Template C2-02a/NS for State Budget Estimate Withdrawal? Based on what grounds is the annual state budget estimate prepared?

Form C2-02a/NS State Budget Estimation Withdrawal Paper?

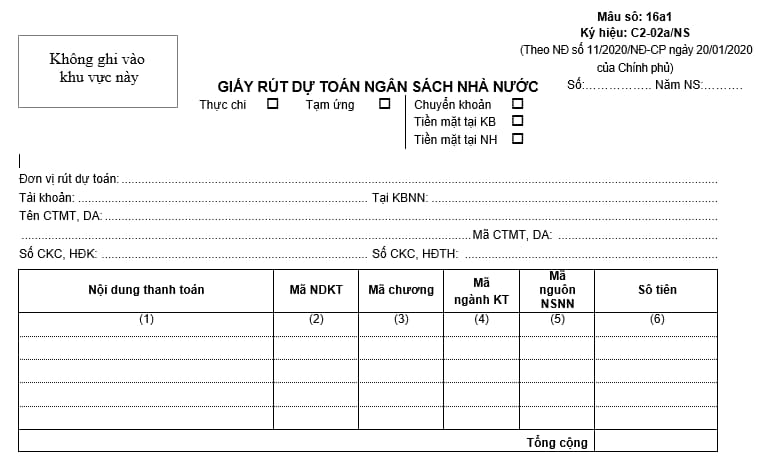

Based on Form C2-02a/NS issued with Decree 11/2020/ND-CP, the state budget estimation withdrawal paper form is regulated as follows:

Download the state budget estimation withdrawal paper form: Download

Note: Form C2-02a/NS State Budget Estimation Withdrawal Paper is applicable for cases of withdrawing state budget estimation, not including tax payments.

State Budget Estimation Withdrawal Paper? On what basis is the annual state budget estimation prepared? (Image from the Internet)

Which authority is responsible for deciding the state budget estimation?

Based on Article 19 of the State Budget Law 2015, the tasks and powers of the National Assembly are regulated as follows:

Article 19. Tasks and Powers of the National Assembly

To make laws and amend laws in the field of finance - state budget.

To decide basic policies on finance - state budget; to regulate, amend or abolish taxes; to decide the national debt safety limit, public debt, and government debt limits.

To decide the 5-year financial plan.

4. To decide the state budget estimation:

a) Total state budget revenue, including domestic revenue, crude oil revenue, revenue from export and import activities, and non-refundable aid revenue;

b) Total state budget expenditure, including central and local budget expenditure, detailed by investment development expenditure, national reserve expenditure, regular expenditure, debt interest payment, aid expenditure, additional financial reserve fund expenditure, budget contingency. In the investment development and regular expenditure, there is a specific spending level for education - training and vocational training; science and technology;

c) State budget deficit, including central and local budget deficit, detailed by each locality; sources to offset the state budget deficit;

d) Total state budget borrowing, including borrowing to offset the state budget deficit and borrowing to pay the principal debt of the state budget.

- To decide the allocation of the central budget:

a) Total central budget expenditure allocated; investment development expenditure by sectors; regular expenditure by sectors; national reserve expenditure; debt interest payment; aid expenditure; additional financial reserve fund expenditure; budget contingency;

b) Estimation of investment development expenditure, regular expenditure, national reserve expenditure, aid expenditure of each ministry, ministry-equivalent agency, Government of Vietnam agency, other central agencies by sectors;

c) The amount supplemented from the central budget to each local budget, including general balancing supplements and target-specific supplements.

[...]

Thus, the National Assembly has the authority to decide the state budget estimation as follows:

- Total state budget revenue, including domestic revenue, crude oil revenue, revenue from export and import activities, and non-refundable aid revenue;

- Total state budget expenditure, including central and local budget expenditure, detailed by investment development expenditure, national reserve expenditure, regular expenditure, debt interest payment, aid expenditure, additional financial reserve fund expenditure, budget contingency. In the investment development and regular expenditure, there is a specific spending level for education - training and vocational training; science and technology;

- State budget deficit, including central and local budget deficit, detailed by each locality; sources to offset the state budget deficit;

- Total state budget borrowing, including borrowing to offset the state budget deficit and borrowing to pay the principal debt of the state budget.

On what basis is the annual state budget estimation prepared?

Based on Article 41 of the State Budget Law 2015, the basis for preparing the annual state budget estimation is regulated as follows:

- Development tasks for socio-economic aspects and ensuring national defense, security, foreign affairs, and gender equality.

- Specific tasks of ministries, ministry-equivalent agencies, Government of Vietnam agencies, other central organizations, and local departments.

- Legal regulations on taxes, fees, and charges, and policies on state budget revenue; budget allocation norms, policies, standards, norms for state budget expenditure.

- Decentralization of revenue sources, budget expenditure responsibilities, and the percentage (%) distribution for shared revenues and balancing supplements from higher-level budgets to lower-level budgets.

- Legal documents from competent state authorities guiding the development of socio-economic plans and the next year's state budget estimation.

- 5-year financial plan, 3-year financial - state budget plan, medium-term investment plan from the state budget.

- The implementation status of the previous year’s state budget.

- Inspection results of budget revenue and expenditure estimations notified to relevant departments, agencies, and units.