations with the same violation will incur a fine double that of individuals.

What documents are included in the Business Household Registration Application in Vietnam?

According to Article 87 of Decree 01/2021/ND-CP regulating business household registration:

Article 87. Business Household Registration

- Business household registration is executed at the district-level business registration authority where the business household’s head office is located.

- The business household registration application includes:

a) The application form for business household registration;

b) Legal documents of individuals for the business household owner, family members registering the business household in cases where family members register the business household;

c) A copy of the meeting minutes of the family members regarding the establishment of the business household in instances where family members register the business household;

d) A copy of the authorization document from family members to a member becoming the business household owner in cases where family members register the business household.

- Upon receipt of the application, the district-level business registration authority will issue a Receipt and the Business Household Registration Certificate to the business household within 03 working days from the receipt of a valid application.

In cases where the application is not valid, within 03 working days from receipt of the application, the district-level business registration authority must issue a written notice to the applicant or the business household founder. The notice must specify reasons and requirements for amending or supplementing the application (if any).

[...]

According to the above regulation, the business household registration application includes the following documents:

[1] Application form for business household registration

[2] Legal documents of individuals for the business household owner, family members registering the business household in cases where family members register the business household

[3] Copy of the meeting minutes of the family members regarding the establishment of the business household in instances where family members register the business household

[4] Copy of the authorization document from family members to a member becoming the business household owner in cases where family members register the business household.