What are details of the Form 01/NDAN - Proposal for gradual payment of tax debt in Vietnam in accordance with Circular 80?

What are details of the Form 01/NDAN - Proposal for gradual payment of tax debt in Vietnam in accordance with Circular 80?

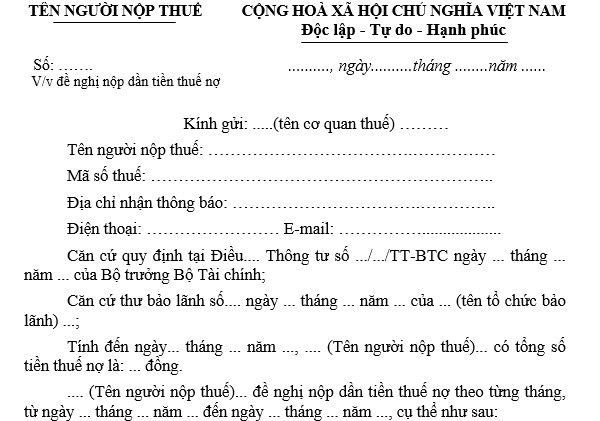

Based on Form 01/NDAN Appendix 1, issued with Circular 80/2021/TT-BTC, on the form of a proposal for gradual payment of tax debt:

Download Form 01/NDAN - Proposal for Gradual Payment of Tax Debt according to Circular 80

What are details of the Form 01/NDAN - Proposal for gradual payment of tax debt in Vietnam in accordance with Circular 80? (Image from the Internet)

What is outstanding tax in Vietnam?

Based on Clause 17, Article 3 of the Law on Tax Administration 2019, the definition is as follows:

Article 3. Interpretation of terms

In this Law, the terms are understood as follows:

[...]

- Advance Pricing Agreement (APA) is a written agreement between the tax authority and the taxpayer, or among the tax authority, the taxpayer, and the foreign tax authority or territory with which Vietnam has signed an agreement to avoid double taxation and prevent income tax evasion for a specific period, in which the bases for calculating tax, methods for determining taxable prices, or market-based prices are clearly specified. The APA is established before the taxpayer submits the tax declaration dossier.

- Tax debt is the tax and other amounts under the state budget that the tax administration authority collects but the taxpayer has not paid to the state budget upon the due date according to regulations.

- Commercial database is the financial information and data system of enterprises, organized, arranged, and updated by business organizations and provided to the tax administration authority according to the law.

[...]

According to the above provision, tax debt is the tax and other state budget collectibles managed by the tax authority that the taxpayer has not yet paid to the state budget upon the specified deadline.

What are cases of classification of the outstanding tax in Vietnam?

According to Article 83 of the Law on Tax Administration 2019, the cases that qualify for tax debt suspension are stipulated as follows:

Article 83. Cases eligible for tax debt suspension

- The taxpayer is deceased, or declared deceased, missing, or incapacitated by the Court.

The suspension period is counted from the date the death certificate, death notice, or substitute documents, as per the civil status law or the Court's decision declaring death, missing status, or incapacitation, is issued.

- The taxpayer has a dissolution decision sent to the tax administration authority and business registration agency. The business registration agency has announced that the taxpayer is undergoing dissolution procedures on the national business registration information system, but the taxpayer has not finalized the dissolution procedure.

The suspension period is counted from the date the business registration agency announces the taxpayer is undergoing dissolution procedures on the national business registration information system.

- The taxpayer has filed for bankruptcy or has been petitioned by an entitled party to open bankruptcy procedures as per the bankruptcy law.

The suspension period is counted from the date the competent Court notifies the acceptance of bankruptcy proceedings or the taxpayer has submitted bankruptcy dossiers to the tax authority, but is undergoing the debt payment and handling procedures as stipulated by the Bankruptcy Law.

[...]

Cases eligible for tax debt suspension include:

[1] The taxpayer is deceased, or declared deceased, missing, or incapacitated by the Court.

[2] The taxpayer has a dissolution decision sent to the tax administration authority and business registration agency. The business registration agency has announced that the taxpayer is undergoing dissolution procedures on the national business registration information system, but the taxpayer has not finalized the dissolution procedure.

[3] The taxpayer has filed for bankruptcy or has been petitioned by an entitled party to open bankruptcy procedures as per the bankruptcy law.

[4] The taxpayer no longer operates at the business address registered with the business registration agency.

The tax administration authority cooperates with the people's committee at the commune level where the taxpayer is headquartered or has a registered address to inspect and verify information when the taxpayer is not present in the locality.

The tax administration authority issues a nationwide announcement about the taxpayer or their legal representative not being present at the registered headquarters or contact address.

[5] The taxpayer has been requested in writing by the tax authority, or already revoked by the competent authority, the business registration certificate, enterprise registration certificate, cooperative registration certificate, establishment and operation license, or practice license.