Guidelines on checking personal tax identification numbers in Vietnam in 2025

What are guidelines on checking personal tax identification numbers in Vietnam in 2025?

Below are the guidelines for checking personal tax identification numbers in Vietnam in 2025:

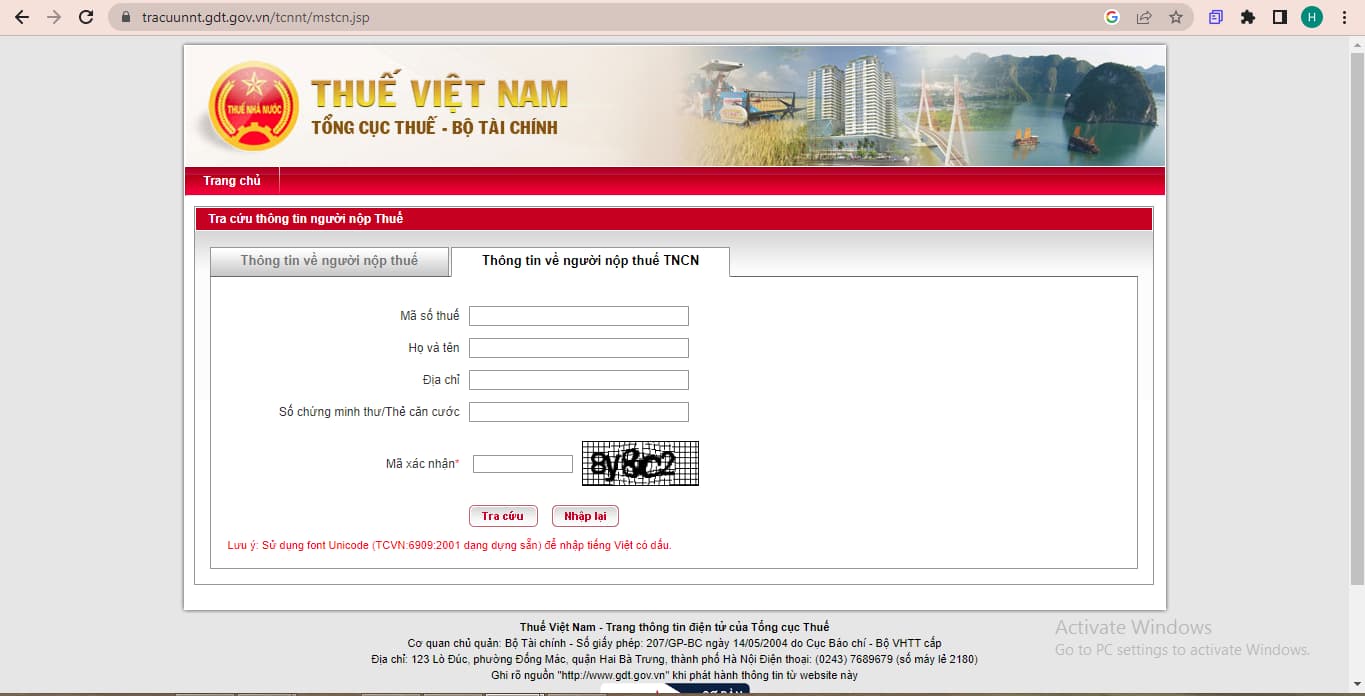

Step 1: Access the link: http://tracuunnt.gdt.gov.vn/tcnnt/mstcn.jsp

Step 2: Enter your ID card number/Citizen ID number

Step 3: Enter the verification code

Note: The verification code is case-sensitive, so ensure to enter the exact uppercase and lowercase letters. Name and Address can be entered or left blank.

Step 4: Click the Lookup button and receive the result.

GGuidelines on checking personal tax identification numbers in Vietnam in 2025 (Image from the Internet)

Do dependents in Vietnam have tax identification numbers?

According to Clause 3, Article 30 of the Law on Tax Administration 2019 regarding taxpayer registration subjects and issuance of tax identification numbers:

Article 30. Taxpayer registration subjects and issuance of tax identification numbers

[...]

- The issuance of tax identification numbers is regulated as follows:

a) Enterprises, economic organizations, and other organizations are issued a unique tax identification number to use throughout their operational period, from taxpayer registration to termination of the tax identification number. Taxpayers with branches, representative offices, or dependent units that directly fulfill tax obligations are issued dependent tax identification numbers. In cases where enterprises, organizations, branches, representative offices, or dependent units register under the single-window mechanism along with business registration, cooperative registration, or enterprise registration, the numbers on the enterprise registration certificate, cooperative registration certificate, or enterprise registration certificate also serve as their tax identification numbers;

b) Individuals are issued a unique tax identification number to use throughout their lifetime. Dependents of individuals are issued tax identification numbers for deductions against family circumstances for personal income tax obligations. The tax identification number issued to dependents also serves as the individual's tax identification number when the dependent incurs obligations to the state budget;

c) Enterprises, organizations, individuals responsible for withholding and paying taxes on behalf of others are issued substitute tax identification numbers for declaring and paying taxes for taxpayers;

d) Issued tax identification numbers cannot be reused for issuing to other taxpayers;

[...]

According to the above regulation, dependents of individuals are issued tax identification numbers to deduct for family circumstances for personal income tax purposes. The tax identification numbers issued to dependents are simultaneously those of the individual when the dependent has obligations to the state budget.

Who are the dependents of taxpayers in Vietnam in 2025?

Based on Point d, Clause 1, Article 9 of Circular 111/2013/TT-BTC (amended by Clause 6, Article 25 of Circular 92/2015/TT-BTC) regarding deductible expenses:

Article 9. Deductible Expenses

The deductible expenses as guided in this Article are those subtracted from an individual's taxable income before determining taxable income from wages, salaries, or business activities. Specifically:

- Deductions for family circumstances

[...]

d) Dependents include:

d.1) Children: biological children, legally adopted children, illegitimate children, stepchildren of the wife, stepchildren of the husband, specifically including:

d.1.1) Children under 18 years old (calculated fully by month).

Example 10: Mr. H's child, born on July 25, 2014, is considered a dependent from July 2014.

d.1.2) Children 18 years and older with disabilities, unable to work.

d.1.3) Children studying in Vietnam or abroad at universities, colleges, vocational education, including children 18 years and older studying at high school level (including the period from June to September of grade 12 while waiting for university exam results) without income or with an average monthly income from all sources not exceeding 1,000,000 VND.

d.2) The taxpayer's spouse, if meeting the conditions at point đ, clause 1 of this Article.

d.3) Biological parents; parents-in-law (or husband’s parents); step-parents; adoptive parents of the taxpayer meeting the conditions at point đ, clause 1, of this Article.

[...]

According to the above regulations, the dependents of the taxpayer in 2025 include the following entities:

[1] Children

Biological children, legally adopted children, illegitimate children, stepchildren of the wife, stepchildren of the husband, specifically including:

- Children under 18 years old (calculated fully by month).

- Children 18 years and older with disabilities, unable to work.

- Children studying in Vietnam or abroad at universities, colleges, vocational education, including children 18 years and older studying at the high school level without income or with an average monthly income from all sources not exceeding 1,000,000 VND.

[2] Spouse of the taxpayer when the following conditions are met:

- Have disabilities, unable to work.

- No income or the average monthly income from all sources does not exceed 1,000,000 VND.

- If outside of working age, no income or the average monthly income from all sources does not exceed 1,000,000 VND.

[3] Biological parents; parents-in-law (or husband's parents); step-parents; adoptive parents of the taxpayer when the following conditions are met:

- Have disabilities, unable to work.

- No income or the average monthly income from all sources does not exceed 1,000,000 VND.

- If outside of working age, no income or the average monthly income from all sources does not exceed 1,000,000 VND.

[4] Other individuals without support whom the taxpayer is directly nurturing and who meet the conditions according to the regulations, including:

- Siblings of the taxpayer.

- Grandparents (both paternal and maternal); aunts, uncles, cousins of the taxpayer.

- Nieces and nephews of the taxpayer, including children of siblings.

- Other individuals the taxpayer must directly support, according to the law.